The Magic of Share Buybacks 🪄 💥

Dividend Investors Must Pay Attention to This!

People often times don't see to understand the true power of share buybacks.

Share buybacks are when a company buys back their own shares from the marketplace. This essentially gives shareholders more ownership of the stocks that they hold.

Think of it this way-

Imagine a pizza with 8 slices, where each slice represents a share of the company. While a typical company is divided into thousands or millions of shares, for simplicity, let's assume this company has only 8.

Now, if management decides to buy back half of the company's shares, the total size of the pizza remains the same, but each remaining slice becomes larger.

Before the buyback, your piece of the pizza was smaller.

But after, your slice is now twice as big!

(In financial terms, this would mean you own more of the company after they buyback shares)

Most realize buybacks give shareholders a larger stake in the company.

BUT-

Here is what they don't realize.

It makes every 'per share' metric look much better.

For example:

If 'Company A' brought in $1000 in revenue in 2022 and had 100 shares outstanding, then their revenue per share would be $10 per share.

But if they bought back 10% of their shares the following year, here is what happens-

in 2023, if 'Company A' brought in $1000 in revenue (same as last year) and had 90 shares outstanding, then their revenue per share would be $11.11 per share.

That's an 11% increase in revenue per share, without the company actually increasing their actual revenue.

This gives them the ability to continue to reward shareholders without major increases in the underlying metric.

Think of the different metrics that become much healthier when companies buy back shares:

- Revenue per share

- Free cash flow per share

- Earnings per share

- Dividends per share

Let’s look at Apple stock for example. (Spreadsheets from Tickerdata)

From 2013 to 2023 Apple’s revenue grew from $170.9 billion to $383.2 billion.

That’s 124.26% growth.

But here’s what’s really crazy.

From 2013 to 2023 Apple’s revenue grew from $6.60 to $24.34.

That’s 269.05% growth.

That’s 124.26% revenue growth vs 269.05% revenue per share growth.

The reason their per share revenue growth was so much more?

Share buybacks.

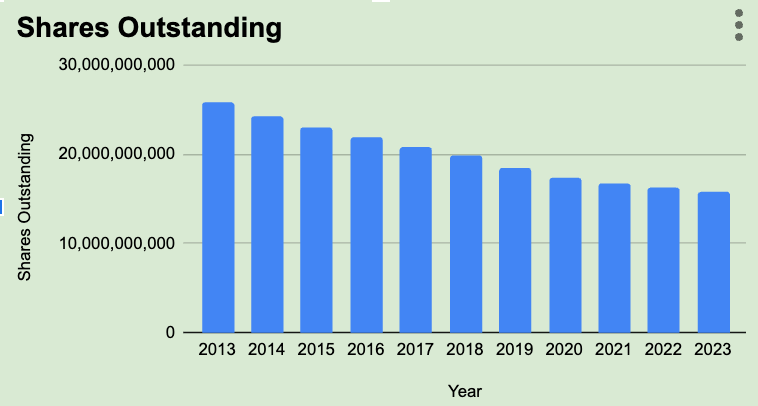

From 2013 to 2023 Apple’s shares outstanding went from 25.9 billion to 15.7 billion.

In fact, share buybacks are so powerful that in 2023, Apple saw a slight decrease in revenue compared to 2022, going from 394.3 billion to 383.2 billion.

Yet on a per share basis, revenue went from $24.32 to $24.34. A slight increase.

So even though revenue slightly decreased, it still increased on a per share basis due to share buybacks the company performed.

Not to mention, there are many other reasons to perform share buybacks (as we see pictured below)

Share buybacks can have immense power when performed correctly.

It's why it is considered by many to be one of the best ways to reward shareholders.

Look for companies that do a good job of buying back shares-

You'll be glad you did!

Other News…

At the end of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

This sheet was received by nearly 200 dividend investors last month. (Wow!)

If you’d like to receive this sheet at the end of this month, you can sign up here:

That’s all for now! Feel free to respond to this email and let me know of any thoughts you have!

See you next week!

Dividendology