The Next Great Dividend Growth Stock 📈 🔥

This Is When Companies Should Pay Dividends

META recently announced they would start paying a quarterly dividend.

While many dividend investors rejoiced at this news, some people believe this is a bad sign for the company, as it indicates it’s rapid growth days are behind them.

But paying out dividends is something META should have done years ago.

Let me explain why:

Over the past decade, META has increased their free cash flow per share going from $2.10 to $17.03.

During that same time period, net income went from 2.9 billion, to 39 billion.

Looking at their balance sheet, their total current assets is sitting at 85 billion, while their total debt is sitting at 38 billion.

Simply put, this company is drowning in cash.

Now, there are 5 different things a company can do with free cash flow:

1. Reinvest back into the business

2. Buyback shares

3. Pay out dividends

4. Pay down debt

5. Attempt mergers & acquisitions

The main choice for most high growth tech companies is to reinvest back into the business, and rightfully so.

But META has found themselves in the unique situation where they have more cash than they know how to intelligently reinvest back into the business.

Anytime a company can't reinvest their cash back into the business at a high rate of return, they should use that capital to pay out dividends.

We saw a few years ago, META placed a massive bet investing over $36 billion into their metaverse project.

This investment had essentially had no return.

META has now realized that instead of using their capital for high risk low reward projects, they should be using that capital to pay shareholders a modest, yet growing dividend.

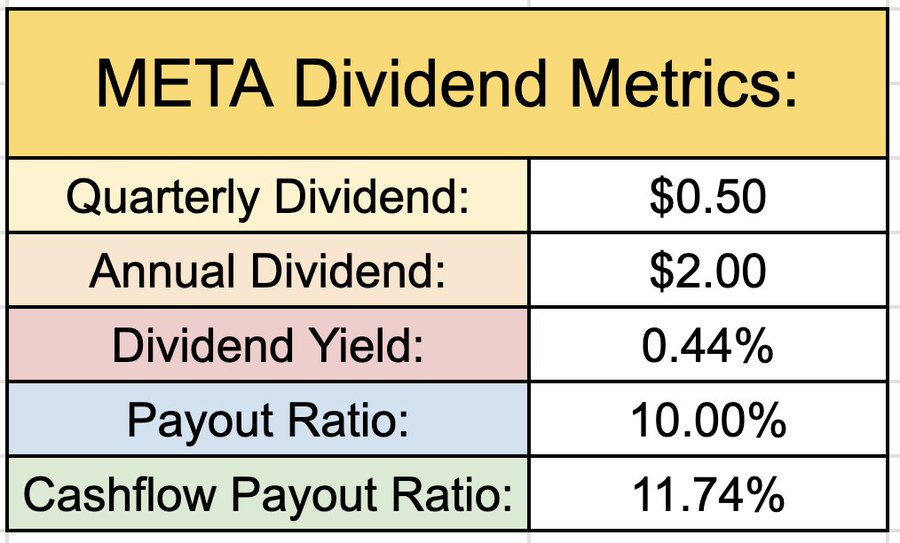

This quarterly dividend payment of just $0.50 per share gives them a cash flow payout ratio of just 11.74%.

This means they still have nearly 90% of their free cash flow to do things like reinvest back into the business, meaning they will likely still see very high levels of growth.

The dividend payment redirects management's focus towards focusing on the most profitable projects. Any cash that cannot be reinvested effectively should be returned to shareholders.

When companies fail to do this, we can billions of dollars allocated to low ROI projects like the metaverse.

So META paying out a dividend is not a bad thing, and it's not a sign that the companies rapid growth days are behind them.

In fact, it's simply a sign the company has more cash than they know what to do with. They aren't the first company to be in this situation.

Look at MSFT and AAPL for example.

High growth companies with piles of cash. They know they can't intelligently reinvest all their capital, so they reward shareholders with a growing dividend.

So this leads me to an important question.

Does META have the potential to be the next great dividend growth stock?

Only time will tell.

Other news…🔥

At the end of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

This sheet was received by nearly 200 dividend investors last month. (Wow!)

If you’d like to receive this sheet at the end of this month, you can sign up here:

That’s all for now! Feel free to respond to this email and let me know of any thoughts you have!

See you next week!

Dividendology