💥 The REIT Market is About to Explode!

Here's what history tells us... 📝

One of the biggest opportunities in the market right now?

Real estate investment trusts.

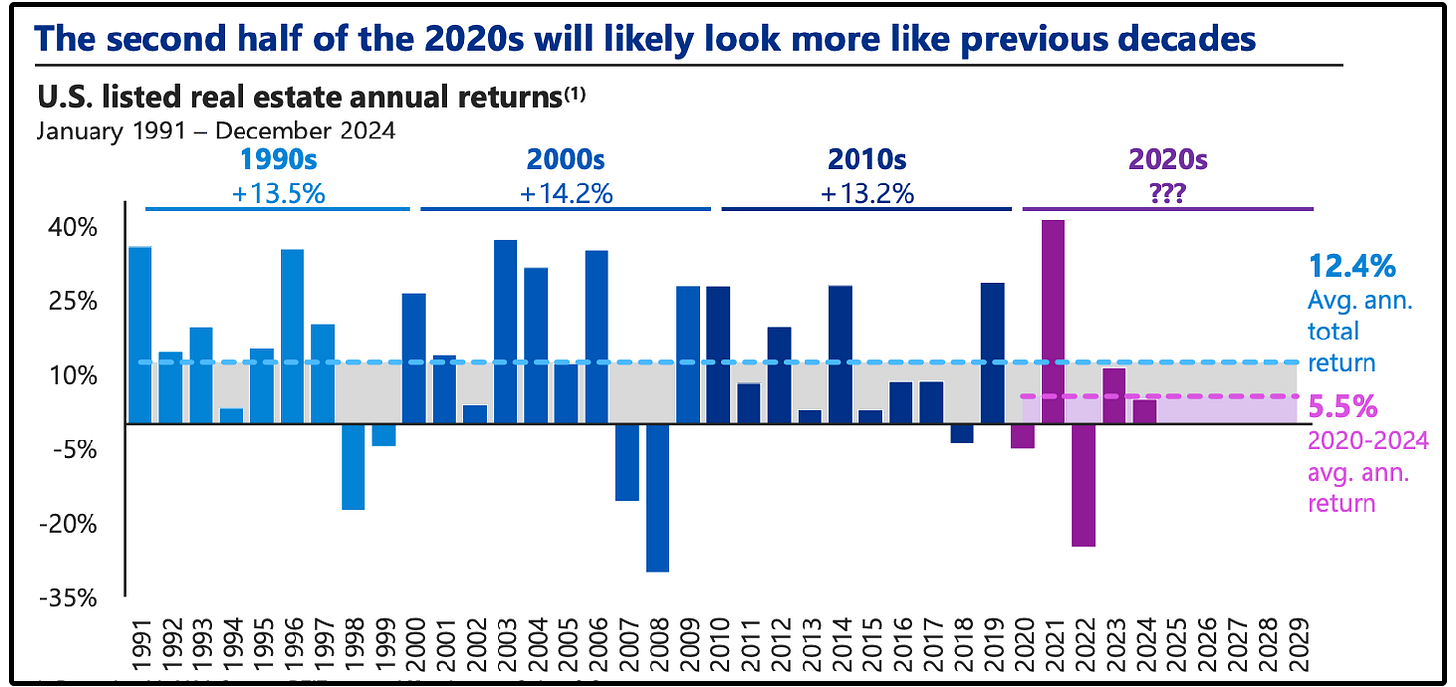

REITs have seen double digit returns each of the past 3 decades with an average annual return of 12.4%.

But the average return over the last 5 years?

Just 5.5%.

REITs are trading at one of their lowest valuations in decades.

This is an opportunity that has to be taken advantage of,

📝 It’s Happening Again

The chart below compares the earnings multiples of REITs to the S&P 500 over the past 20 years.

Historically, REITs trade at a slight discount to the market — about 0.6 turns lower on their price-to-earnings ratio.

When REITs have traded at a discount of -2.0x or greater to U.S. equities, the average forward returns have been impressive:

1 year later: +25.6% for REITs vs. +21.0% for U.S. equities

2 years later (annualized): +18.7% vs. +12.7%

3 years later (annualized): +13.9% vs. +12.8%

But Today?

They’re trading at a 6.5x discount, which is one of the steepest discounts in history.

We’ve only seen this level of undervaluation two times in the last 20 years— during the Global Financial Crisis in 2009, the COVID crash in 2020, and now.

So what happened to REITs the last time the discount was this large?

REITs essentially doubled the returns of the S&P 500, with an average annual return of close to 22%.

⚖️ Asset Classes and Gravity

There is a direct correlation between interest rates and asset prices.

The core of investing has always been about 2 things:

What is your potential return?

What is the risk you are taking on to achieve that return?

For investors purchasing REITs, one of the primary reasons to invest is the higher-than-normal dividend yields.

But again, we have to look at these investments through a risk vs reward perspective.

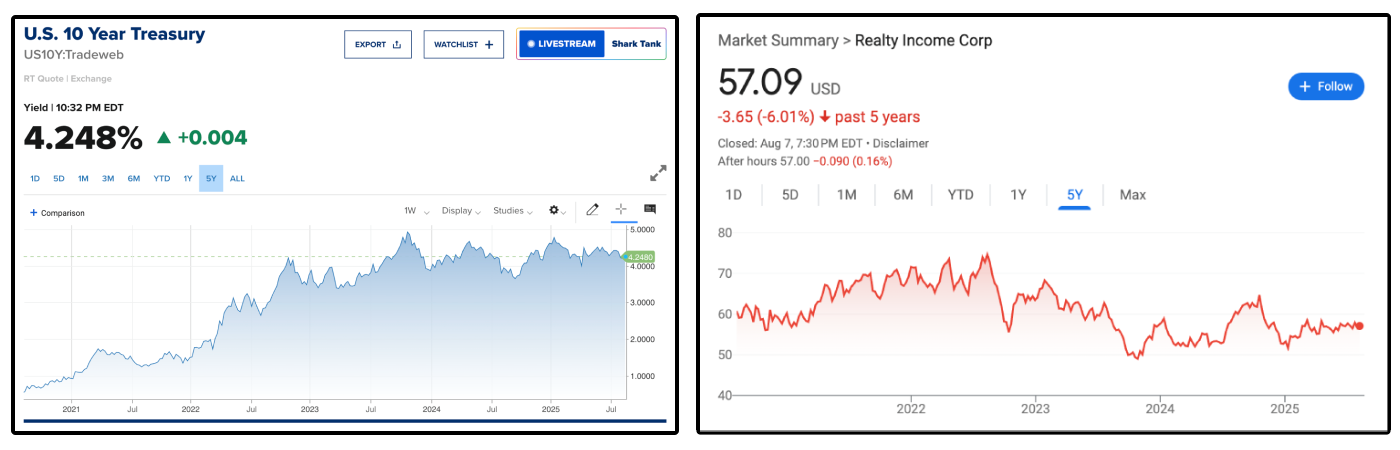

In the last few years, the U.S. 10 year treasury has climbed all the way to around 4.25%.

A 4.25% yield from Treasuries is virtually risk-free.

No tenant risk. No market volatility. No refinancing concerns.

So this forced investors to ask the question:

“Why buy a REIT yielding 5.5–6% when I can get 4.25% with no risk at all?”

This led hordes of risk averse investors to treasuries, leading to alternative income asset classes selling off. 👇

Realty Income is a perfect example.

The stock is down around -6% in the last 5 years, while the U.S. 10 year treasury has more than 4X’d.

💭 Here’s What’s Been Brewing…

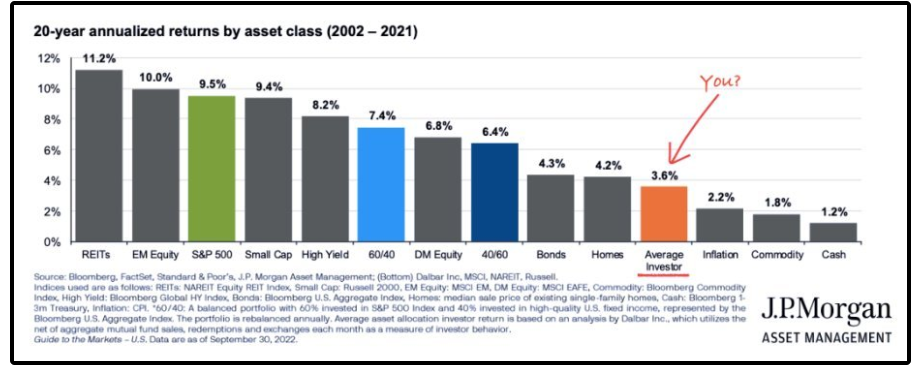

Share price drives sentiment, and most investors are extremely short sighted.

This is the exact reason investors currently have a very negative view of REITs, and it’s also the same reason that most investors drastically underperform the market.

But in the midst of REITs underperforming, something has been happening.

As investors, it is critical we understand our investments ‘sources of returns’.

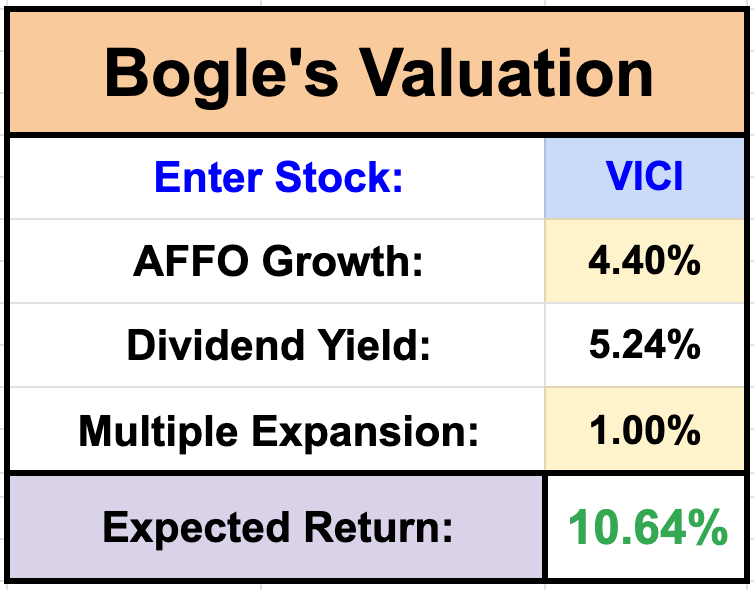

Investment returns derive from 3 things:

Earnings growth (AFFO growth for REITs)

Dividends

Multiple expansion/contraction

Here’s a simple example:

Assuming VICI grows AFFO per share at 4.4%, then accounting for their dividend yield of 5.24%, and then assuming their PE multiple expands by 1%-

You’d be looking at a total return of 10.64%.

So what’s been happening with the majority of REITs the last 5 years?

The high quality ones have continued to grow their AFFO per share.

This is important because it helps us understand the source of this sell off.

The sell off was not due to declining AFFO per share, and it wasn’t due to no dividends being paid.

It’s been due purely to multiple contraction.

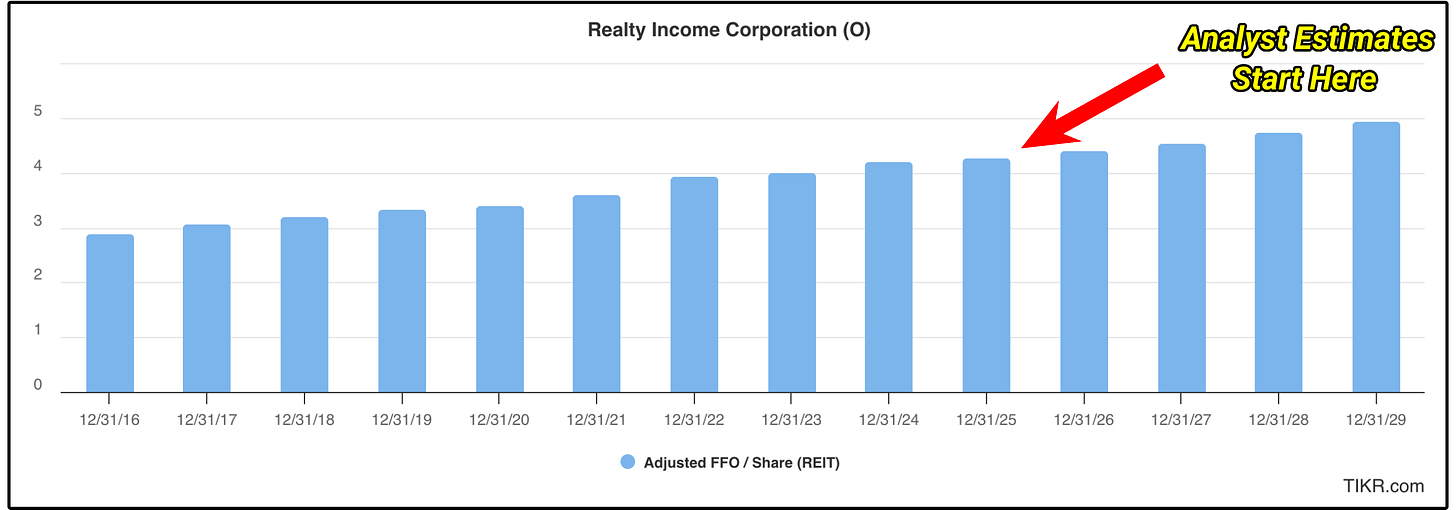

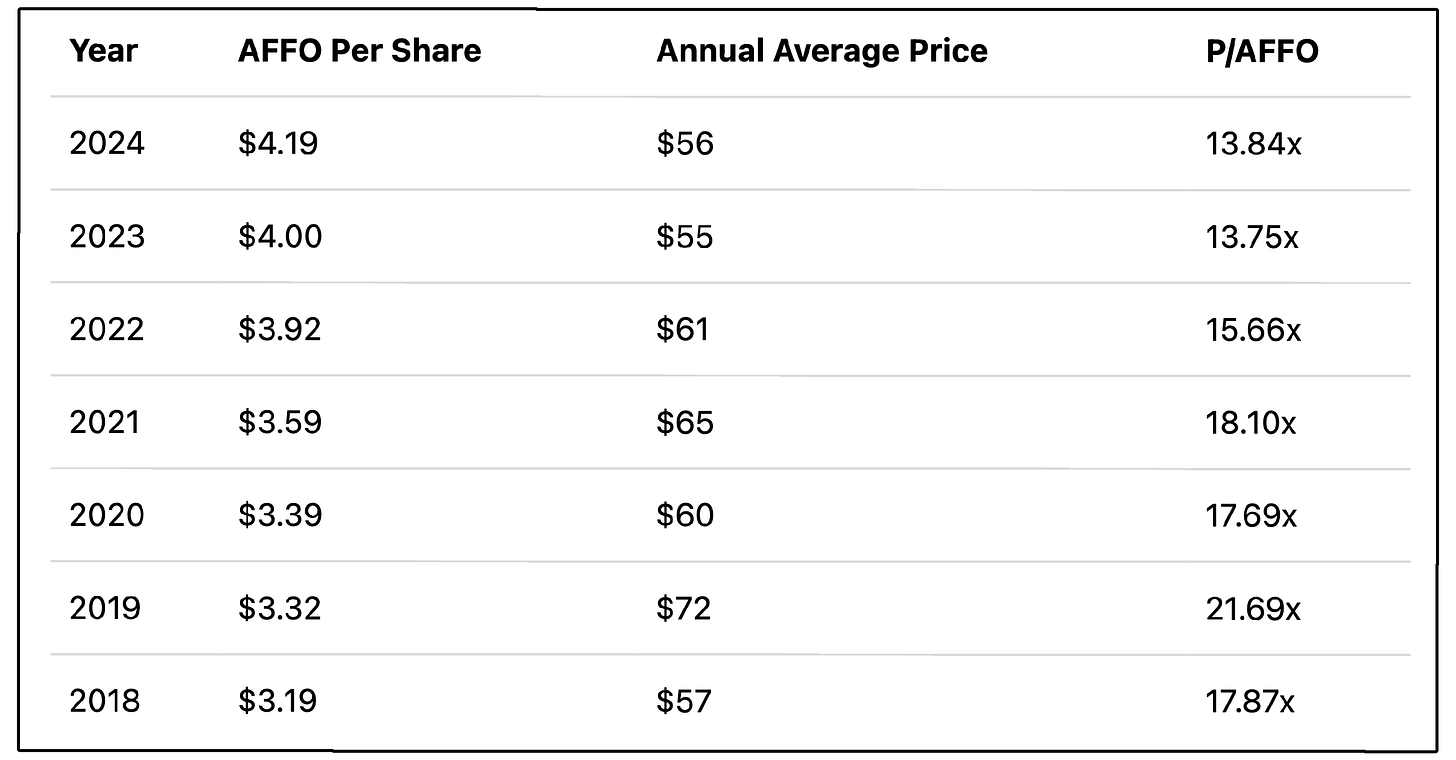

Let’s look at Realty Income again for example. 👇

Despite selling off over the last 5 years, Realty Income has been growing their AFFO per share every single year.

In other words, the intrinsic value of Realty Income is continuing to grow.

So if Realty Income has been growing their intrinsic value while continuing to sell off, it means their valuation is becoming much more attractive.

Their P/AFFO multiple (the key valuation metric for REITs) is now the lowest it has been in over a decade.

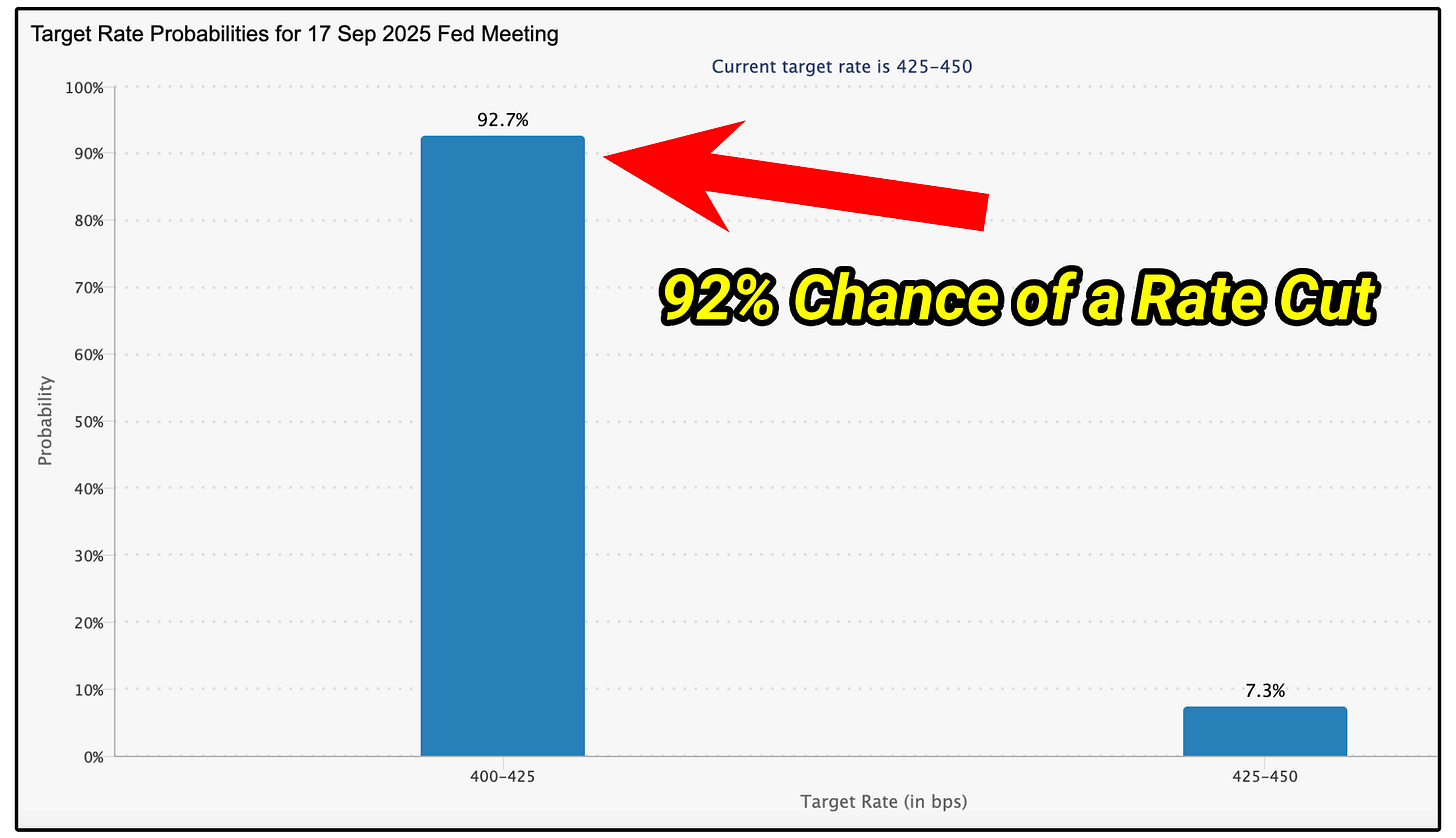

🚀 The Catalyst is Here

We’ve currently been in an accumulation phase when it comes to REITs for the last few years.

But it appears that phase is almost over.

There is now a 92.7% chance that the FED will lower rates on September 17th.

The gravitational pull on assets (and especially REITs) is starting to weaken.

Let’s take a look at just a few of the more interesting opportunities in the REIT market.

But first…

Have You Heard The News? 🛠️

Dividendology will be transforming into a full scale investment research platform in just ONE month.

Here’s everything you get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with now over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

The full launch is almost here.

1. Realty Income (O)

Yield: 5.7% | 5 YR Dividend Growth: 3.58%

Realty Income is one of the most well-known REITs in the world.

This Dividend Aristocrat pays a monthly dividend with a current yield of 5.7%, and has now raised its payout for 111 consecutive quarters.

Here’s what you should know:

✅ AFFO continues to grow steadily (3–4% projected CAGR)

✅ 98.6% portfolio occupancy

✅ 95% of debt is fixed-rate

✅ Expanded into Europe with strong acquisition spreads

✅ Trades at one of the lowest valuations in the past decade

Based on AFFO multiples and dividend discount models, fair value sits around $64–$66, offering solid upside from today’s ~$57 share price.

2. CubeSmart (CUBE)

Yield: 5.27% | 5 YR Dividend Growth: 9.58%

CubeSmart is one of the most under-the-radar beneficiaries of the AI megatrend.

As AI reshapes the economy — from solopreneurship to mobility to e-commerce — demand for flexible, low-cost storage is expected to rise. CubeSmart sits at the center of that shift, with a high-quality portfolio and a scalable, tech-enabled business model.

Here’s what you should know:

✅ Properties located in high-barrier, urban markets (NYC, LA, D.C.)

✅ Capital-light growth via third-party management platform

✅ Conservative balance sheet with just 4x debt-to-EBITDA

✅ Trading at the lowest multiple in its peer group

With a 5.27% dividend yield and 5–7% projected FFO growth, CUBE offers strong total return potential — plus 15–20% upside if it simply re-rates closer to peers.

3. Armada Hoffler (AHH)

Yield: 8.4% | FFO Growth Forecast: ~4%

I recently covered this REIT more in depth in my list of monthly undervalued dividend stocks, which you can read here.

Armada Hoffler isn’t your typical REIT.

While most REITs acquire buildings, AHH develops them from the ground up — either for itself or other companies. This vertically integrated model allows them to capture development profits and own premium assets at below-market cost.

Here’s what you should know:

✅ In-house development engine adds flexibility across market cycles

✅ Dividend was recently cut 30%, but is now fully covered by rental income

✅ No longer reliant on fee income to support the dividend

✅ Insider ownership is high (10.2%) + large recent insider buying

✅ Trading at lowest price-to-book in 3 years

After a 44% sell-off over the past year, AHH is now yielding 8.4%, with a healthier payout ratio and projected 4% FFO growth. This setup offers income-focused investors a mix of yield, value, and insider conviction.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($30 off! + 7day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

This is a REIT fest! Grab your yield plate!

What is your take on Pacaso (PCSO)? Would you buy in now?