🇪🇺 The Top 30 European Dividend Stocks!

I Bought These 2 European Dividend Stocks 📊

When I first started investing, my research never ventured outside of the United States.

But now?

The two most recent additions to my portfolio have both been European dividend growth stocks.

Why European Dividend Stocks Are Interesting 🏛️

According to recent data from Bloomberg-

The S&P 500 is now trading at a forward P/E ratio of about 22.5.

This puts it roughly 50% higher than international stocks tracked by the MSCI World Ex-US Index (currently at ~15x forward earnings).

No doubt, U.S. equities do deserve to trade at a premium over international stocks.

Historically, U.S. equities have traded at a premium due to faster earnings growth, stronger profitability, a larger concentration of high-growth tech companies, and the relative strength of the U.S. economy.

But since 2020, the valuation gap between U.S. and international stocks has widened to its highest level in decades.

As a result, international stocks now appear significantly more attractive on a valuation basis.

European Noble 30 📈

There are nearly 10,000 different publicly traded stocks in Europe.

So how do we narrow down where to start looking for quality dividend stocks?

My friend, European Dividend Growth Investor, created what is known as the European Noble 30 index.

The criteria is straightforward:

Must be headquartered in Europe

At least 20 consecutive years of paying or growing dividends

Market cap above €5 billion

Many of these companies have been around for over a century.

These are 30 high-quality European stocks that make paying dividends a priority.

Using Tickerdata, I built a spreadsheet with in-depth details on the Noble 30 stocks.

You can download this spreadsheet here:

The Problem With European Dividend Stocks 🚩

There is a reason that the index is ‘The Noble 30’ and not ‘The Noble 300’.

Many European dividend stocks do not have the same commitment to rewarding shareholders the way U.S. stocks do.

In fact, most European dividend stocks have a few major differences that make them less attractive than U.S. dividend stocks:

Payout Frequency

Typically annual or semiannual, unlike U.S. stocks which pay quarterly

Dividend Policy

Dividends are often adjusted year to year based on profits

Withholding Taxes

Most European countries impose 15% to 35% dividend withholding taxes

In the spreadsheet above, you can see the data on payout frequency, dividend growth history, and withholding taxes is listed.

2 European Dividend Stocks in My Portfolio 🚀

Only 3.5% of my portfolio value is currently allocated to European stocks.

However, the 2 most recent additions to my portfolio this year have both been European dividend growth stocks:

ASML - ASML Holding

NVO - Novo Nordisk

Both of these companies have massive growth/dividend growth potential over the next decade.

ASML ⚙️

ASML is headquartered in the Netherlands and is the only company in the world that creates EUV lithography machines.

Let me explain just how integral these lithography machines are in terms as simple as possible:

No ASML.

No EUV lithography.

No EUV lithography. No TSMC or Intel.

No TSMC or Intel? No Nvidia GPUs. No Apple or Qualcomm chips. No iPhones, no cloud servers, no ChatGPT. No Tesla self-driving tech. No AWS or Azure data centers running the world’s AI models.

Without ASML, the entire way that we live our lives on a day-to-day basis changes.

Earnings per share are projected to grow at close to 20% annually over the 5 years.

Over the long term, dividends can only grow as fast as earnings and free cash flow grow.

So while the starting yield is low at around 1%, the dividend growth is immense. Management has also stated growing their dividend is a priority.

Novo Nordisk 💉

Novo Nordisk is headquartered in Denmark and operates in diabetes and obesity care.

They are the global market leader in the GLP-1 segment (weight loss drug) with a 55.1% value market share.

And with most projections showing around a 26% to 32% GLP-1 annual market growth rate, Novo Nordisk is set to be a primary beneficiary.

The company currently has its highest starting yield in the last 5 years, and has a 5 year dividend growth rate of over 21.5%!

That is rapid dividend growth.

Final Thoughts 🗒️

European stocks are trading at their cheapest valuation levels compared to U.S. stocks in nearly 20 years.

The Noble 30 can be a great place to start looking for European dividend growers.

But you need to be aware of the key differences European stocks have compared to U.S stocks, like:

Payout frequency

Dividend policy

Withholding taxes

If you want a spreadsheet with in-depth details on the Noble 30 stocks, you can get it here:

🛠️ P.S. – I Have Something BIG For You…

Dividendology is about to evolve into a full-scale investment platform. 🚀

Over the years, two questions have come up more than almost any others:

“How would you invest right now if you were starting from scratch?”

“What would you buy if you were building a high-yield portfolio today?”

Both are great questions, because how you invest depends entirely on where you are in your dividend journey.

So instead of just answering…

I’m going to show you.

I’ll be launching two real-money portfolios on Dividendology.com:

💰 The Dividend Growth Portfolio – Built from $0, showing exactly how I’d begin investing today if I were starting from scratch

🧾 The High-Yield Portfolio – Designed to maximize immediate dividend income (think 8%+ yields) without sacrificing capital

These aren’t mock portfolios. I’ll be investing real money, tracking every move, every dividend, and every update with full transparency, just like I always have.

And these portfolios are only the beginning.

Behind the scenes, I’ve been pouring in countless hours (and a lot of capital) into what will soon become the Dividendology Database.

This will be a game-changing platform for income investors.

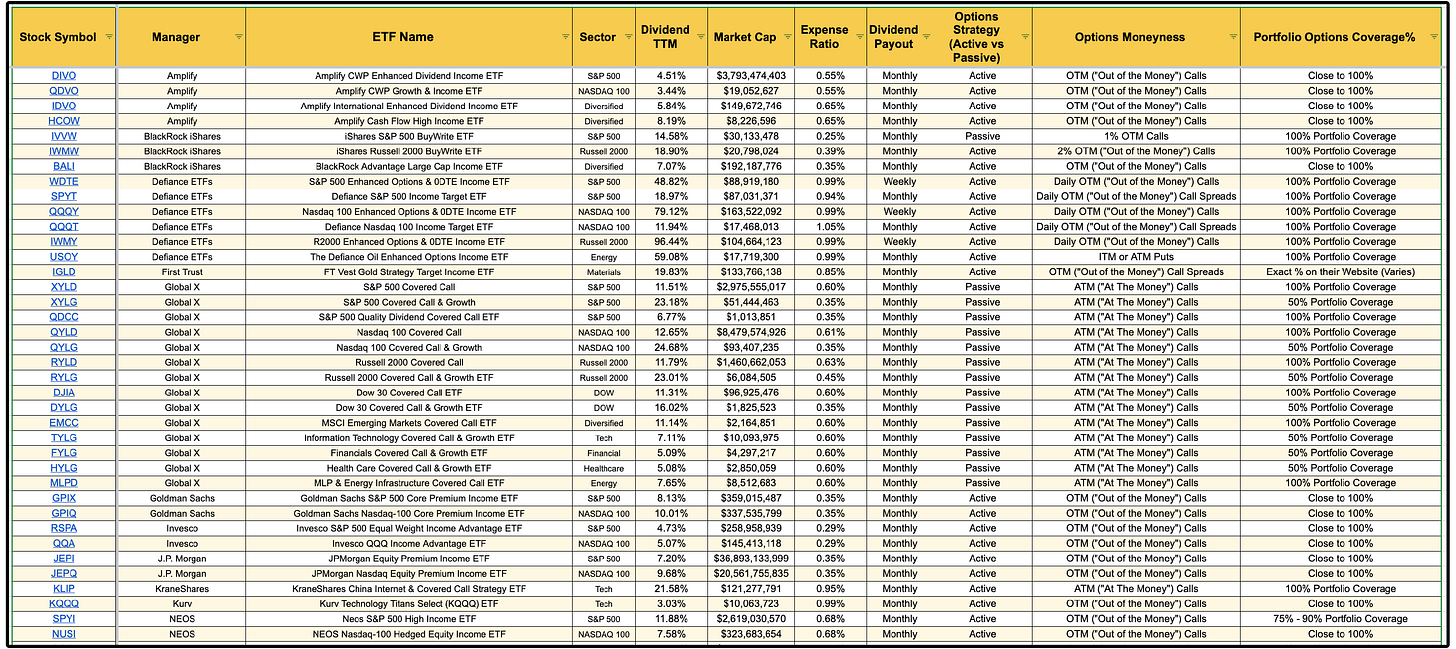

You may have already seen a glimpse of the Covered Call ETF database-

But I’ve been adding even more features to this database that is not featured on websites like Yahoo Finance, Seeking Alpha, Etc, such as whether or not the fund has grown Net Asset Value since inception.

But the full platform will go much deeper — including research and data on:

🧠 Owner-Operator Dividend Growth Stocks

🥇 Super Investor Buying Activity

💼 BDCs

🏢 REITs

💸 Covered Call ETFs

💰 Preferred Shares

📊 High-Yield Opportunities

… and a lot more.

Most investors have no idea just how many quality dividend opportunities are out there, or how to properly evaluate them.

This platform is being built to change that.

Stay tuned!

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($60 off!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Europe is a whole boring socialist museum. The core population dies out. Energy and welfare taxes eat up any development and innovation. If you wanna lock up your capital, invest there.

Thank you for the analysis. Are there specific sectors which standout in Europe (for dividend returns)?