👑 The Top Dividend King Stocks

50+ Years of Unbroken Dividend Growth 💎

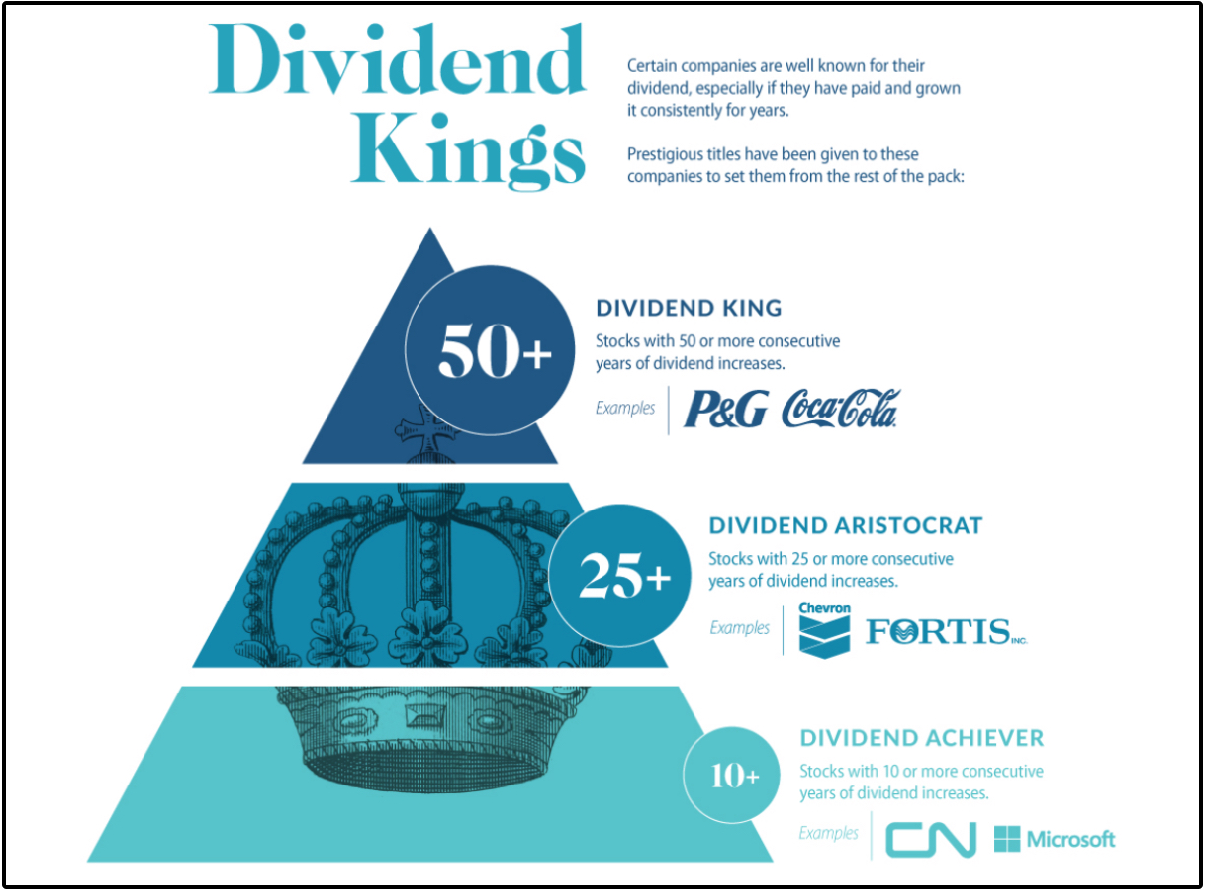

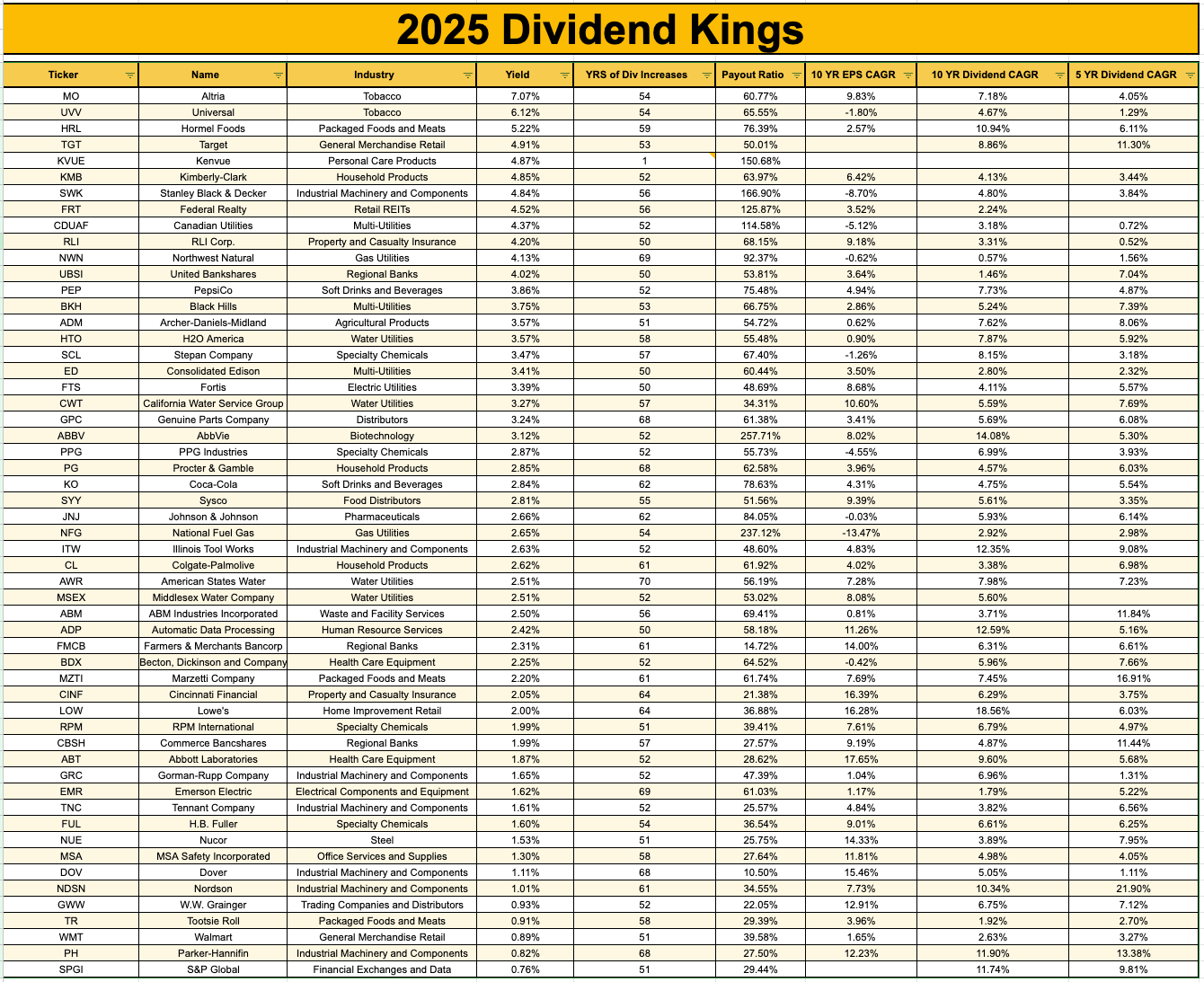

Dividend Kings are companies that have increased their dividends for 50 consecutive years or more.

And right now, there are only 55 in the world.

Today, we will be looking at the top Dividend Kings, based on different criteria.

Let’s dive in!

👑 The True Dividend Kings

Growing dividends for 50+ consecutive years is impressive.

It means earnings growth has supported dividend growth, and that management is committed to rewarding shareholders.

But did you know that the 10 year “breakeven inflation rate” is 2.29%?

This means any stock that has grown their dividend at a compounded growth rate of at least 2.29% over the past decade is technically paying less in dividends in real terms.

So if we filter out the stocks with 10 year dividend growth rates below inflation, here are the stocks that get removed:

FRT - Federal Realty

TR - Tootsie Roll

EMR - Emerson Electric

UBSI - United Bankshares

NWN - Northwest Natural

KVUE - Kenvue

Are these companies truly Dividend Kings?

I’ll let you decide that one.

📊 The Outperformers

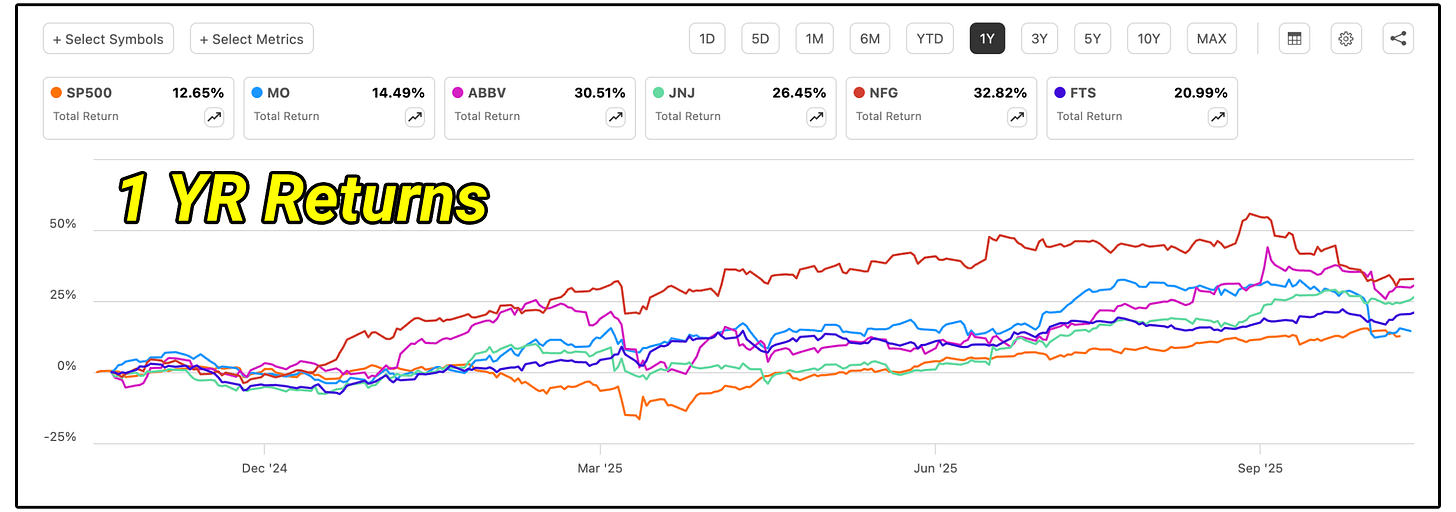

The market has been incredible in 2025.

The S&P 500 has a total return of nearly 13% in the last year.

There have been very few ‘non-tech’ stocks to outperform the market…

But here are just a few of the Dividend King stocks that have done exactly that:

🏰 Longest Dividend Hike Streak

Which Dividend Kings have grown dividend the longest?

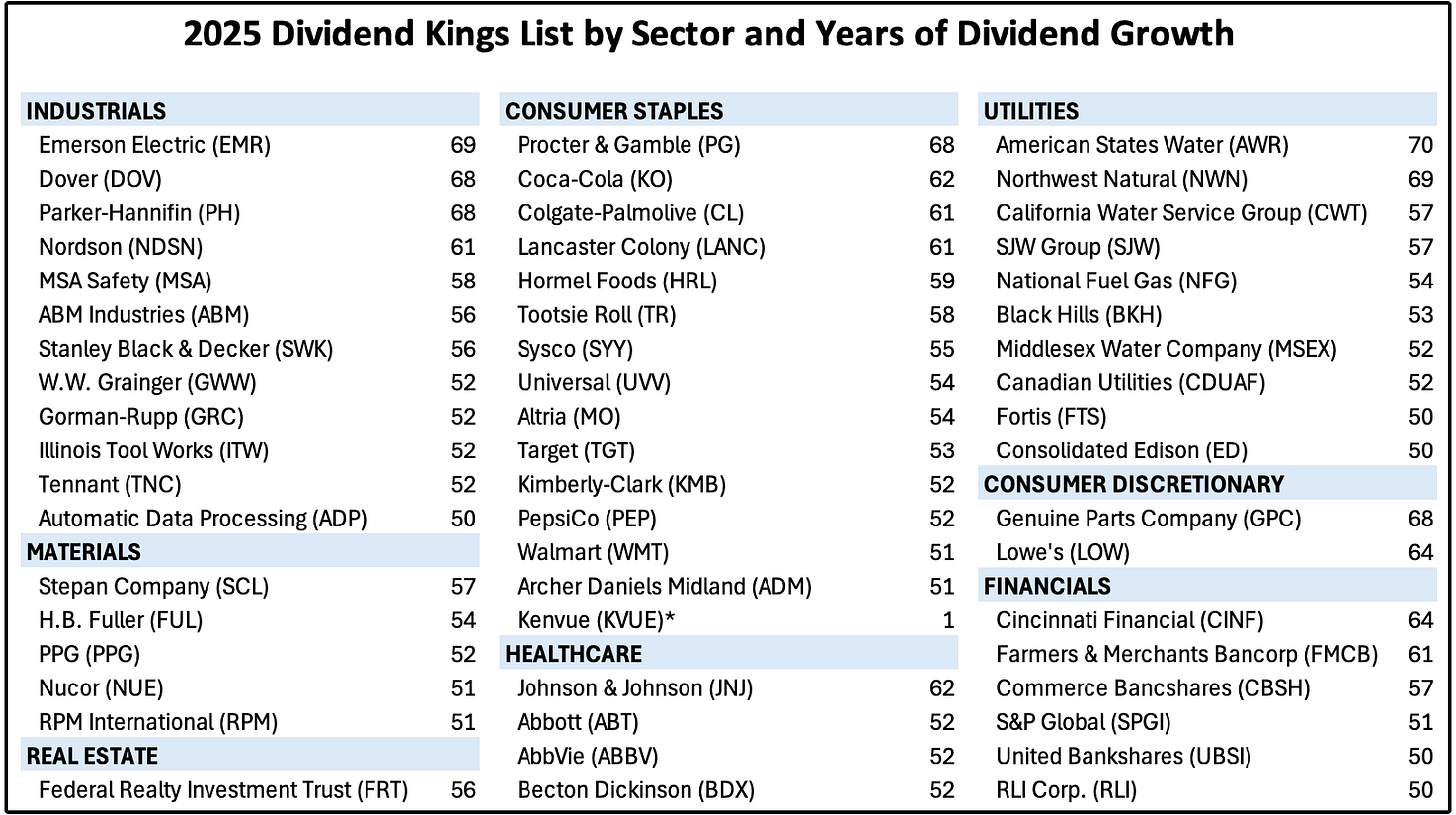

Here’s the full list of Dividend Kings by sector with their years of dividend growth:

Dividend Kings with the longest track record of growing dividends:

AWR - American States Water (70 years)

EMR - Emerson Electric (69 years)

NWN - Northwest Natural (69 years)

PH - Parker-Hannifin (68 years)

GPC - Genuine Parts Company (68 years)

DOV - Dover (68 years)

PG - Procter & Gamble (68 years)

💰 Highest Yield

High Yield does not always equal high risk-

Although, that is a common misconception.

This is one of the reasons we are currently in the midst of building out a real-money high yield portfolio.

We’ve already added a stock yielding around 9.2%, and one yielding around 8.4%, and we’ll be adding our third position to the portfolio this Friday that is also yielding well over 8%.

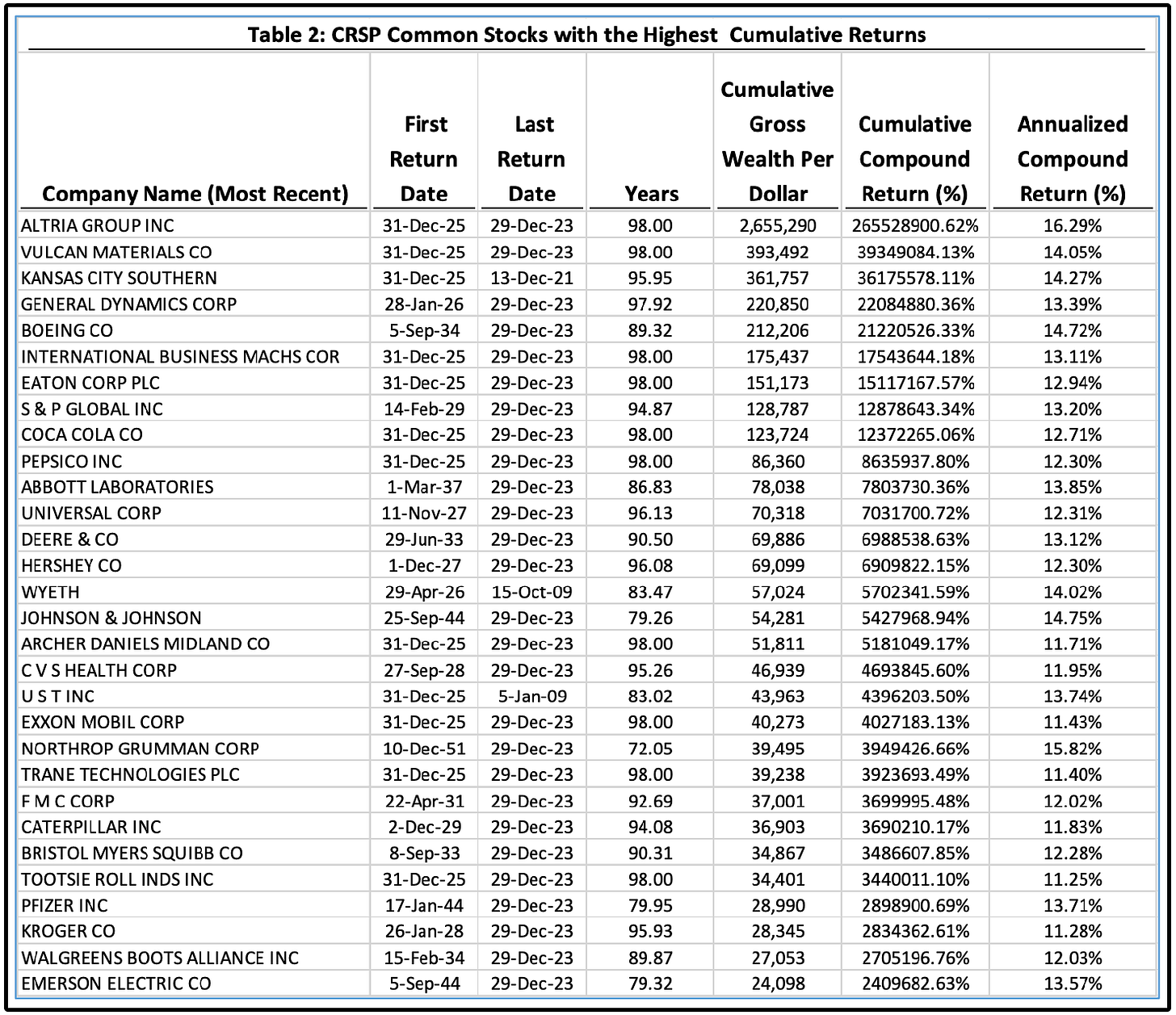

Did you know that the highest yielding Dividend King is also one of the best performing stocks of all time?

If you had invested $1 in Altria Group in 1925, that single dollar would have grown to $2,655,290 by the end of 2023, a total cumulative return of 265,529,000%.

That’s the equivalent of compounding at 16.29% per year for 98 years straight.

Here are the highest yielding Dividend Kings:

MO - Altria (7.07%)

UVV - Universal (6.12%)

HRL - Hormel Foods (5.22%)

TGT - Target (4.91%)

KVUE - Kenvue (4.87%)

🥇 Highest Dividend Growth

Dividend Growth is what really causes the snowball effect to take place.

Here are the Dividend Kings growing dividends the fastest over the last 10 years:

LOW - Lowe’s (18.56% CAGR)

ABBV - AbbVie (14.08% CAGR)

ADP - Automatic Data Processing (12.59% CAGR)

ITW - Illinois Tool Works (12.35% CAGR)

PH - Parker Hannifin (11.90% CAGR)

SPGI- S&P Global (11.74% CAGR)

If you look at the ten year returns for these stocks, you’ll see most of them outperform the market.

High levels of dividend growth (if backed by free cash flow) is almost always a sign of outperformance.

🧾 The Chowder Rule

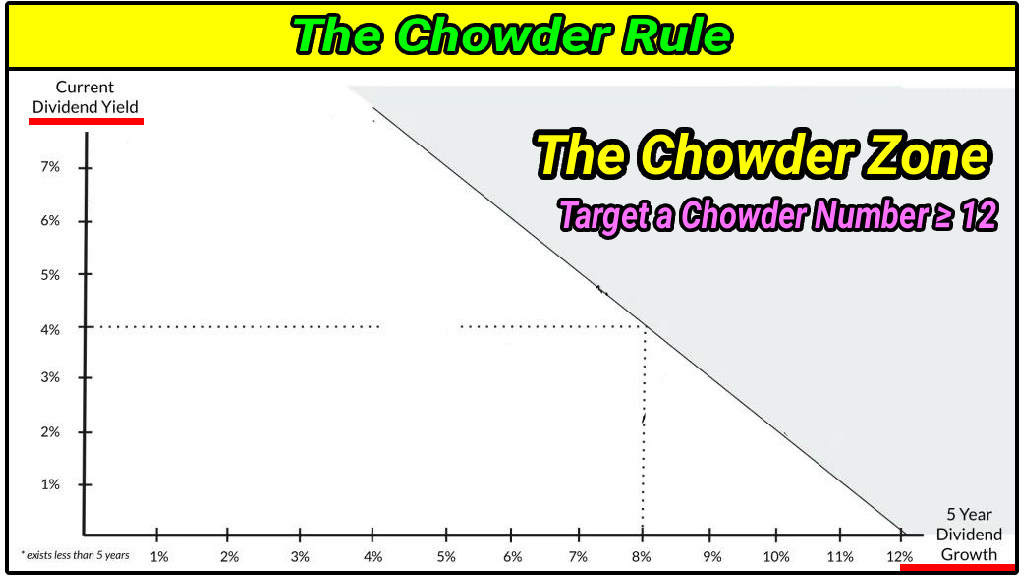

Have you heard of the Chowder Rule?

The Chowder Rule adds a stock’s current dividend yield to its five-year dividend growth rate to get a more complete view of the dividend metrics.

Chowder Number = Dividend Yield + 5 Year Dividend Growth RateHere are the top Dividend Kings by Chowder Rule:

NDSN - Nordson: 22.91

MZTI - Marzetti Company: 19.12

TGT - Target: 16.21

ABM - ABM Industries Incorporated: 14.34

PH - Parker Hannifin: 14.20

💡 The Entire List

Want to get the entire list of 2025 Dividend Kings?

You can download the sheet below:

You can also see the full list below:

🪞Final Thoughts

Being a Dividend King doesn’t necessarily make a stock ‘great’.

But it does mean:

Management is committed to growing dividends

The company has grown dividends during turbulent market periods

The business model has proven durable across economic cycles

Use the above sheet to find the Dividend Kings that best fit your needs.

And guess what?

We actually added a Dividend King to our Dividend Growth Portfolio that we’re building from scratch, which you can read about here.

If you’d like to get access to the Portfolios and all the features below, you can do so here:

Here’s everything you’ll get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 ($30 off! + 7 day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

I’m looking forward to this Friday!

Excellent article, the chowder rule supports my thesis that Target is an excellent buy at this time. It has its structural issues but the dividend is extremely safe with a payout ratio around 50%. Consumer defensive will be a great place to have your money in for the next recession and these stretched valuations.