🚀 These are YOUR Top Stocks for 2026!

What 90,000 Dividend Investors Are Buying for 2026 🧩

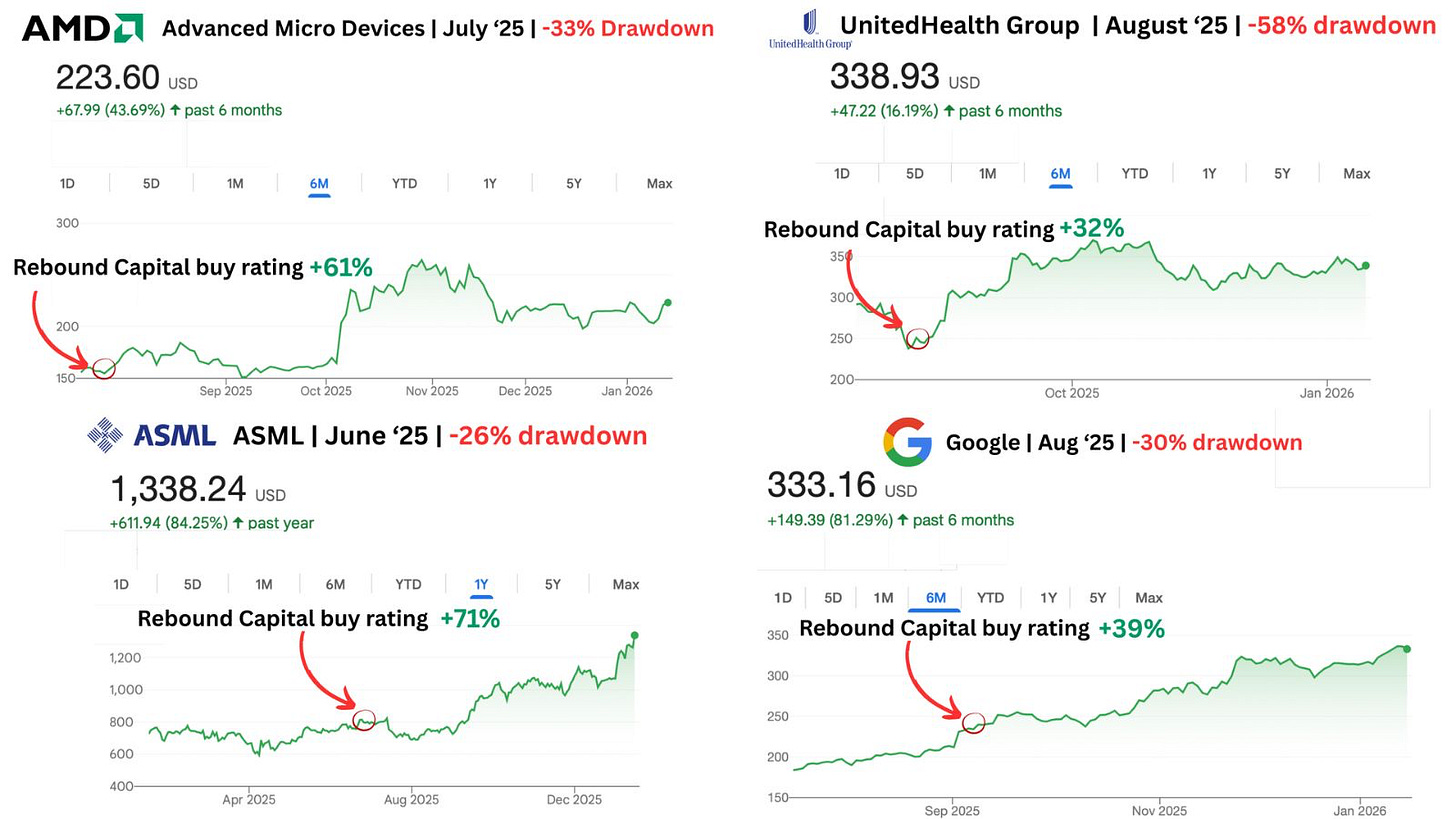

Top 10 Rebound Stocks for 2026 From Rebound Capital

Meta once dropped 70%. Netflix: 50%. Amazon: 40%. Every investor had ruled them out, citing “the companies were done”.

But they all rebounded - Meta: 690%. Netflix: 540%. Amazon: 153%.

Every world-class company suffers deep drawdowns. Rebound Capital identifies high-quality companies undergoing drawdowns to capitalize on their eventual rebound.

Just last year, they identified ASML (up 58%), Google (up 40%), and AMD (up 61%) as ideal rebound prospects. Dividendology readers can now unlock their exclusive 25-page report on the top 10 rebound opportunities for 2026 for free!

Thanks to Rebound Capital for sponsoring.

🏆 Your Top Stocks for 2026!

I did something rare over the past few days.

I sent out a poll to the near 90,000 people who subscribe to this newsletter asking these three simple questions:

What are your top Dividend Growth stocks for 2026?

What are your top High Yield stocks for 2026?

What are your top funds/ETFs for 2026?

I heard back from many of you-

So I spent the past few days reviewing and aggregating the data.

In total, the Dividendology community submitted over 400 unique stocks and funds!

Let’s review the top stocks for 2026 according to the Dividendology community.

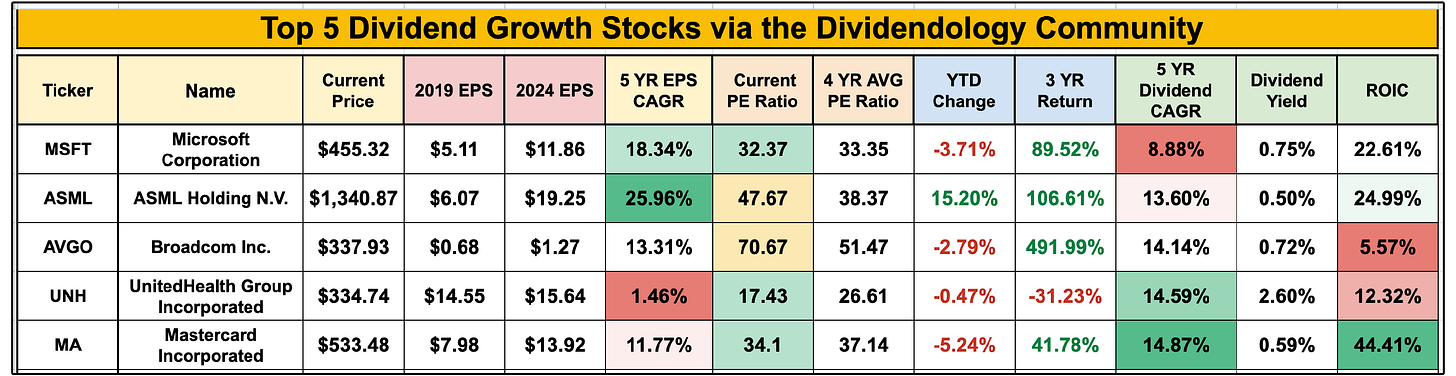

💎 The Top 5 Dividend Growth Stocks

Dividend growth stocks are the best friend of the long term investor.

Historically they’ve provided market beating returns while also providing lower volatility.

The top 5 dividend growth stocks from our community are stocks set to grow free cash flow at a high rate over the next decade-

Allowing them to continue to grow dividends at a high rate.

Let’s review the top 5 picks from the community:

Microsoft - MSFT

ASML Holding - ASML

Broadcom - AVGO

UnitedHealth Group - UNH

Mastercard - MA

Here’s the data:

Note: Some companies have not yet reported full 2025 results; therefore, CAGRs and averages are calculated using the most recent available data (2024).

💰 The Top 5 High Yield Stocks

One of the goals of Dividendology over the past year has been to reveal how many opportunities there are in the high yield space-

And also reveal that high yield does not automatically mean high risk.

With that being said, I was particularly interested to see what the community would select as their top high yield picks.

Let’s review the top 5 picks from the community:

VICI Properties - VICI (Yield: 6.21%)

Altria Group - MO (Yield: 6.87%)

MPLX LP Common Units - MPLX (Yield: 7.61%)

Main Street Capital - MAIN (Yield: 6.75%)

Verizon Communications - VZ (Yield: 7.09%)

As I hope you know, it’s a bit more difficult to review the data for these companies side by side, as we have multiple different asset classes listed in the top 5 (REITs, BDCs, MLPs, etc).

To summarize, I was pleased with the ability of the Dividendology community to select high yield stocks that are currently paying sustainable dividends!

If you don’t know how to analyze these different asset classes, I’d highly recommend you make the time to watch the following video:

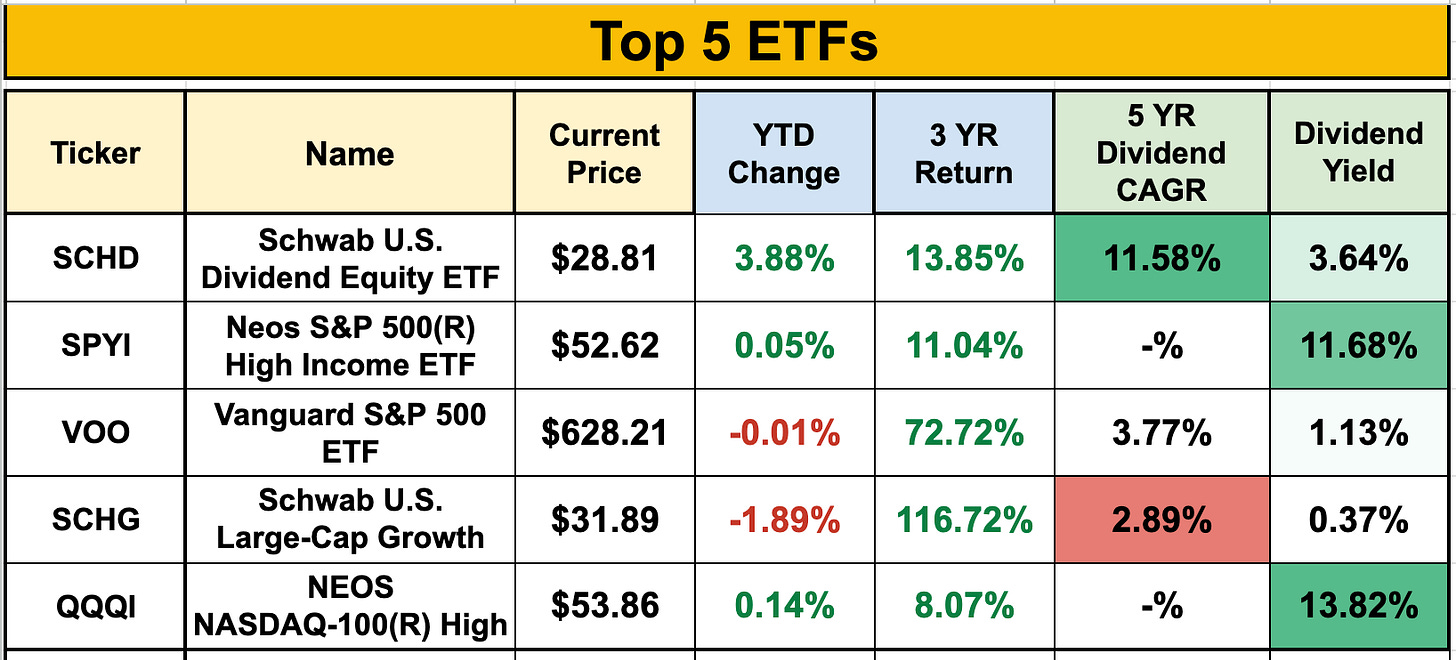

🛠️ The Top 5 ETFs

ETFs make your life simple.

For every goal, for every strategy, there is an ETF.

Here are the top 5 ETFs for 2026 according to the Dividendology community:

Schwab U.S. Dividend Equity ETF - SCHD

Neos S&P 500 High Income ETF - SPYI

Vanguard S&P 500 ETF - VOO

Vanguard S&P 500 ETF - SCHG

Neos NASDAQ-100 High Income ETF - QQQI

The needs of the Dividendology community are diverse, as we can see:

Dividend growth ETFs

S&P 500 ETFs

Growth ETFs

Two covered call ETFs

🪨 Turning Over The Most Rocks

“The person that turns over the most rocks wins the game” - Peter Lynch

With the Dividendology community submitting over 400 unique stocks and funds, there are plenty of rocks for us to continue turning over.

That’s the edge of our community.

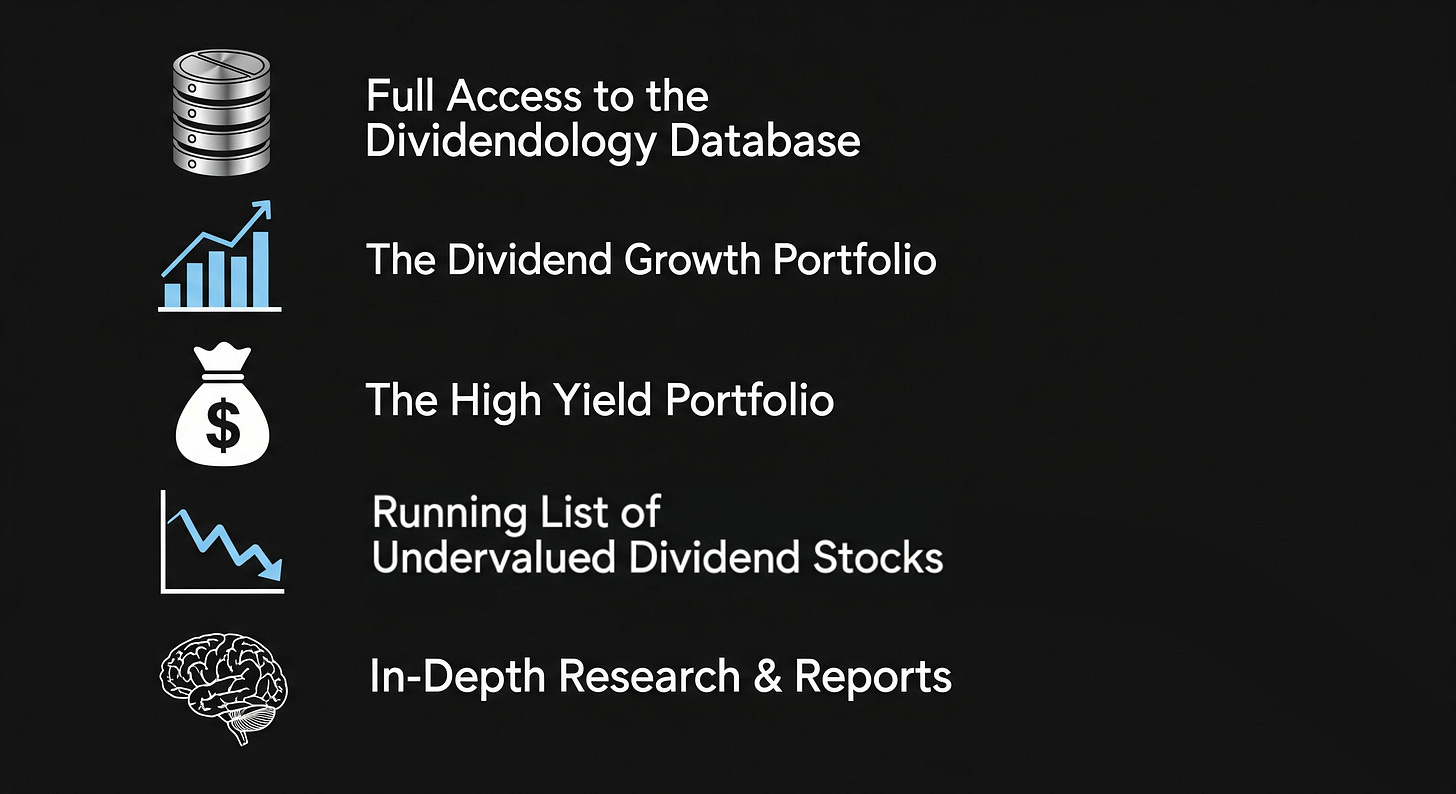

If you want even more out of the community and access to all the features mentioned below, you can join here:

See you on Friday!

Dividendology 🚀

I bought visa, currently have an average of 339, not sure if it was the best decision, any thoughts?

MA still reeling on interest rate limit comments...?