🚀 These Stocks Outperform The Market!

56 Owner Operator Dividend Growth Stocks! 📋

The end goal for most dividend investors is typically to live off dividends.

This means:

You get paid whether the market goes up or down

You get paid without stressing about short-term prices moves

You aren’t forced to sell assets

It’s truly the ultimate sleep-well-at-night strategy.

But if you’re in the early to mid-stages of building your dividend snowball, it’s important to not solely focus on the dividend yield of your investments.

You need to focus on buying stocks with high dividend growth potential.

What gives stocks the ability to grow dividends at a high rate?

Growing free cash flow.

And ironically enough, growing free cash flow at a high rate not only leads to high levels of dividend growth, but it often leads to market outperformance as well.

Note: You can read about the above study on how dividend growth stocks outperform here.

📊 The ‘Other’ Outperforming Group

But dividend growth isn’t the only historical indicator of outperformance.

The other category of outperforming stocks?

Founder-Led Companies. AKA: Owner Operators.

Over a 14-year period, family-owned businesses consistently outperformed their non-family counterparts.

The family-owned universe grew to nearly 2.5x (250%) the original value.

The non-family universe only reached about 1.5x (150%).

The reason for this outperformance is straightforward:

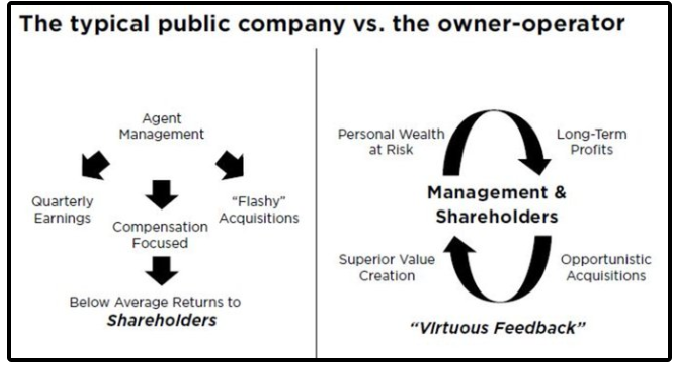

Owners think and act differently from management.

Management thinks about maximizing their next quarterly earnings.

Owners think in decades.

Think of it this way:

📉 The Typical Public Company

Run by agents, not owners

Focused on quarterly earnings

Compensation tied to short term incentives

📈 The Owner-Operator Model

Management = Shareholders

Personal wealth is at risk

Focus on long-term profits and value creation

Basically, skin in the game matters.

📑 56 Owner Operator Dividend Growth Stocks

Many of the companies that are founder led also happen to be dividend growth stocks.

This shouldn’t come as a surprise.

I’ve identified 56 different owner operator dividend growth stocks. 👇

You can download the above spreadsheet of 56 Owner Operator Dividend Growth Stocks here:

💎 An Owner Operator Dividend Growth Stock in My Portfolio

Louis Vuitton - LVMHF 👜🇫🇷💎

Have you heard of Louis Vuitton?

Louis Vuitton makes money by selling high-end luxury goods across several product categories:

Leather Goods: Handbags, wallets, and luggage are its most profitable segment.

Fashion & Accessories: Clothing, shoes, belts, and scarves for both men and women.

Watches & Jewelry: Premium timepieces and fine jewelry collections.

Fragrances & Cosmetics: Perfumes and skincare products under the LV brand.

Despite being down 30% in the last year, Louis Vuitton has outperformed the S&P 500 in the last decade by a wide margin.

This outperformance is due to a significant increase in free cash flow over the past decade, leading to high levels of dividend growth.

Free Cash Flow:

2014 free cash flow: $2.75B

2024 free cash flow: $13.37B

A 17.2% compounded free cash flow annual growth rate.

Dividends Paid Out:

Total 2014 dividends paid out: $1.61B

Total 2024 dividends paid out: $7.32B

A 16.37% compounded annual dividend growth rate.

Notice how close the free cash flow growth rate is to the dividend growth rate?

Over the long term, dividend growth always follows free cash flow growth.

It is now estimated that founder Bernard Arnault owns around 50% of the company after significant insider purchasing activity in the last year.

✅ The Bottom Line

As a long term investor looking to one day live off dividend income, I need to own stocks that continue to grow free cash flow long term.

This most often happens when management thinks and acts like owners.

Because when leaders have skin in the game, they prioritize sustainable growth, capital efficiency, and long-term value creation.

All of which fuel dividend growth.

In the end, the best dividend stocks aren’t just income machines…

They’re compounding engines run by people who treat the business like it’s their own.

🛠️ P.S. – The Dividendology Database is Coming Along...

Last week I announced I’ve been building something big behind the scenes:

The Dividendology Database — a comprehensive tool designed to help you navigate the income investing world with confidence.

I’ve already poured over $10,000 into research and data, and spent countless hours creating what I believe will be the most useful resource for dividend investors like us.

So far, you’ve seen a preview of the Covered Call ETF database, complete with details like option moneyness and portfolio coverage (data most platforms ignore).

But that’s just the beginning.

I’m currently expanding it to include Owner Operator Dividend Growth Stocks, BDC insights, REIT data, Covered Call ETFs, Preferred Shares and more.

The average investor has no idea how many great investment options there actually are to fit their needs. (You can see what I mean by reading last month’s newsletter here)

This will fix that problem.

Stay tuned, more updates are on the way soon.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($60 off!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Great read.

I am currently looking to make a portfolio with an emphasis on these compound growth stocks that you mentioned. Thought adding some dedicated growth stocks would be a good round out to it. Something like a 60/40 split.

I hope your platform comes right and know that I will definitely be a user of it!

Great piece! This is the classic “skin in the game” effect. When founders or families have significant ownership, they’re more engaged and committed to long-term growth.