👑 This Changes The Way You Invest Forever!

The Shocking ROIC Truth Every Investor Should Know 📝

The best opportunities exist in uncertain times.

Apple once fell 83%. Amazon, 90%. Netflix, 74%. Even the greatest companies face brutal drawdowns.

Rebound Capital finds those moments, identifying high-quality businesses poised for a comeback. In just the last 3 months, they flagged:

ASML, now up 26%

Google, now up 52%

AMD, now up 65%

Dividendology readers get an exclusive 20% discount on a Rebound Capital subscription, but only if you join in the next 24 hours.

🏆 Buying Quality Dividend Growth

On Tuesday, we added the first stock to our Dividend Growth Portfolio.

Why am I so excited about the position?

The company is currently:

Projected to grow earnings at a double digit rate

Trading below its historical valuation multiples

Essentially, it’s positioned to take advantage of both of the engines of outperformance.

But that’s not the main reason I’m so excited about this company.

The main reason?

The quality of the business.

🌍 Our Buy Zone

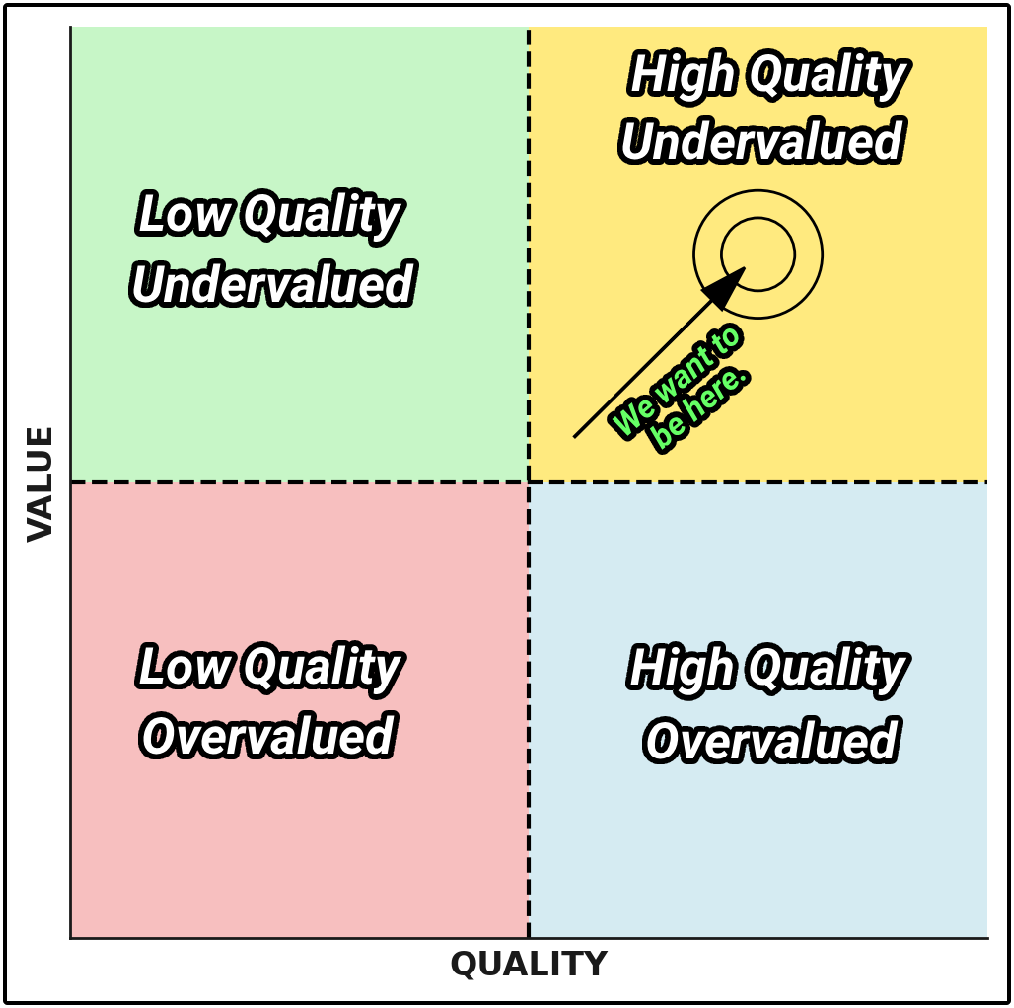

We could essentially place our potential investments into four categories:

Low Quality/Overvalued

Low Quality/Undervalued

High Quality/Overvalued

High Quality/Undervalued

As you already know, we want to be in the “High Quality/Undervalued” area.

This seems obvious at first.

But you’d be surprised how often people overlook the quality of the business and focus purely on valuation.

This is a common mistake, and one that I certainly made starting out-

And this mistake can cost you valuable years of compounding.

⏳ Warren Buffett’s Mistake

This mistake is so common, Warren Buffett even admitted to it in his early career.

Buffett coined this style of investing the “cigar-butt strategy”.

“If you buy a stock at a sufficiently low price, there will usually be some hiccup in the fortunes of the business that gives you a chance to unload at a decent profit, even though the long-term performance of the business may be terrible.” - Warren Buffett

However, Buffett moved on from this approach in his later years.

The reason?

Charlie Munger and return on invested capital.

💎 The Most Important Metric

Charlie Munger taught Buffett to focus on the actual quality of the business.

The easiest way to do this according to Munger was simple.

Buy businesses with high returns on invested capital.

“We’ve really made the money out of high-quality businesses. Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns.” -Charlie Munger

Return on Invested Capital (ROIC) measures how efficiently a company generates profit from the capital invested in the business.

I understood this years ago-

But it wasn’t until I saw a real life example that my investing philosophy changed forever.

📝 Shocking Example

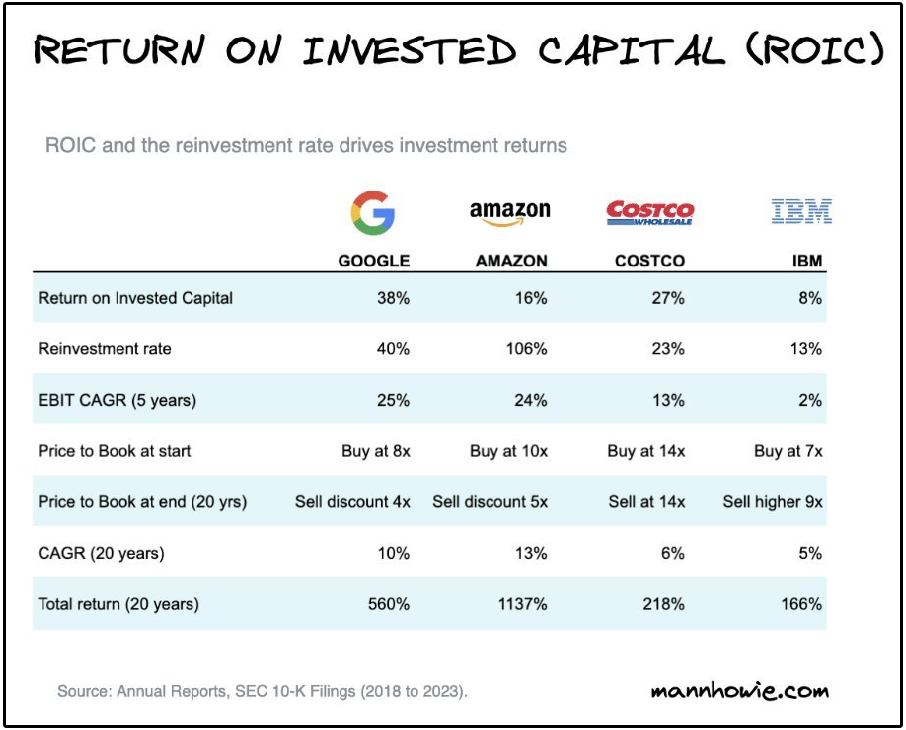

Take a close look at the image below.

It shows four well-known companies — Google, Amazon, Costco, and IBM — and compares their return on invested capital (ROIC), their reinvestment rates, and the resulting shareholder returns over 20 years.

Now here’s the shocking part:

If you bought Google at a high valuation of 8× price-to-book… and sold it later at a lower valuation of 4× price-to-book…

You still would have earned a 560% total return over 20 years.

But if you bought IBM at a lower valuation of 7× price-to-book… and eventually sold it at a higher valuation of 9× price-to-book…

Your total return would be just 166%.

Read that again:

Google’s valuation went down over time, but still massively outperformed.

IBM’s valuation went up over time, but dramatically underperformed.

Why?

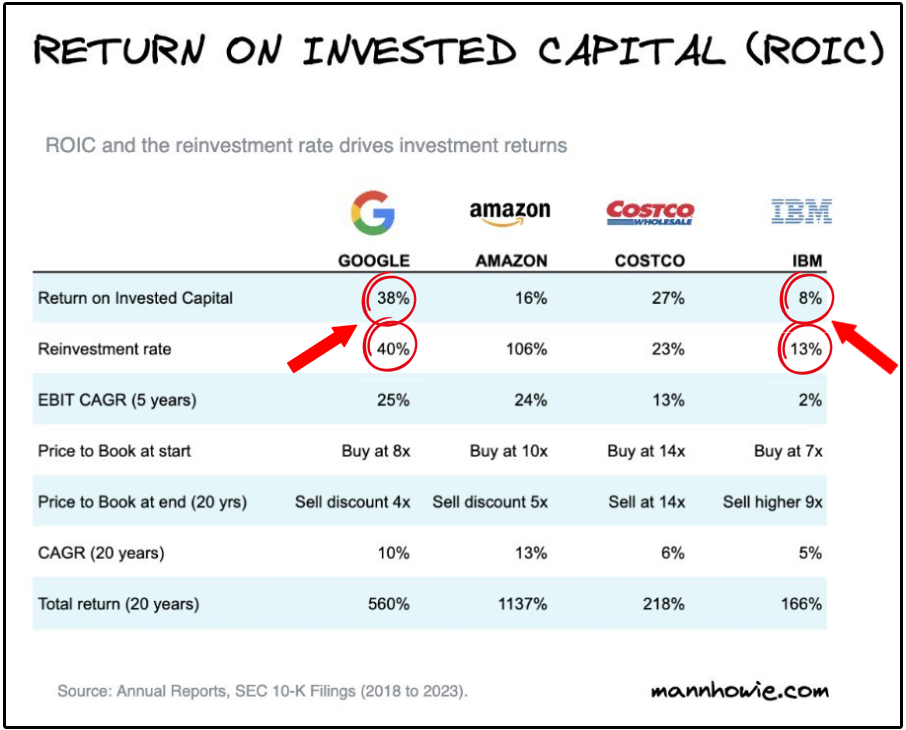

Take a closer look again.

Google consistently generated high returns on invested capital (38%) and had a healthy reinvestment rate, taking advantage of high-return opportunities.

IBM earned low returns on invested capital (8%) and had far fewer profitable places to deploy capital.

This isn’t just a cherry picked example.

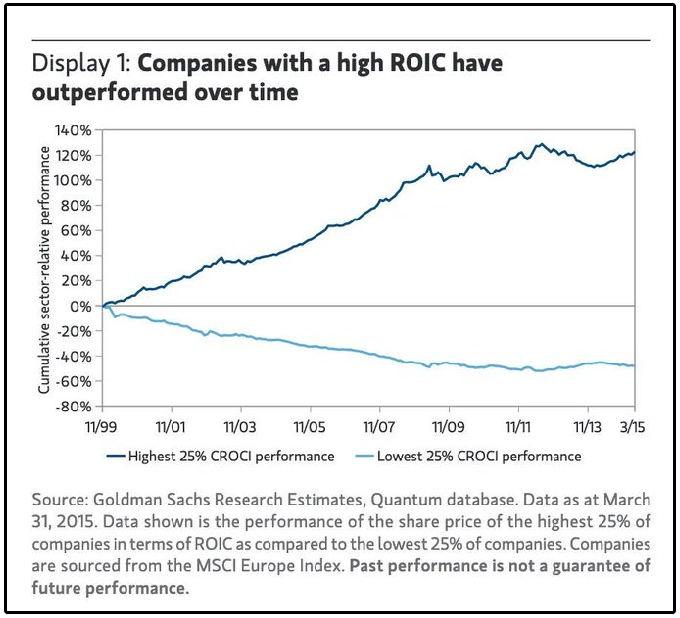

In fact, Goldman Sachs analyzed decades of market data and released a report where they compared two groups of companies:

The top 25% of businesses based on ROIC

The bottom 25% of businesses based on ROIC

The results were staggering.

This realization that ROIC was the key to long term compounding is what shifted Buffett’s mindset from ‘cigar butt’ investing, to quality investing.

“It’s far better to buy a wonderful business at a fair price than a fair business at a wonderful price.” - Warren Buffett

So… What businesses have been producing the highest levels of ROIC over the past decade?

🥇 High ROIC Stocks

There is a high level of overlap between high ROIC stocks and dividend growth stocks.

The reason as to why is what I’ve been pointing out for years.

The greatest businesses generate so much in free cash flow, it becomes near impossible to intelligently reinvest all of it back into the business and still generate high levels of ROIC.

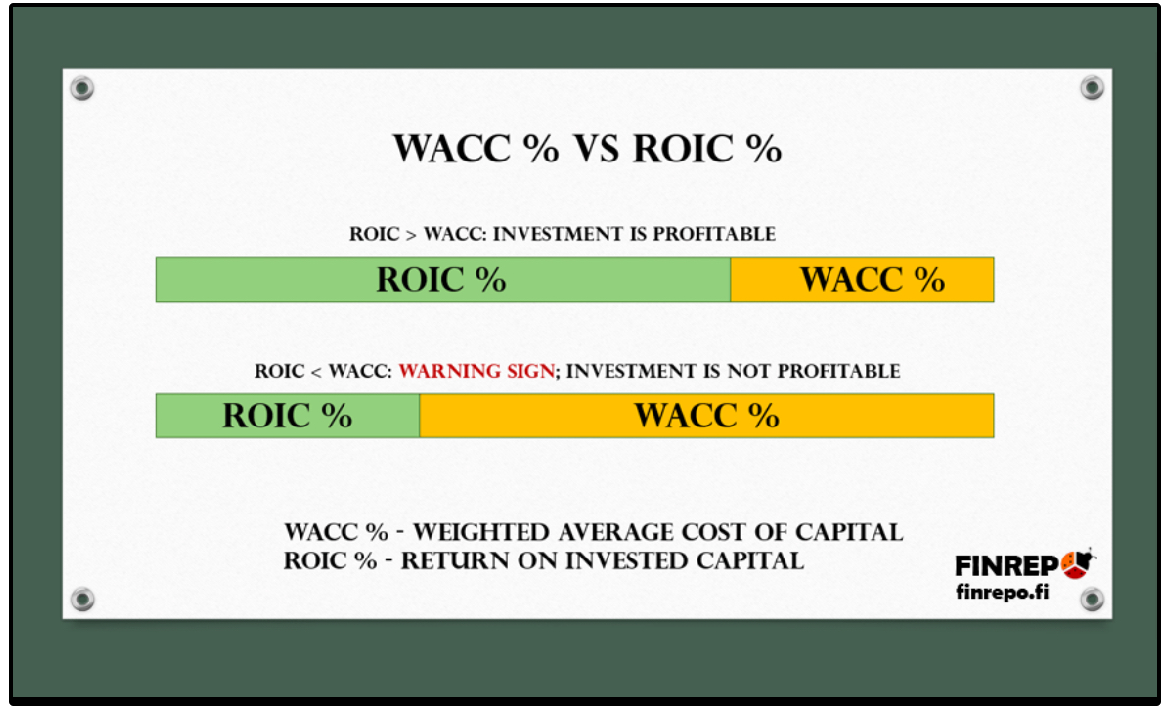

And anytime return on invested capital is not greater than your weighted average cost of capital, then shareholder value is being destroyed.

This is the exact reason we recently saw tech stocks like Google and Meta recently start paying dividends.

Here are some examples of dividend growth stocks with high levels of ROIC:

1. 💻 Microsoft (MSFT)

2024 ROIC: 22.61% | 10YR ROIC Average: 17.50%

The company leverages cloud infrastructure and scalable software platforms (like Azure and Office 365) where incremental revenue comes at very low additional capital cost-

Enabling strong returns on invested capital.

2. 🍕 Domino’s Pizza (DPZ)

2024 ROIC: 54.10% | 10YR ROIC Average: 61.79%

Nearly 99% of Domino’s global stores are owned and operated by independent franchisees. This leads to an incredibly asset-light franchise model. This combined with their vertically integrated supply chain and heavy focus on digital ordering, enable very high margins and minimal incremental invested capital-

Driving an exceptionally high ROIC.

3. 💳 Visa (V)

2024 ROIC: 28.65% | 10YR ROIC Average: 18.84%

As a global payments-network operator, Visa has high operating leverage, minimal physical asset intensity and recurring fee-based revenue from each transaction, which translates into a high ROIC.

4. 🚬 Altria (MO)

2024 ROIC: 33.20% | 10YR ROIC Average: 17.17%

With recurring demand in the tobacco business and relatively low incremental investment needs, Altria is able to generate high returns on capital deployed.

Note that Altria uses the majority of their free cash flow to pay out dividends, meaning less capital is reinvested, making it easier to generate high ROIC.

5. 💉 Novo Nordisk (NVO)

2024 ROIC: 38.99% | 10YR ROIC Average: 58.91%

Thanks to blockbuster treatments, high margins in its therapeutic areas, and strong pricing power paired with disciplined capital investment, the company earns very high ROIC on its pharmaceutical assets.

📈 Our Dividend Growth Purchase

We’ve now added 2 positions to our high yield portfolio, and added our first position to our dividend growth portfolio on Tuesday-

Which members of Dividendology can view at anytime.

As you might suspect, our new purchase has exceptional historical ROIC.

Let’s analyze the ROIC of our new dividend growth position: