📊 This High Yield Portfolio Outperformed the Market!

Less Volatility. Better Returns. Big Dividends. 🔔

I did a fun experiment around 11 months ago.

I made a video titled “How to Build a SAFE High Yield Dividend Portfolio!”

The goal was simple.

We wanted to create a portfolio that:

Had a starting yield of close to 7.5%

Paid out sustainable and predictable dividends (No future dividend cuts)

Would grow dividends in-line with inflation

Would NOT have continual share price decline

Basically, we wanted all the qualities that would allow someone to sustainably live off a high yield portfolio.

So… How did we do?

The High Yield Portfolio 💰

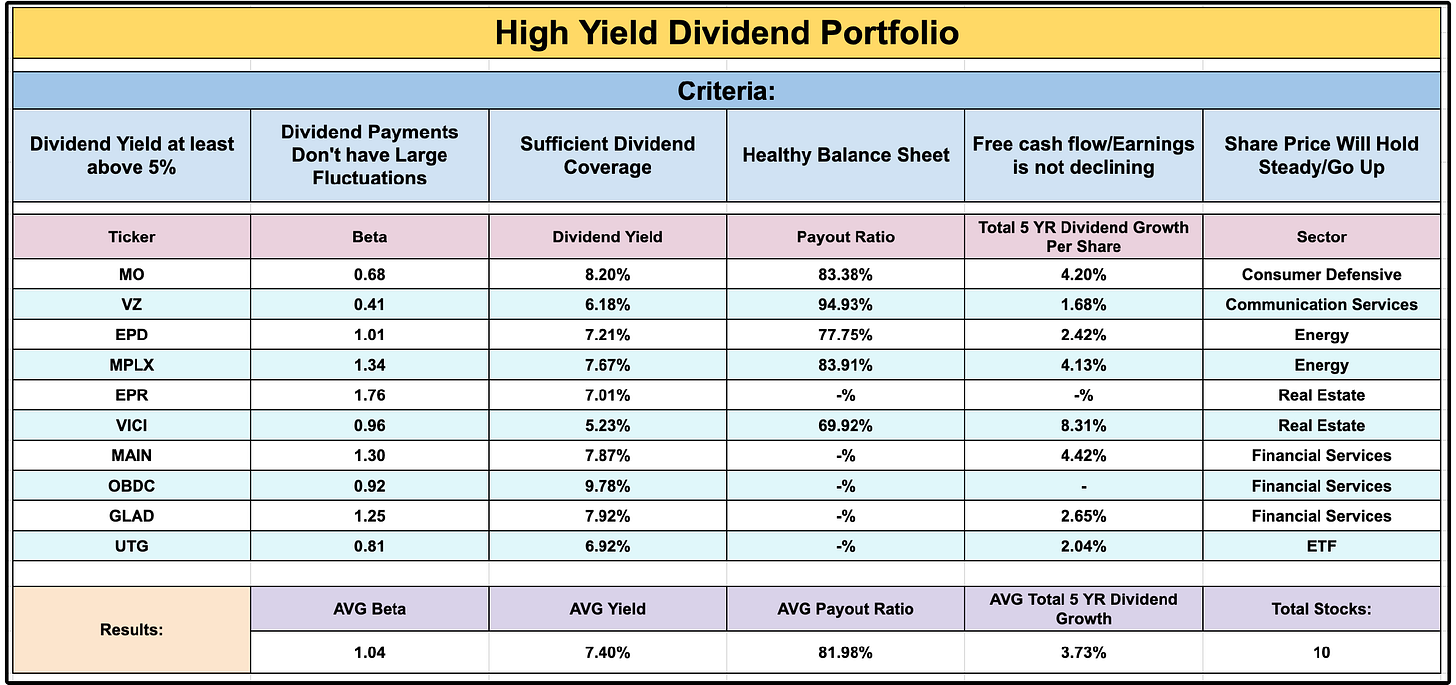

Let’s review the different positions that were in this portfolio.

The portfolio had 10 positions.

At the time of the creation of the portfolio, the average yield was 7.40%.

The payout ratio was shown at around 81.9% (which it was technically lower, considering the way we measure dividend sustainability for REITs, MLPs, and BDCs is different).

And the historical dividend growth was between 3% - 4%.

Solid dividend metrics, but the real question is-

How did this portfolio actually perform?

Portfolio Performance 📈

I’ll be straightforward.

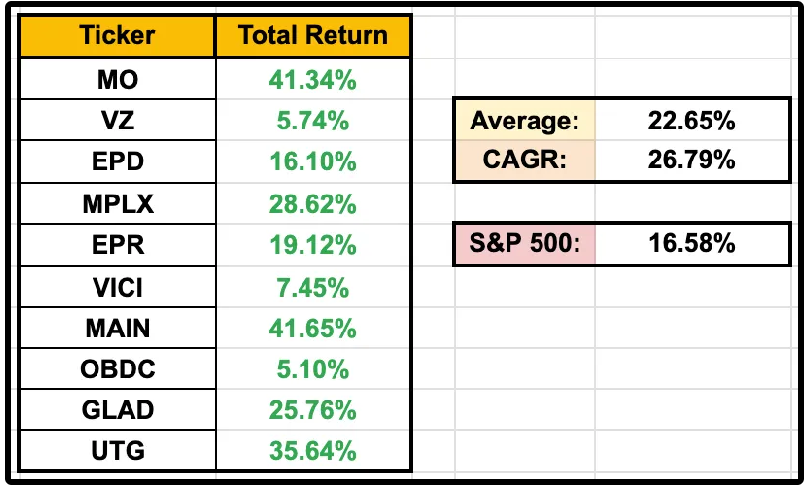

The performance of this portfolio since ‘inception’ has been amazing.

The portfolio return has been 22.65%.

That’s a compounded annual return of 26.79%!

Meanwhile, the S&P 500 return has been 16.58%.

Our high yield portfolio outperformed by over 6%!

6 of the 10 positions actually outperformed the tech heavy S&P 500.

Simply amazing.

But the performance doesn’t tell the whole story.

I ran a backtest on it for deeper insights.

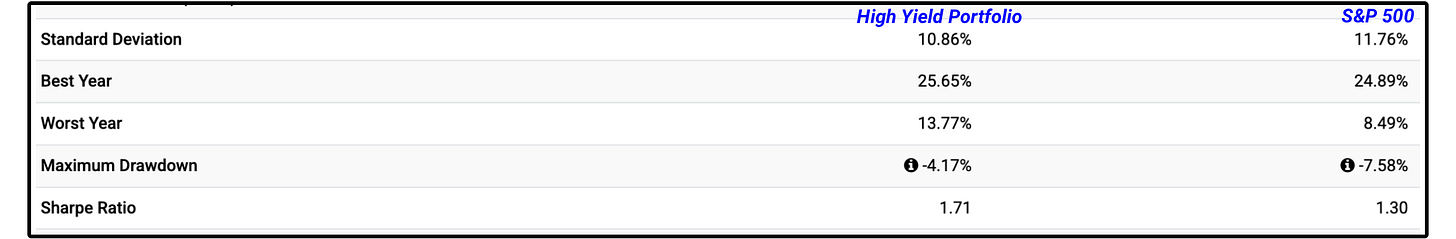

Not only did this portfolio outperform by a wide margin, but it:

Had lower volatility (standard deviation)

Had a lower maximum drawdown

Had a stronger Sharpe Ratio

The Sharpe Ratio is an important one.

The Sharpe Ratio is a way of measuring how much return you’re getting for every unit of risk you take.

A higher Sharpe Ratio essentially means that you’re being compensated more generously for the volatility your portfolio experiences.

Basically, we took on less risk than the S&P 500, while still experiencing better returns.

This portfolio simply saw amazing performance.

Time for the Truth 🔎

We will be launching our 2 model portfolios (The Dividend Growth Portfolio and The High Yield Portfolio) to paid members on September 8th.

Just 3 days away! 🎉

I’m quite excited for the launch, along with the launch of the Dividendology Database.

But we need to discuss the truth about the high yield portfolio we will be launching.

If we can attain just a sliver of the success that we saw with our example portfolio above, then it will be a major success.

In fact, the goal of the high yield portfolio isn’t even to outperform the market.

The goal will be to build a real money, high yield portfolio from scratch, with sustainable dividends, and no capital erosion.

Ideally, we achieve a yield of 8% with no decay in value.

Why 8%?

Because it reduces the amount of capital you need to retire by 50%.

Let me explain.

The 4% Rule vs High Yield ⚠️

The 4% rule is a retirement planning guideline that helps estimate how much you can safely withdraw from your retirement savings each year without running out of money.

If you have $1 million in your portfolio, you should be able to ‘safely’ withdraw $40,000 a year, without depleting your portfolio over a 30 year retirement.

However, there is a major flaw with the 4% rule:

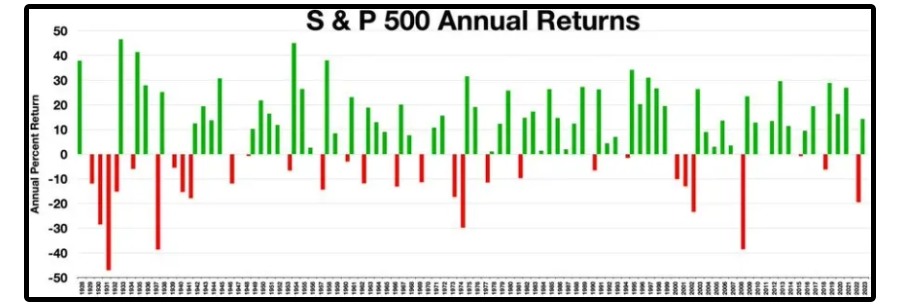

Sequence of return risk.

Sequence risk refers to the danger of experiencing poor investment returns early in retirement, when an investor is making withdrawals.

Look at the example pictured below.

In the above example, both investors started with $100,000, and had an average annual return of 4% over a 15 year time period.

But here is what each finished with:

Investor 1: $105,944

Investor 2: $35,889

Why such a difference?

Because the sequence of returns you get plays a major role in the potential longevity of your portfolio.

Dividend investing solves this problem.

You continue to get paid, regardless of the fluctuations of your portfolio.

Unfortunately, the 4% rule is still commonly used by many.

But what if we could achieve our goal of building a portfolio that yields 8%, with no capital erosion?

All of a sudden, the amount of capital we need to retire is cut in half.

In the example mentioned above, based on the 4% rule, you would need a $1 million portfolio to live off $40,000 a year.

With a portfolio that has a dividend yield of 8%, you would only need $500k to generate that same $40,000 a year.

But there is one more thing to consider: Inflation.

However, this can still be accounted for 2 ways with a high yield portfolio:

Dividend Growth

Reinvesting a small portion of dividends to offset inflation

A sustainable high yield has the potential to be extremely powerful.

It’s Almost Showtime! ⏰

On Monday, September 8th, Dividendology is transforming into a full scale investment platform.

This is a project that I’ve been building out for the last 8 months.

Some of the things I’m most excited about?

The launch of the Dividendology Database.

This will provide in depth data on alternative income asset classes that other software fail to provide. (I’ve spent months and over $10,000 to compile this data).

On top of this, the two most common questions I get:

“How would you invest right now if you were starting from scratch?”

“What would you buy if you were building a high-yield portfolio today?”

I’ll be launching two real-money portfolios on Dividendology.com:

💰 The Dividend Growth Portfolio – Built from $0, showing exactly how I’d begin investing today if I were starting from scratch

🧾 The High-Yield Portfolio – Designed to maximize immediate dividend income (think 8%+ yields) without sacrificing capital

These aren’t mock portfolios.

I’ll be investing real money, tracking every move, every dividend, and every update with full transparency, just like I always have.

Here’s everything you’ll get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with now over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

The full launch is almost here!

You can sign up to get everything here.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Favorite investment research platform ($30 off! + 7 day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

That’s all for now!

See you next week!

Dividendology 🚀

Woow enlighting and timely for me ...#latebloomer