This Made Buffet, Munger, & Lynch Rich 💰

And it will make you rich too. 🔥

What made Warren Buffett, Charlie Munger, and Peter Lynch so rich?

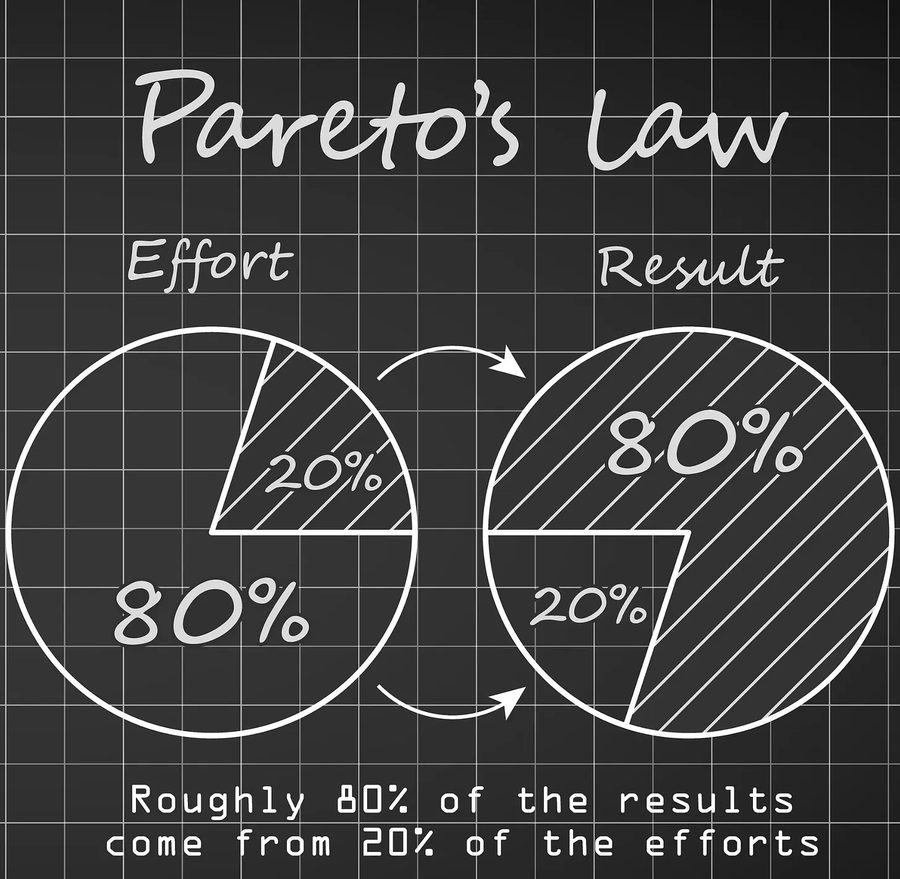

Pareto's law.

The idea that you can get 80% of the results from 20% of the effort.

"All you need for a lifetime of successful investing is a few big winners"

- Peter Lynch

Here is an example for each: 👇

1. Warren Buffett

Buffett began buying American Express stock in the fall of 1960s, and added more capital in the 90s.

He eventually built a $1.3 billion position.

He has held this position for 31 years.

The market value now?

Around $34.5 Billion.

A 26.5X return.

2. Charlie Munger

Munger held BYD Company Limited for over 15 years.

The cost was $232 million.

The market value at its peak?

Over $7 billion.

Over a 30x return.

3. Peter Lynch

Peter Lynch started buying shares of YUM Brands when the stock price dropped from $14 to $7, and then to $1 per share in the 80s.

Pepsi acquired YUM a few years later for $42 per share.

This was likely a return of anywhere between 10X to 30X.

One or two great investments held for a long period of time can change everything.

"You only have to do a few things right in your life so long as you don't do too many things wrong." - Warren Buffett

Tired of boring, text-heavy investing newsletters?

My good friend Carbon Finance sends out a weekly visual newsletter with the most important infographics, insights, and insider trades.

It’s completely free and only takes 5 minutes to read.

Join 25,000+ investors! Click the button below to subscribe now 👇

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Good stuff!