❌ This Mistake Will Cost You Thousands

Your Dividends Will Get Cut 🔥

Living off dividends is the ultimate sleep well at night retirement strategy.

It allows you to:

Get MASSIVE tax benefits (Potentially paying $0 in taxes in retirement)

Eliminate sequence risk (The biggest threat to ‘non-dividend investors’)

Get paid, regardless of how the market is performing

And when done right, the payments you receive grow larger and larger every single year.

The one major threat we have to watch out?

Dividend cuts.

Dividend cuts are the biggest risk to investors seeking to live off dividends, so it’s absolutely vital that we learn to assess the sustainability of a stock’s dividend payouts.

Real Life Example 🔬

In February of 2024, I wrote an article (and made a video) on 3M stock, and how a future dividend cut was likely.

Keep in mind, at the time I wrote this article, 3M had grown their dividend payments for over 60+ years (making them a Dividend King)-

And had also just recently announced another dividend increase.

It was clear that management’s priority for decades was rewarding shareholders with a growing dividend.

So naturally, I got a lot of pushback for this article. 👇

It was difficult for investors to imagine a dividend king like 3M would ever cut their dividend.

But just a few months later, that is exactly what happened.

In a single moment, the payments investors were receiving from 3M were slashed in half.

Devastating.

But leading up to this event, all of the warning signs were there.

This was completely avoidable-

Investors just didn’t know what to look for.

The Warnings Signs 🔥

The average investor typically looks at 1 single metric to assess dividend sustainability:

The payout ratio.

Payout Ratio = Dividends per Share / Earnings per ShareYou’re probably familiar with this metric and formula.

However, I favor the free cash flow payout ratio, as it typically gives a more accurate representation of the companies dividend sustainability

FCF Payout Ratio = Dividends per Share / Free cash flow per shareLooking at this metric alone does not tell us enough about a company’s dividend sustainability.

Some companies can go a period of time with a high payout ratio and still maintain their dividend.

What they cannot afford, is to have bad capital allocation.

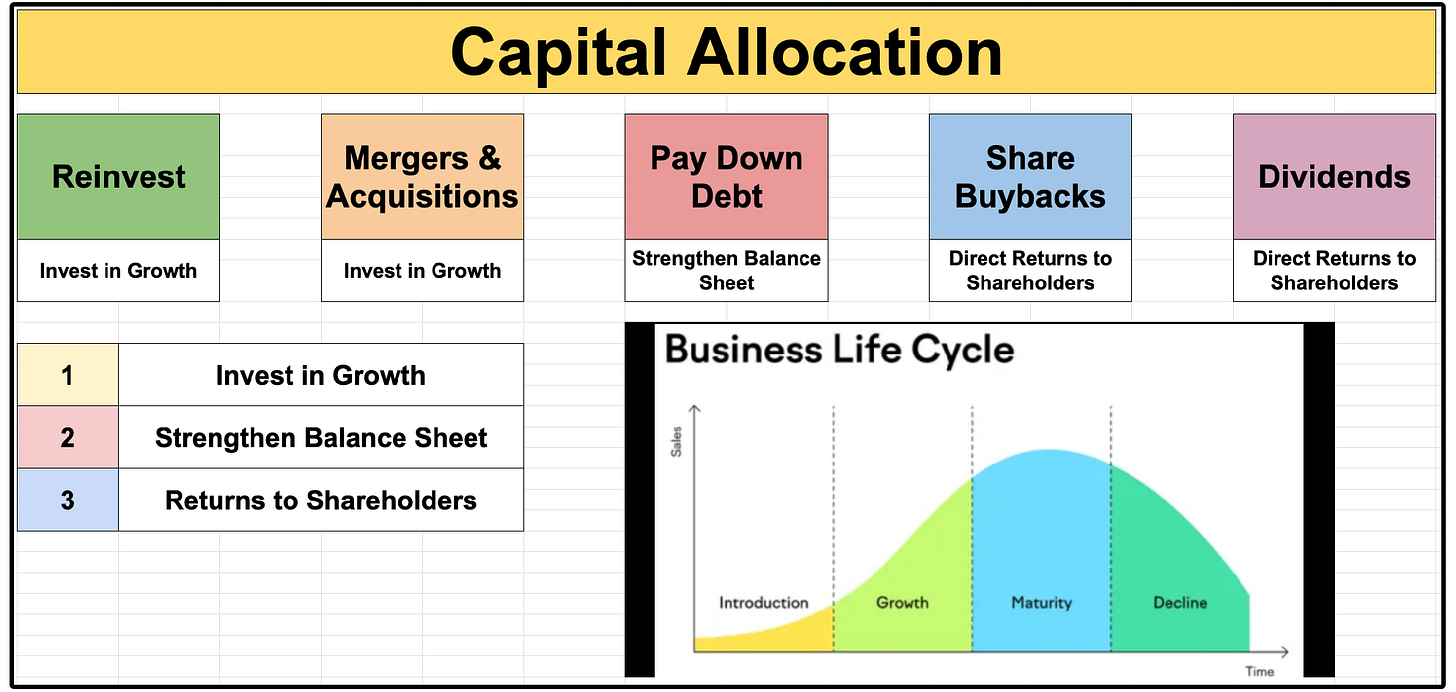

Capital Allocation 💰

If you can have a basic understanding of capital allocation, you will be ahead of 90% of dividend investors.

Here’s what you need to know-

There are 5 different ways that a company can allocate capital (use free cash flow):

Reinvest back into the business

Pay down debt

Mergers & Acquisitions

Buyback shares

Payout dividends

Each of these categories serves a different purpose.

Understanding free cash flow and capital allocation is how I knew 3M was at a major risk of cutting their dividend, despite being a dividend king.

Let’s look at what happened.

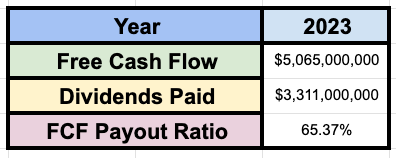

3M Dividend Cut 📉

It was February of 2024 when I wrote the article stating 3M was at risk of a dividend cut.

During the previous year, 3M only had a free cash flow payout ratio of 65.37%.

Under most circumstances, a 65.37% FCF payout ratio is actually quite sustainable.

But we need to look at the full financial health picture.

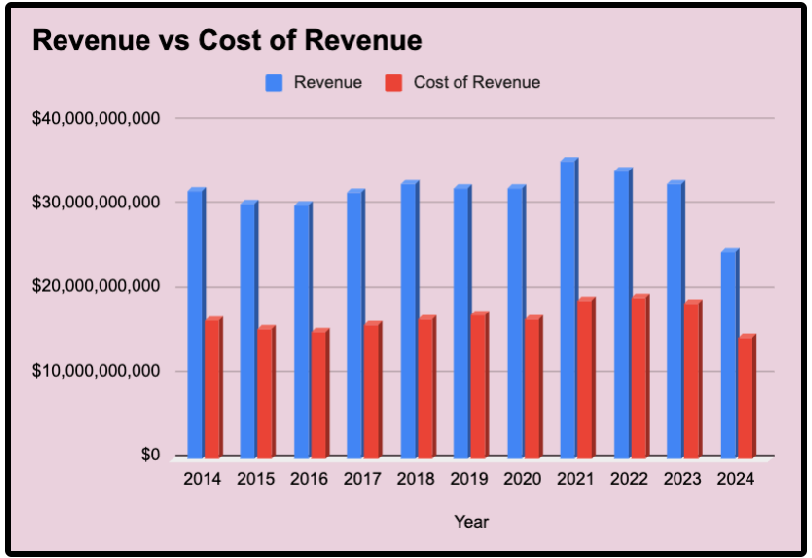

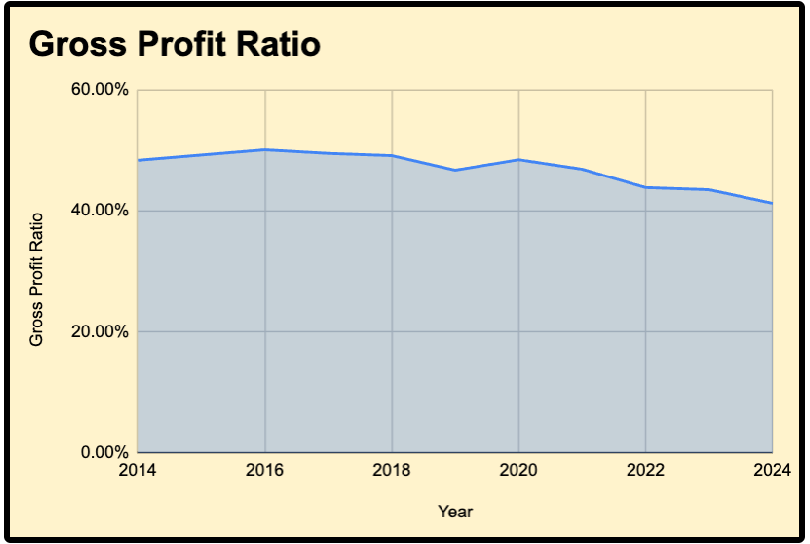

To start, 3M was already seeing declines in revenue, and that was projected to continue in 2024.

But even if revenues are declining, free cash flow can still grow if a company is increasing their margins.

So was that the case for 3M?

Not at all.

Margins had actually seen a stark decline in the last few years.

So it was easy to project that free cash flow would likely be lower in 2024, which is exactly what ended up happening.

But it doesn’t stop there.

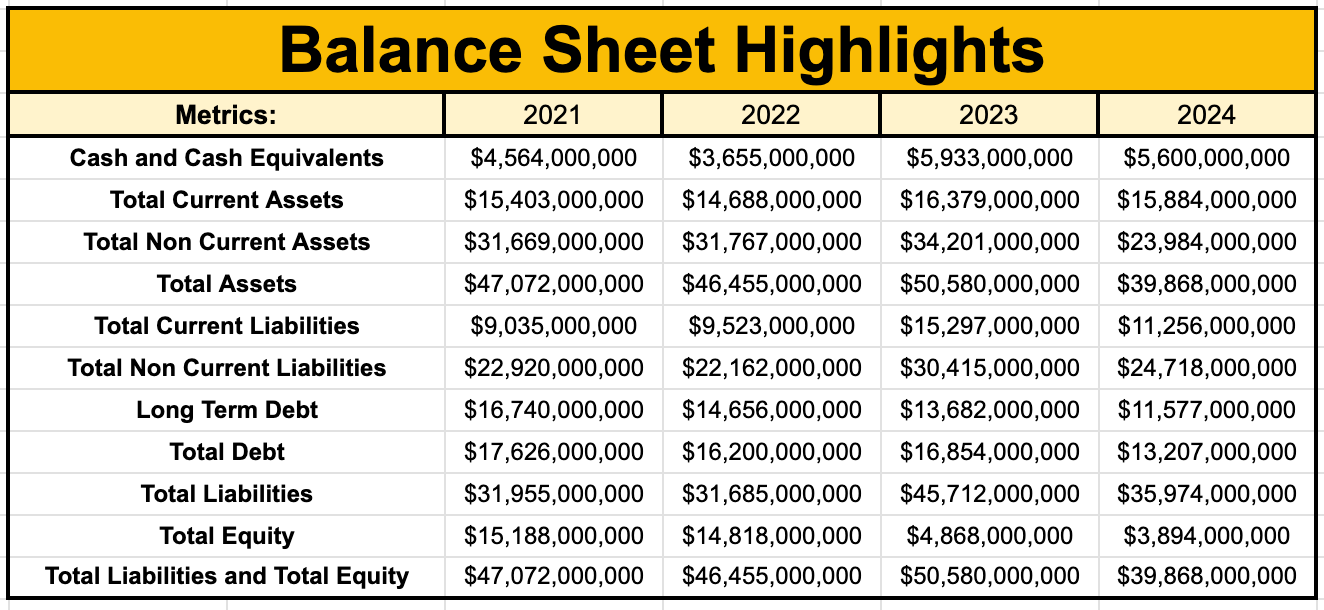

3M was staring down over $16 billion in legal settlements, all while holding more than $13 billion in long-term debt.

To make matters worse, 3M was preparing to spin off its healthcare segment, one of the company’s most profitable divisions contributing 25% of operating income.

Remember, the ‘magic capital allocation number’ in 2023 for them was $5.06B. (The amount they generated in free cash flow).

$3.3B of that was being used to pay out dividends.

Around $300M was being used for share buybacks.

And there was $16B that needed to be paid out in legal settlements.

There quite literally wasn’t capital to reinvest back into the business, pay down debt, or seek out mergers & acquisitions.

They couldn’t turn to the balance sheet for the legal payments and dividend payments-

There was too much long-term debt.

Understanding free cash flow, and the five ways management can use it made it abundantly clear-

The dividend was in trouble.

Don’t Be Average ❌

The average investor knew 3M was a dividend king with over 50+ years of dividend increases, and they knew the free cash flow payout ratio was only around 65%.

But they didn’t have the full understanding of 3M’s capital allocation woes.

And this is why the average investor fails.

I don’t want you to be average, which is why I’m working on something BIG.

🛠️ P.S. – Something BIG is Coming…

Dividendology is about to evolve into a full-scale investment platform. 🚀

Over the years, two questions have come up more than almost any others:

“How would you invest right now if you were starting from scratch?”

“What would you buy if you were building a high-yield portfolio today?”

Both are great questions, because how you invest depends entirely on where you are in your dividend journey.

So instead of just answering…

I’m going to show you.

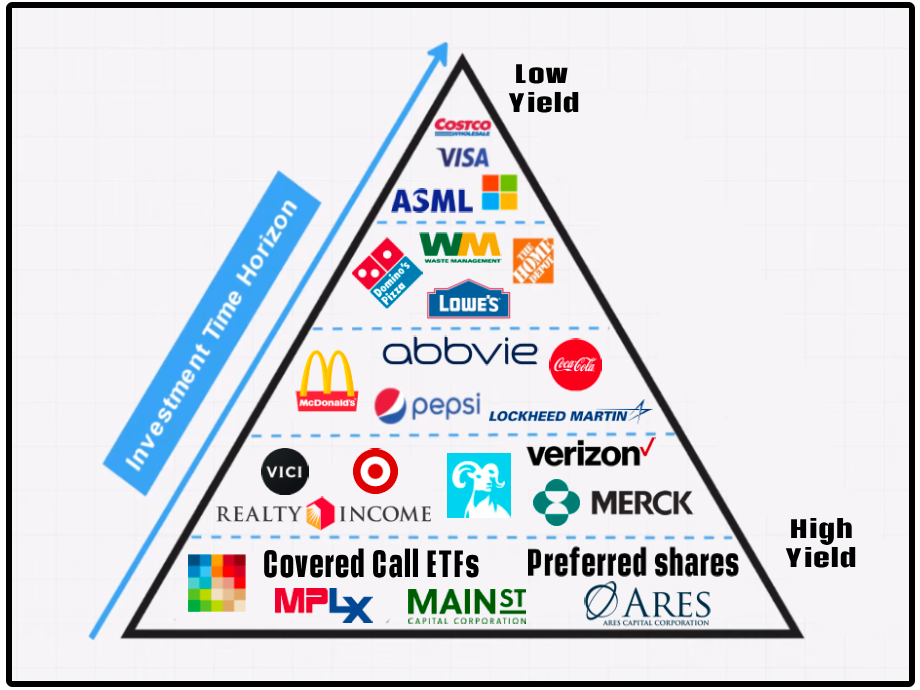

I’ll be launching two real-money portfolios on Dividendology.com:

💰 The Dividend Growth Portfolio – Built from $0, showing exactly how I’d begin investing today if I were starting from scratch

🧾 The High-Yield Portfolio – Designed to maximize immediate dividend income (think 8%+ yields) without sacrificing capital

These aren’t mock portfolios. I’ll be investing real money, tracking every move, every dividend, and every update with full transparency, just like I always have.

And these portfolios are only the beginning.

Behind the scenes, I’ve been pouring in countless hours (and now over $10,000 of capital) into what will soon become the Dividendology Database.

This will be a game-changing platform for income investors.

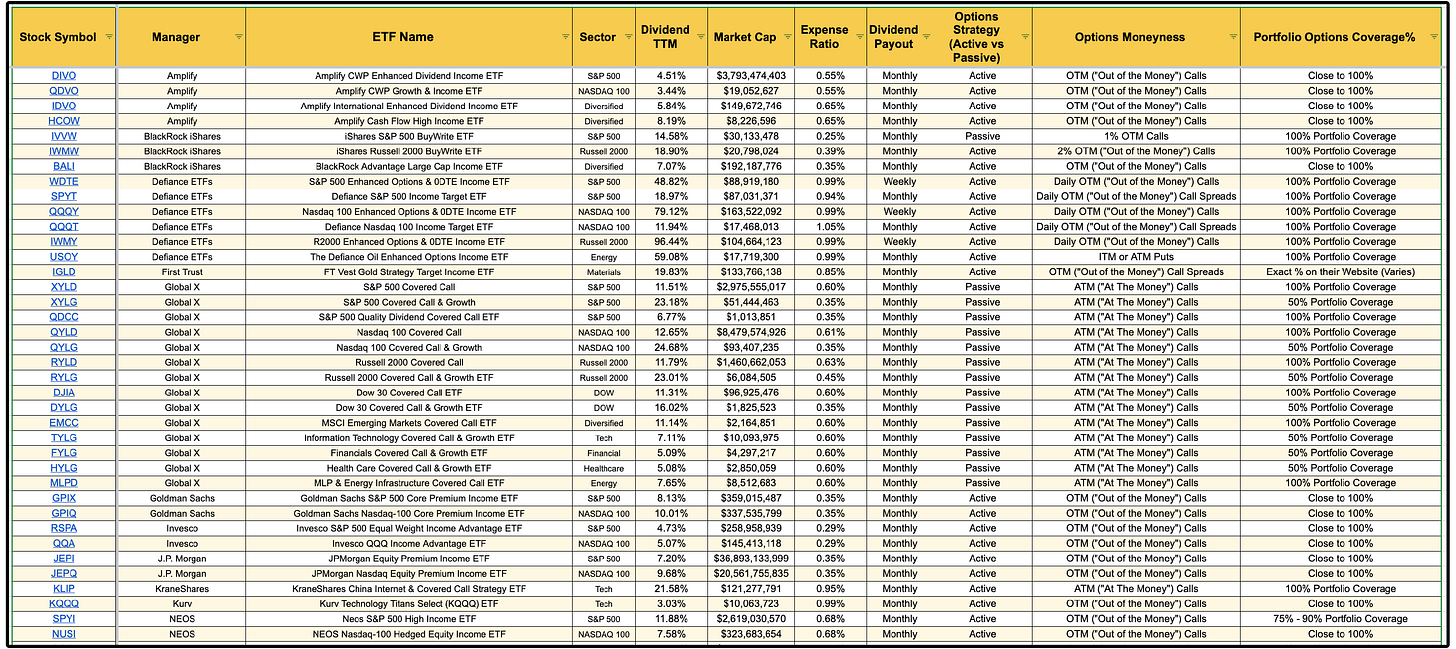

You’ve already seen ‘the early version’ of the Covered Call ETF database (featuring portfolio coverage, option moneyness, and more coming soon).

But the full platform will go much deeper — including research and data on:

🧠 Owner-Operator Dividend Growth Stocks

🥇 Super Investor Buying Activity

💼 BDCs

🏢 REITs

💸 Covered Call ETFs

💰 Preferred Shares

📊 High-Yield Opportunities

… and a lot more.

Most investors have no idea just how many quality dividend opportunities are out there, or how to properly evaluate them.

This platform is being built to change that.

This platform will be launched in the next 1 - 2 months.

Stay tuned!

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($60 off!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

I know you made a video recently where you went over similar topics, but the way you 1.research the data, 2. structure it in bite-size parts and 3. Combine the first two to make engaging content, which is very impressive. I hope you keep up the hard work

Honestly looking forward to this.. Been paid up to Tickerdata for a while and it’s so good.. appreciate these new additions will feature as part of subscription to dividendology but non the less your analysis, YouTube videos etc are as good as I’ve seen so will look to subscribe once all is in place.. good luck