This Will Make You a GREAT Investor 🚀

It's Easier Than You Think 💭 ✅

You’ve been lied too.

You’ve likely been told being a great investor means beating the S&P 500 every year.

But I can assure you, that is NOT the best way to define it. ❌

Here’s why:

The image below show the performance of Warren Buffett’s Berkshire Hathaway vs the S&P 500 each year from 1965 to 2022.

During this time period, there were 19 different years where Berkshire Hathaway underperformed the S&P 500.

In fact, there was even a period (2003-2005) where Berkshire underperformed the S&P 500 for 3 years in a row!

But here’s what’s so eye opening about this:

Here’s the compounded annual gain from each of these over this time period:

S&P 500: 9.9%

Berkshire Hathaway: 19.8%

That’s a massive difference.

But to put it into even more perspective, let’s look at the overall gain during this time period:

S&P 500: 24,708%

Berkshire Hathaway: 3,787,464%

Yes, I typed that correctly.

Despite underperforming the market 19 different times from 1965 to 2022, Berkshire’s returns were 3,787,464%, while the S&P 500 returned 24,708%.

So it’s clear that outperforming the market every year is not at all necessary to be a great investor.

But let’s take this a small step further.

Everyone has different investment goals, risk tolerance, and time horizon.

For example, if you are someone who is looking to live off dividend in less than 5 years, then your goal should absolutely NOT be to try and outperform the market, or even keep up with the market.

It should be building a reliable, predictable, and growing stream of dividend income, built off of the backs of quality business that will continue to grow.

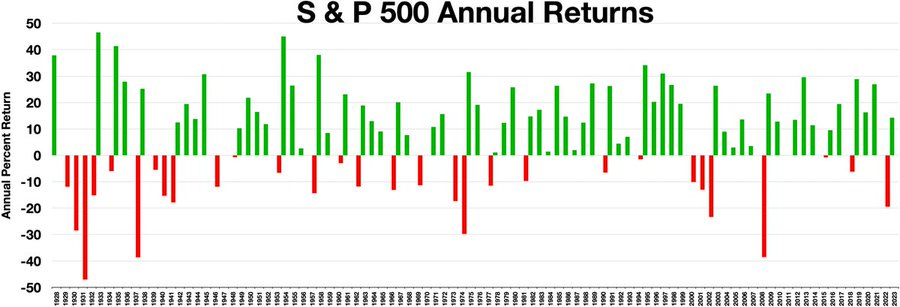

Just look at the volatility of the market through the S&P 500 annual returns:

Over the long run, the S&P 500 has been great.

But if you’re someone looking to retire or live off dividends soon, it can be risky.

This is why some choose to only focus on building a stream of dividend income.

Over the past 10 years, the dividend payments from the S&P 500 have grown every single year.

So for many, being a great investor might just mean avoiding the volatility of the market, and building a reliable stream of growing passive income.

No one is in the same exact situation as you.

Everyone has different goals, risk tolerance, and time horizon.

And all of those items should greatly impact the way you choose to invest.

So in reality, only you can define what it means to “Be a great investor.”

Because I can assure you-

The person out there reading this who is currently living off of reliable dividend payments, does not care if they “beat the market his year.”

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News…

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

When will I start receiving it. I just signed up and paid the $60 fee.