🚀 Top 10 High Yield Stocks For 2026!

10%+ Dividend Yields With Upside? 💰

Most people approach high yield investing the same way they play the old game minesweeper.

They start going around randomly clicking on squares, and maybe make a few lucky guesses-

But they are basically guaranteed to hit a mine eventually, ending their game.

Of course, if you know what to look for, you can strategically avoid the mines, and win the game.

This is a perfect metaphor for high yield investing.

Today, we will be looking at the top 10 high yield opportunities as we head into 2026.

🏆 Building a High Yield Portfolio

There are two major advantages to high yield investing most don’t take the time to acknowledge:

📝 Limited analyst coverage & market inefficiencies

Unlike the mega-cap S&P 500 names that have Wall Street analysts dissecting every detail, many high-yield alternatives trade with less attention. This lack of coverage often results in pricing inefficiencies and misvaluations, both on the upside and downside.🔍 Greater opportunity for diligent investors

For those willing to roll up their sleeves and learn the nuances of high yield asset classes (things like AFFO for REITs, NAV growth for BDCs, or option coverage ratios for Covered Call ETFs), there are chances to capture both yield and capital appreciation where the broader market overlooks it.

This is the beauty of high yield investing.

While there are certainly a multitude of risky investments out there, there are also some massive overlooked opportunities.

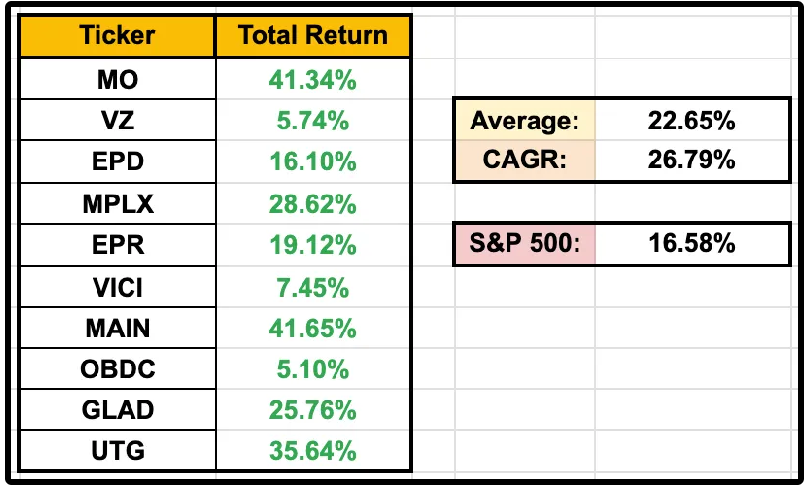

For example, a little over a year ago, I built an example high yield portfolio. (You can see and read about that portfolio here)

Our example high yield portfolio had the goal of of providing a reliable yield of close to 8%, without seeing erosion of our net asset value.

At the time we analyzed our portfolio, the returns had been amazing.

This portfolio actually outperformed the market!

But the performance doesn’t tell the whole story.

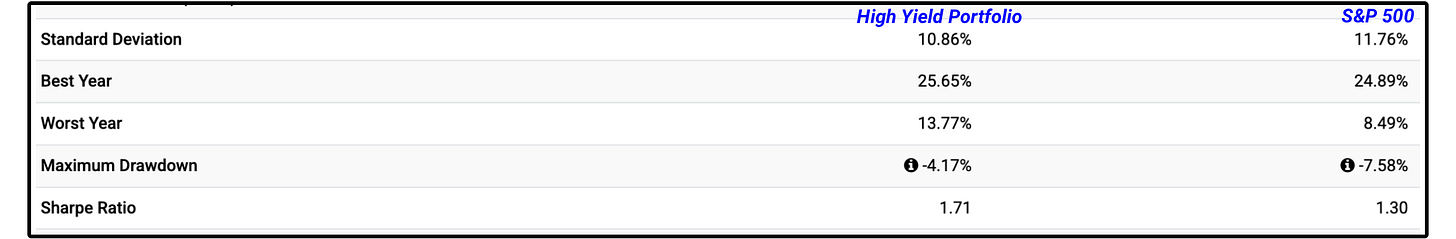

I ran a backtest on it for deeper insights.

Not only did this portfolio outperform by a wide margin, but it:

Had lower volatility (standard deviation)

Had a lower maximum drawdown

Had a stronger Sharpe Ratio

The Sharpe Ratio is an important one.

The Sharpe Ratio is a way of measuring how much return you’re getting for every unit of risk you take.

Basically, this portfolio took on less risk than the S&P 500, while still experiencing better returns.

🎯 What We Expect From Our High Yield

Let me be perfectly clear-

While some of the stocks on our list today have significant upside, outperforming the market is not the goal for our high yield picks and the model high yield portfolio we run at Dividendology.

The goal of the High Yield Portfolio is simple:

Deliver a sustainable dividend yield of around 8%

Preserve capital (no long-term value erosion)

Provide predictable cash flow

Keep in mind, true success in investing can only be measured over a long term time period.

With that being said…

Let’s dive into our top high yield dividend stocks for 2026.

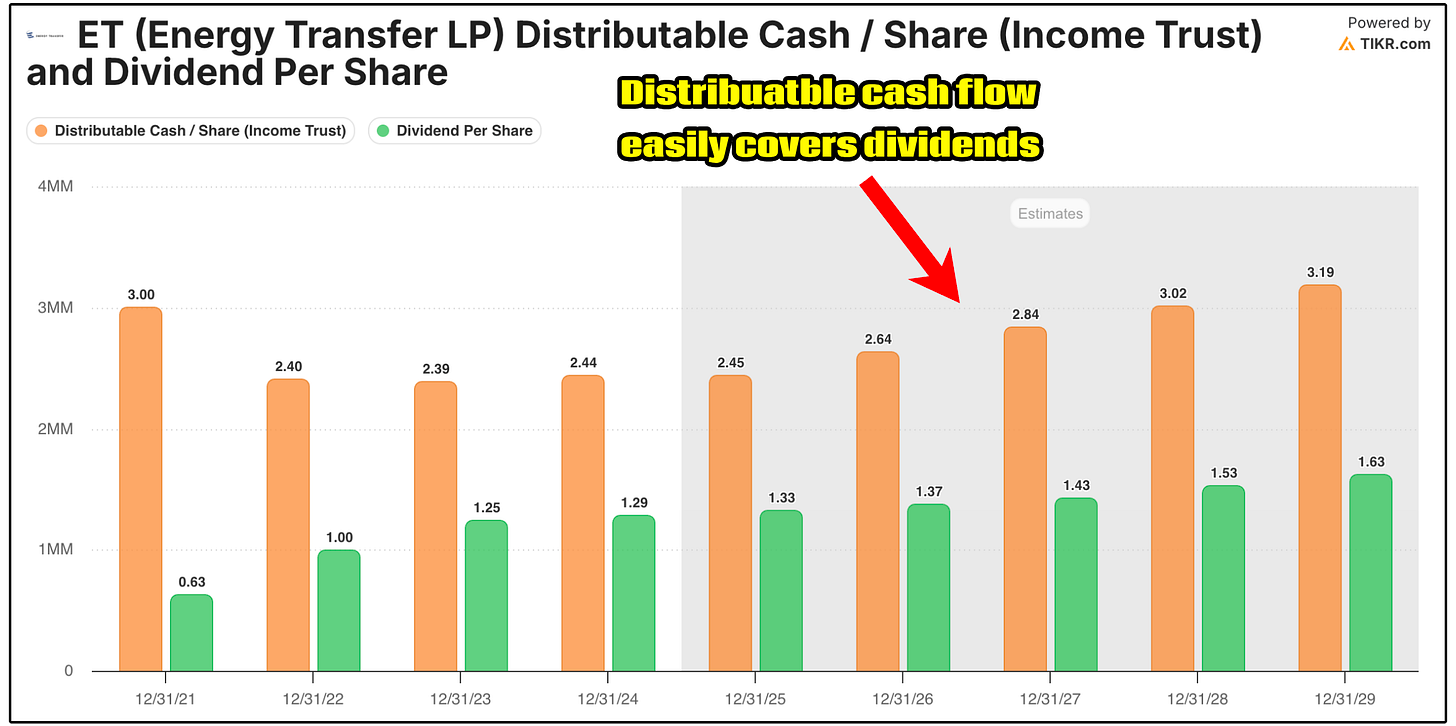

10.🚰 Energy Transfer (ET)

This is one of the largest midstream operators in North America, with a vast, irreplaceable network of pipelines, terminals, and processing assets spanning natural gas, crude oil, NGLs, and refined products.

These assets are mission-critical to the U.S. energy system and extremely difficult (and costly) to replicate today.

From an income perspective, ET checks several important boxes:

8.15%+ distribution yield, covered by stable, fee-based cash flows

Improving balance sheet, with leverage trending lower after years of deliberate deleveraging

Management has guided towards 3% - 5% distribution growth annually

Importantly, this is not the same Energy Transfer of the past.

Management has shifted away from aggressive empire-building and toward capital discipline, prioritizing distribution coverage, debt reduction, and selective growth projects with attractive returns.

Because the majority of ET’s cash flows are fee-based and volume-driven and not directly tied to commodity prices, the business offers more predictability than many investors assume when they see an energy-related yield this high.

9. 🏨 VICI Properties (VICI)

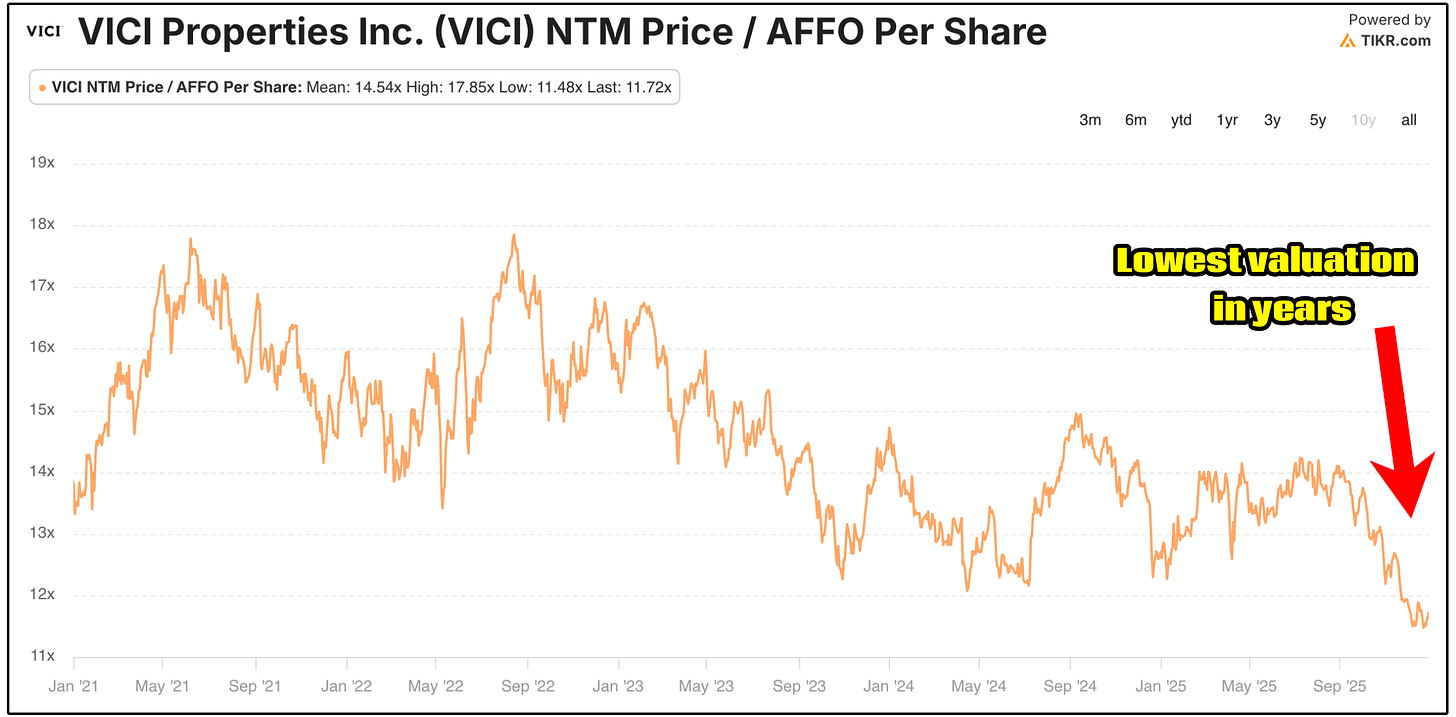

Despite being one of the highest-quality net-lease REITs in the S&P 500, VICI is trading near a 52-week low, pushing its dividend yield to 6.4%.

At the same time, the dividend has compounded at over 5% annually over the past three years, and the forward AFFO payout ratio of 74% remains well within a healthy range.

The recent selloff can largely be traced to two perceived risks:

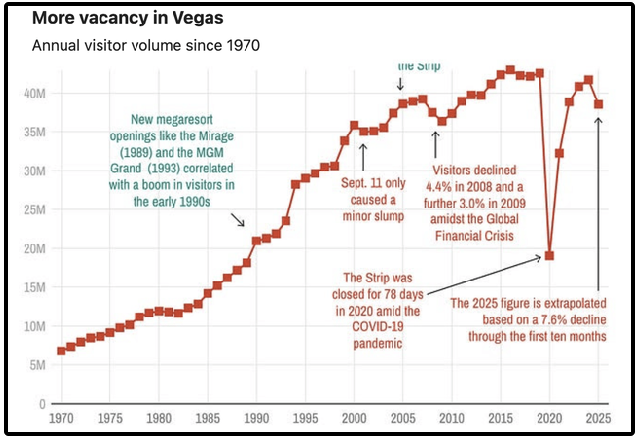

Las Vegas exposure, where short-term visitation has softened in 2025

Caesars regional properties, which experienced temporary weakness driven by unusually low hold rates, meaning casinos kept less of what was wagered. These fluctuations normalize over time and have little impact on VICI’s rent collection or dividend safety.

While these risks are real, the market reaction appears to be pricing them as permanent impairments rather than short-term operating risks.

Today, occupancy remains at 100%, rent escalators are CPI-linked, and analysts still expect AFFO per share growth of ~3–4% annually.

When you combine that growth with a 6.5% starting yield, you’re already looking at 10% operational returns (dividend yield + AFFO per share growth), before any benefit from valuation normalization.

VICI is now trading at one of its lowest valuations ever.

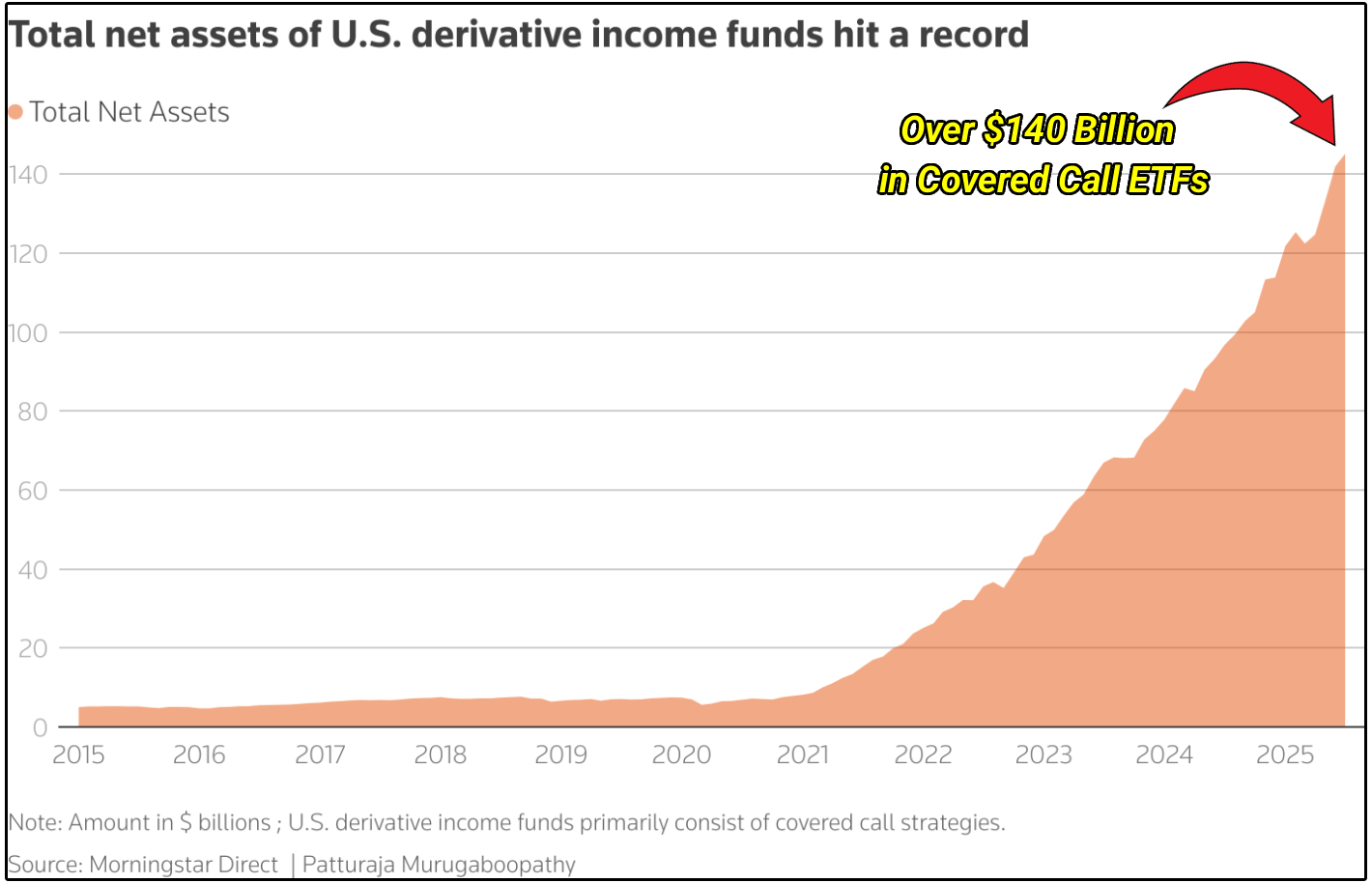

8. 💸 Infrastructure Capital Equity Income Fund ETF (ICAP)

ICAP is not a mainstream covered call ETF.

Most covered call ETFs have close to 100% portfolio options coverage, which severely limits upside. On top of that, it means you have the potential to see significant NAV erosion over time.

ICAP only writes options on around 30% - 40% of their portfolio.

This allows them to:

Leave a significant amount of upside uncapped

Payout stable dividends

Grow their dividend payouts

Still yield around 8.4%

ICAP is one of the only covered call ETFs I know of that actually grows dividends over time.

Here is ICAP’s investment process:

If you’d like to learn more about ICAP, you can read my recent interview with the fund manager, Jay Hatfield here:

7. 📌 Ares Capital (ARCC)

ARCC is a BDC (business development company), which is an investment vehicle that lends money to private, middle-market companies.

In exchange, BDCs earn interest income, which is then passed through to investors as dividends. Like REITs, they are required to payout 90% of earnings as dividends.

We track BDCs closely over on the Dividendology Database.

Despite growing skepticism around BDCs as rates fall, ARCC’s Q3 results reinforced why it's still considered one of the higher quality BDCs:

20th consecutive quarter of covering the dividend

Core earnings of $0.50 vs. $0.48 dividend

Record NAV per share of $20.01

Low non-accruals (~1% at fair value)

Just as important, ARCC has built significant dividend protection.

The company ended Q3 with $1.26 per share in spillover income, giving it more than two quarters of dividend coverage even if earnings temporarily compress as rates fall.

At today’s price, ARCC yields 9.5%, as well as trading slightly below its historical average P/TBVPS multiple.

6. 🛢️ Western Midstream Partners (WES)

WES is a large midstream operator in the Permian Basin, providing services across four core segments:

Natural gas gathering & processing

Crude oil gathering & stabilization

NGLs

Water gathering, disposal, and recycling

Its most important relationship is with its sponsor and largest customer, Occidental Petroleum, which gives WES long-term volume visibility and strong alignment around cash flow and distributions.

Here’s what makes WES stand out:

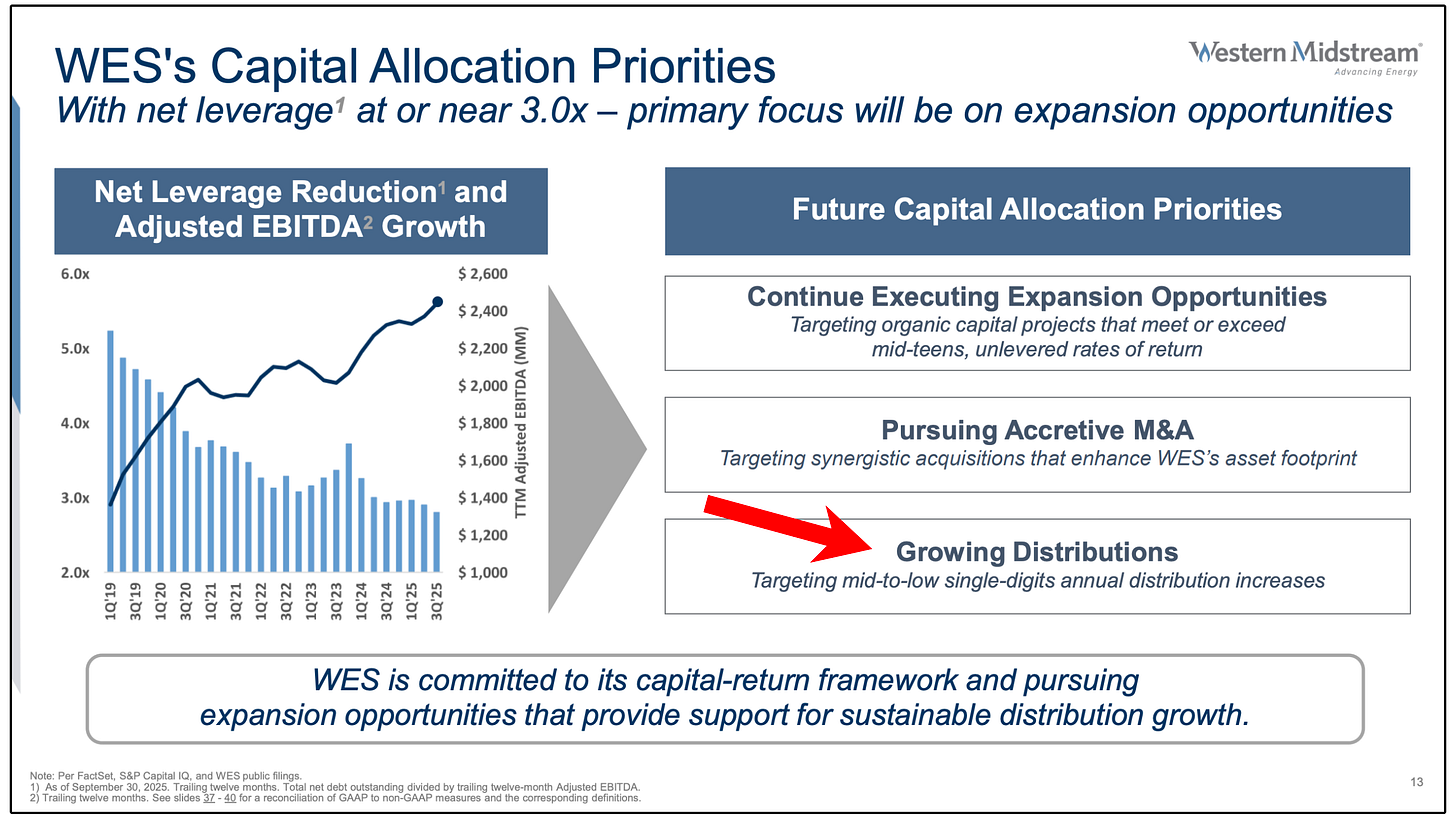

9.3% distribution yield

Investment-grade credit

Very low leverage (~2.9x)

Healthy dividend coverage ratio (~1.12x)

Growing distributable cash flow per share

This is not a stressed balance sheet reaching for yield.

Management has been explicit that leverage is already in a healthy range, allowing WES to both reinvest in the business and grow the distribution at a mid-to-low single-digit rate.

When a business like this yields over 9%, one of two things typically happens over time:

The distribution gets cut

The share price rises and the yield compresses to the average (AKA: mean reversion)

Given WES’s fundamentals, balance sheet, and sponsor incentives, the second outcome is far more likely.

A re-rating toward a more typical 6–7% midstream yield would imply meaningful upside on top of an already compelling income stream.

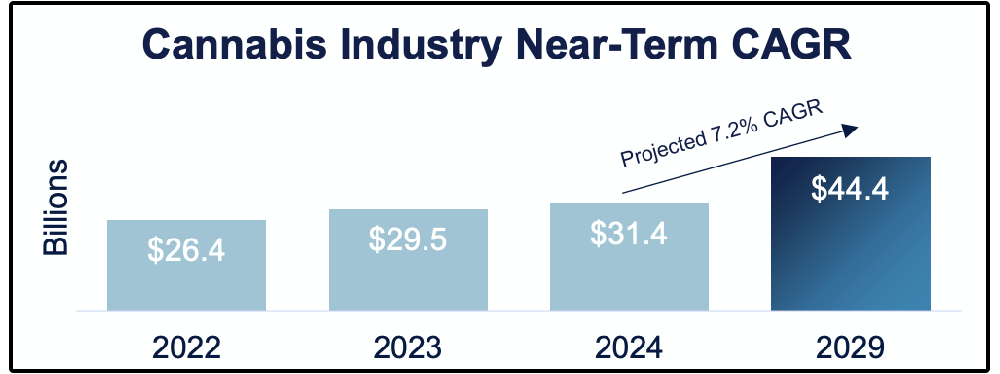

5. 🌿 NewLake Capital Partners (NLCP)

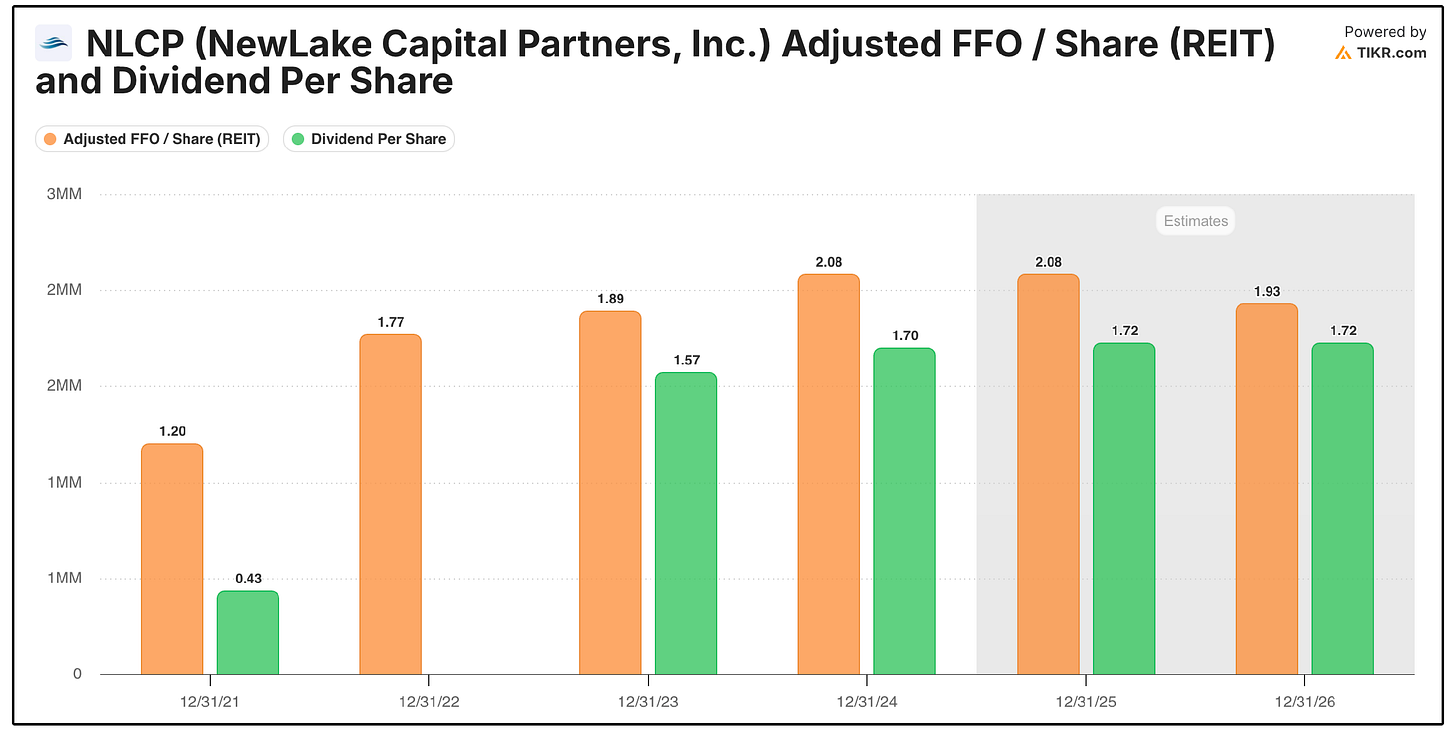

NewLake Capital Partners is a high-yield REIT where fundamentals are improving faster than the market is willing to price in.

The key catalyst is cannabis moving toward Schedule III status at the federal level.

Under Schedule I, operators were unable to deduct basic business expenses, resulting in effective tax rates of 60–80% and severely constrained profitability.

Reclassification allows normal deductions, which should lead to immediate improvements in free cash flow, balance sheets, and overall tenant credit quality.

That matters because tenant risk is the primary reason NLCP trades at such a deep discount.

Even after the recent rally, NLCP still trades at:

7.95x P/AFFO

Price to book value of just 0.82, meaning the market is valuing the company at 18% less than the value of its net assets.

11.32% dividend yield

~82% AFFO payout ratio, near the low end of management’s target range

Net cash position, with more cash than debt

To be clear, NLCP has faced real challenges, including tenant restructurings and vacancies, which explains the depressed valuation.

However, those issues occurred under one of the most hostile operating environments cannabis companies have ever faced.

If tenant fundamentals improve as this policy shift suggests, the outlook for rent collection, re-leasing, and long-term cash flow stability improves materially.

NLCP remains a riskier speculative REIT and should be sized appropriately.

But with an over 11% dividend yield and a conservative balance sheet, even without significant AFFO per share growth, total returns could look attractive.

4. 🎯 Neos S&P 500(R) High Income ETF (SPYI)

Covered Call ETFs have become incredibly popular in the last few years.

But again, this can be an incredibly dangerous asset class, so we must be careful.

SPYI is a covered call ETF that owns the entire S&P 500 and generates income by writing index options, allowing it to maintain exposure to market leaders while producing high monthly income.

But the team at NEOS has structured this fund in a way that has allowed it to:

Provide an 11.62% yield

Capture 90%+ of the S&P 500

Provide stable distributions

Provide more favorable tax treatment

Remember, covered call ETFs are not designed to outperform their underlying holdings/index over time, so this certainly is not for everyone.

But it is also important to point that SPYI has been beating its peer, JEPI, in nearly every measurable category lately.

You can read much more about the JEPI vs SPYI matchup here.

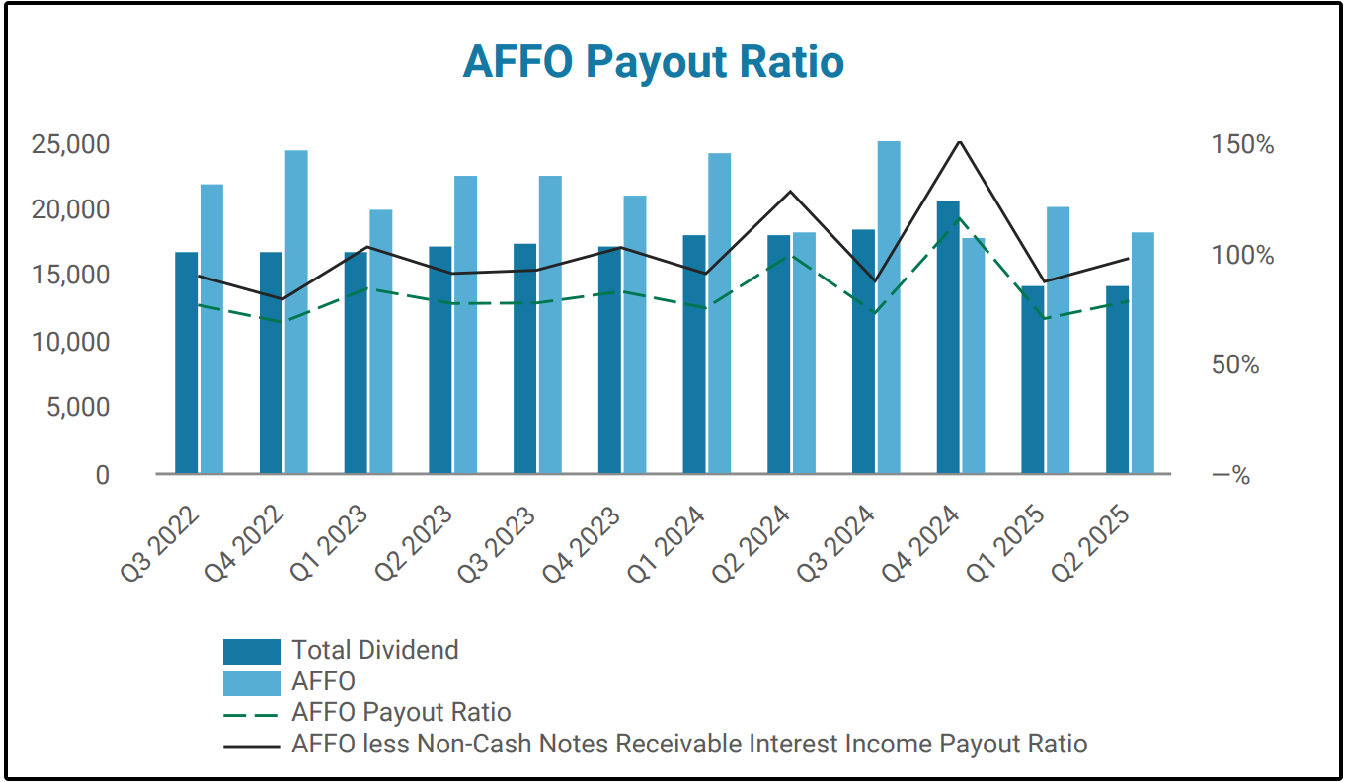

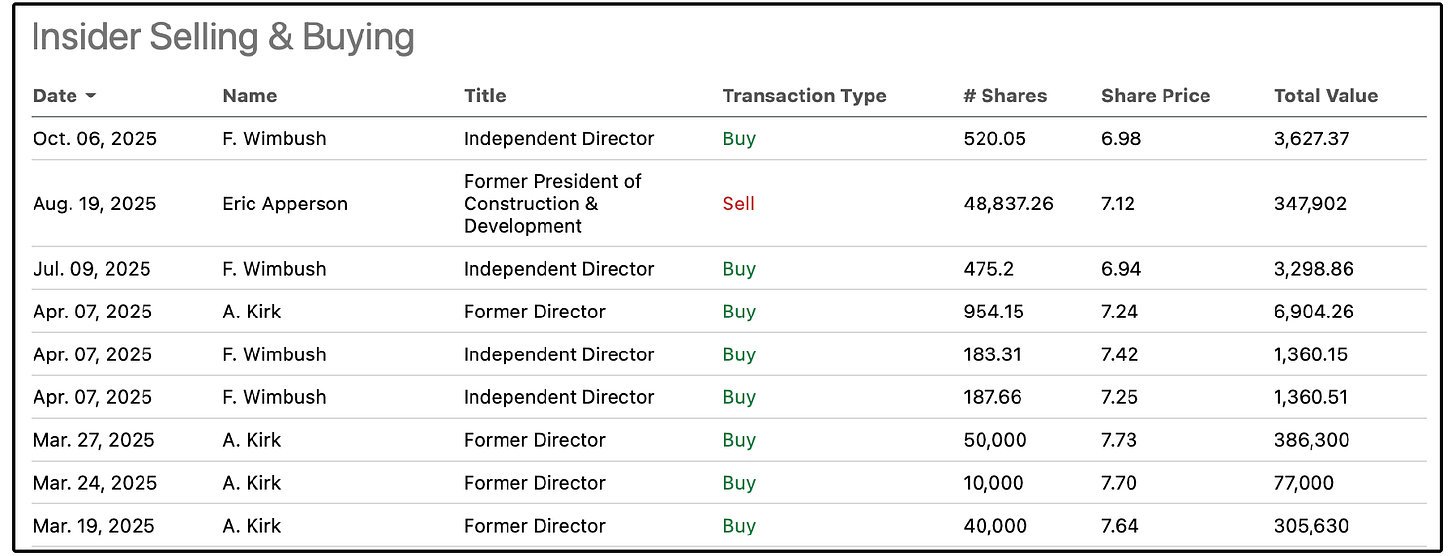

3. 🏗️ Armada Hoffler Properties (AHH)

AHH is different from most REITs.

It operates a development-first model, building high-quality mixed-use, multifamily, office, and retail assets, then selectively keeping only the best properties as long-term holdings.

Today, the portfolio consists of 72 income-producing properties with ~95% occupancy, including “Class A trophy” assets in walkable, high-barrier-to-entry Sunbelt markets.

AHH shares are down 33% this year.

We typically try and avoid companies that have dividend cuts in their recent history, but AHH is going under a complete structure change under their new CEO, Shawn Tibbets

Under new CEO Shawn Tibbetts, AHH is undergoing a fundamental shift:

Moving away from volatile fee-based construction income

Prioritizing recurring property-level cash flows

Deleveraging the balance sheet and targeting higher-quality financing

Focusing on fewer, better assets rather than growth for growth’s sake

The dividend cut was necessary. The payout had become unsustainably high.

Importantly, management reset the dividend so it is now fully covered by rental income alone and not development fees, with the AFFO payout ratio back in the low-70% range.

This transforms AHH from a developer that owned properties into a true property company first, with development as a value-add, not the core thesis.

8.37%+ dividend yield is now properly covered

Significant insider buying since restructuring (insiders own 10%+ of the comapny!)

Trading at the lowest Price/AFFO multiple in a decade

AHH is more of a deep value pick-

But with a safer dividend, improving asset quality, and a more conservative strategy, AHH now offers high current income and meaningful upside if the market begins to reward the new business model.

For example, just 1.5% dividend growth moving forward would imply over 21% upside.

Now, let’s dive into our top 2 picks…