Warren Buffett Just Bought This! 🔥 🚀

And He Also Sold This...

Warren Buffett's Berkshire Hathaway recently released their latest form 13F.

This document reveals every move he made last quarter and gives us an update on his entire portfolio.

I spent hours reviewing all of his moves, and found 6 key takeaways from this recent quarter.

But first-

I created a free spreadsheet listing out details on every holding in Buffett’s portfolio.

You can download it here:

1. Buys and Sells

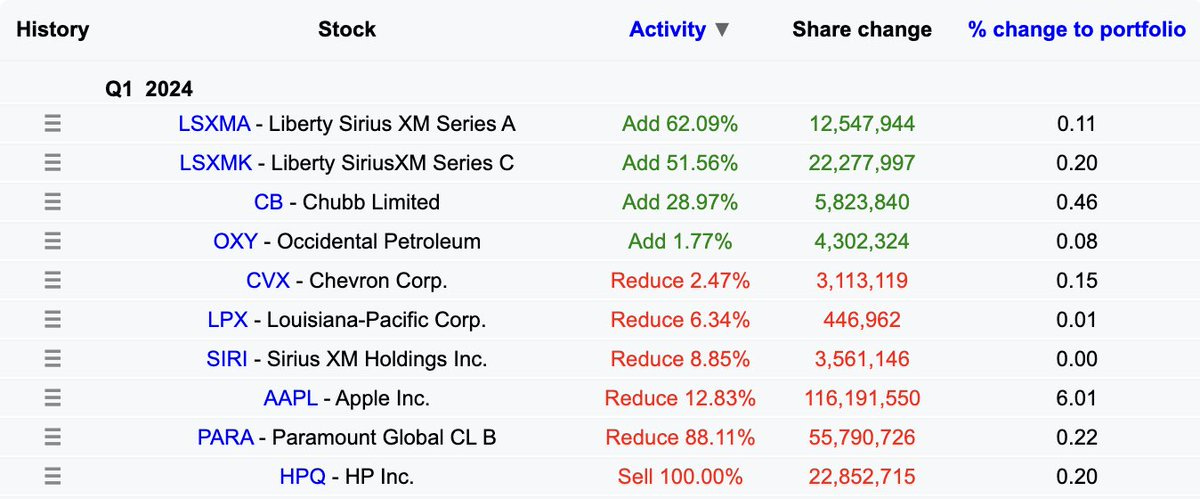

In the most recent quarter, Buffett added to 4 positions, reduced 5 positions, and completely sold out of his small position in $HPQ.

2. The 'Paramount Global' Mistake.

In Q1 of of 2022, $BRK.B initiated a position in $PARA.

He added to this position in:

Q2 2022

Q3 2022

Q4 2022

Q1 2023

In Q4 of 2023, Buffett reduced this position by 32.44%.

And it was just announced he reduced it again by 88.11%.

Over the past 5 years, $PARA is down 74%, and in the last year, down over 20%.

Buffett explained the decision to buy $PARA and then sell at a large loss was completely his decision.

Buffett selling $PARA at a large loss is a simple reminder that no one is right all the time.

Don’t blindly copy peoples trades.

Everyone has different time horizons, risk tolerance, and goals.

3. Selling... $AAPL?

Buffett shocked many when it was announced he sold 12.83% of his $AAPL stake.

When asked about this, Buffett indicated that the sale was motivated by tax considerations after substantial gains, as well as wanting to increase his cash position.

Buffett also noted that $AAPL will continue to be a large (and likely the largest) position in the $BRK.B portfolio for a long time.

$AAPL now makes up 40.81% of Buffett's portfolio.

4. Buffett's Secret Purchase Revealed

Over the past 6 months, Warren Buffett has been adding to a secret position.

Warren Buffett obtained permission from the U.S. Securities and Exchange Commission (SEC) to keep the holding confidential in Berkshire’s last two 13-F filings.

Additionally, he chose not to reveal the stock's name at the company's recent annual meeting.

He did the same thing when acquiring shares of $VZ and $CVX.

( Side note: How is this allowed? )

After the most recent 13F filing, it was revealed that the position he had been adding to was Chubb Limited, $CB.

This is a financial company that operates in property and casualty insurance.

Shares of $CB are up nearly 8% after it was revealed Buffett purchased this company.

5. Heavy on the Tech & Financials

Even after reducing his position in $AAPL, Buffett's portfolio is still heavily weighted towards tech, as well as financials.

Tech currently makes up 41.37% of his portfolio.

Financials currently makes up 29.94% of his portfolio.

6. Buffett Still Likes His Dividends

Out of Buffett's top 10 positions, 9 of them currently pay a dividend.

Here's the current yield for those 9 companies:

$AAPL- 0.53%

$BAC- 2.47%

$AXP- 1.16%

$KO- 3.07%

$CVX- 4.00%

$OXY- 1.39%

$KHC- 4.46%

$MCO- 0.83%

$CB- 1.36%

Let me know if you have any thoughts on Buffett’s portfolio and his recent moves by replying to this email!

Check out these resources as well:

Other News…

At the end of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

This sheet was received by nearly 200 dividend investors last month. (Wow!)

If you’d like to receive this sheet at the end of this month, you can sign up here:

That’s all for now!

See you next week!

Dividendology