Warren Buffett Just Bought This Stock! 🔥

The Oracle of Omaha Made Some Eye Opening Moves.

Warren Buffett's Berkshire Hathaway recently released their latest form 13F.

This document reveals every move he made last quarter and gives us an update on his entire portfolio.

I spent hours reviewing it, and found 10 key takeaways for us to review. 👇

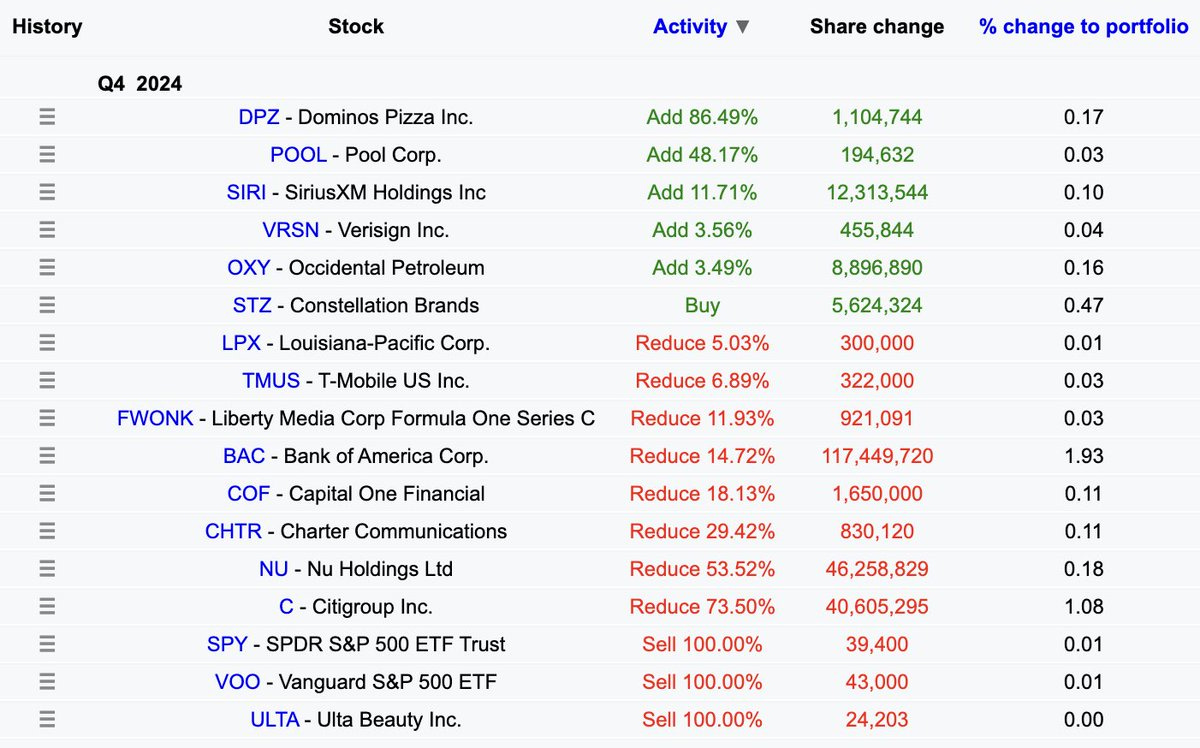

1. Buys and Sells

In the most recent quarter, Buffett added to 5 positions, and added 1 entirely new position, Constellation Brands (STZ).

He reduced the size of 8 positions, and sold out of 3 positions entirely.

2. Cash Position is STILL Growing

1.5 years ago, investors were astounded that Buffett's cash position was above $150B (A record).

His cash position is now?

Estimated to be close to $334B.

3. Finally done selling Apple Stock

Buffett had been reducing his $AAPL position for 4 consecutive quarters.

Q4 2023: Reduced $AAPL -1.09%

Q1 2024: Reduced $AAPL -12.83%

Q2 2024: Reduced $AAPL -49.33%

Q4 2024: Reduced $AAPL -25%

Before the selling, $AAPL was 51% of his portfolio.

It nows sits at 28.12%.

Buffett had previously hinted that these sells were for 'tax purposes'.

Was Buffett expecting a Harris/Waltz administration in the White House, leading to higher capital gains tax?

4. Buy and Hold Forever? (Or for a few quarters?)

In Q2 of 2024, Buffett bought $ULTA.

By Q4 of 2024, he sold completely out of $ULTA.

This trend of quick buy and sells has become more common for Buffett recently.

EX: $PARA (2 year holding period)

The average holding period for each stock in his portfolio is now around 6.1 years.

5. Di-Worsification?

Buffett has 38 holdings in his portfolio.

But the top 10 holdings makeup 89.72% of his portfolio.

Here are the top 10 holdings and allocation:

🍏 AAPL - Apple Inc. → 28.12%

💳 AXP - American Express → 16.84%

🏦 BAC - Bank of America Corp. → 11.19%

🥤 KO - Coca Cola Co. → 9.32%

🛢️ CVX - Chevron Corp. → 6.43%

⛽ OXY - Occidental Petroleum → 4.89%

📊 MCO - Moody's Corp. → 4.37%

🧀 KHC - Kraft Heinz Co. → 3.74%

🏢 CB - Chubb Limited → 2.80%

🏥 DVA - DaVita HealthCare Partners → 2.02%

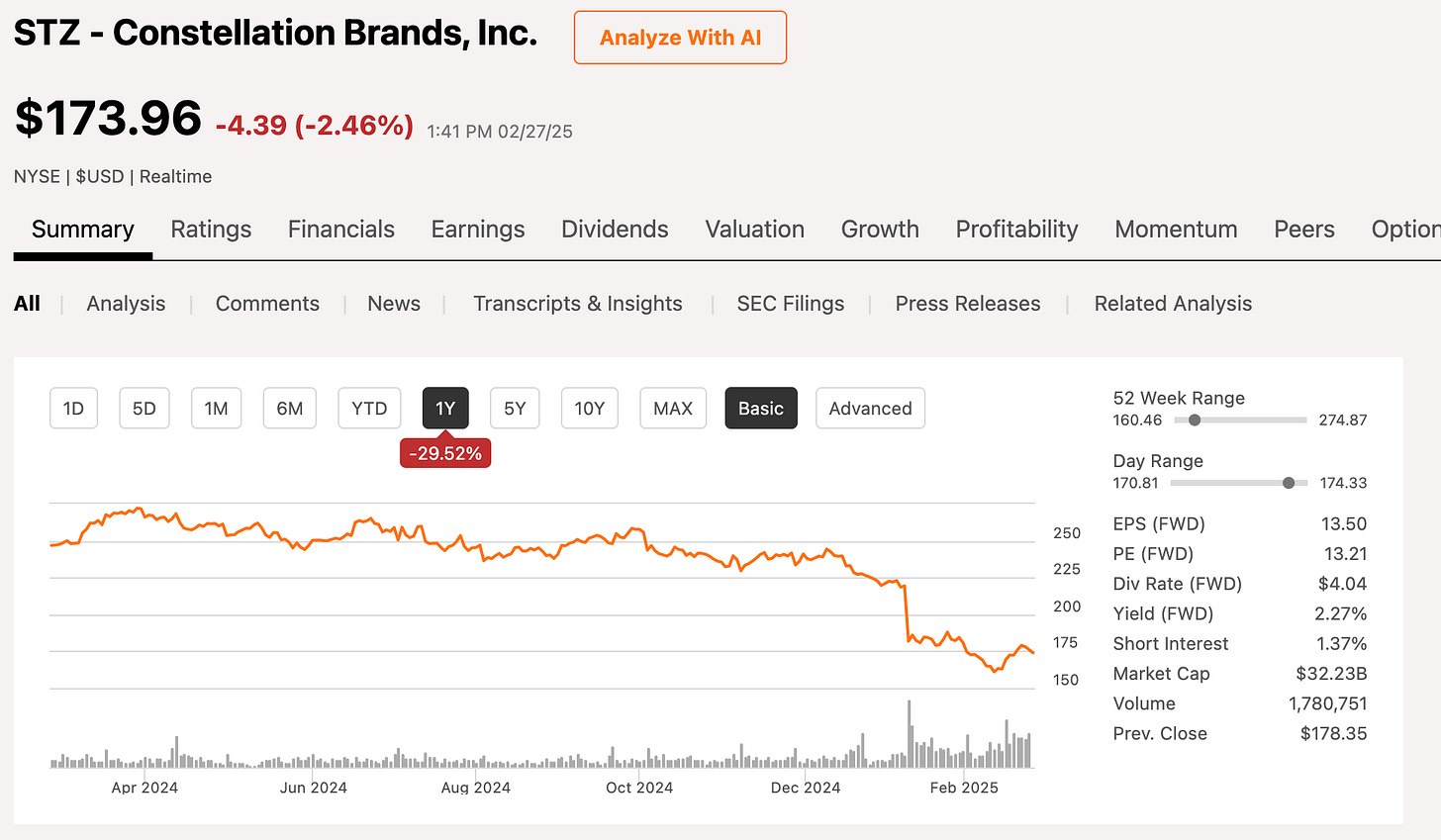

6. The New Buy

The only new purchase in Buffett's portfolio was $STZ, Constellation Brands.

$STZ is a prominent producer and marketer of beer, wine, and spirits. Their portfolio includes well-recognized beer brands such as Corona Extra, Modelo Especial, and Pacifico.

The company trades at a 13.21 forward PE ratio, which is 36% lower than its 5 year average of 20.67.

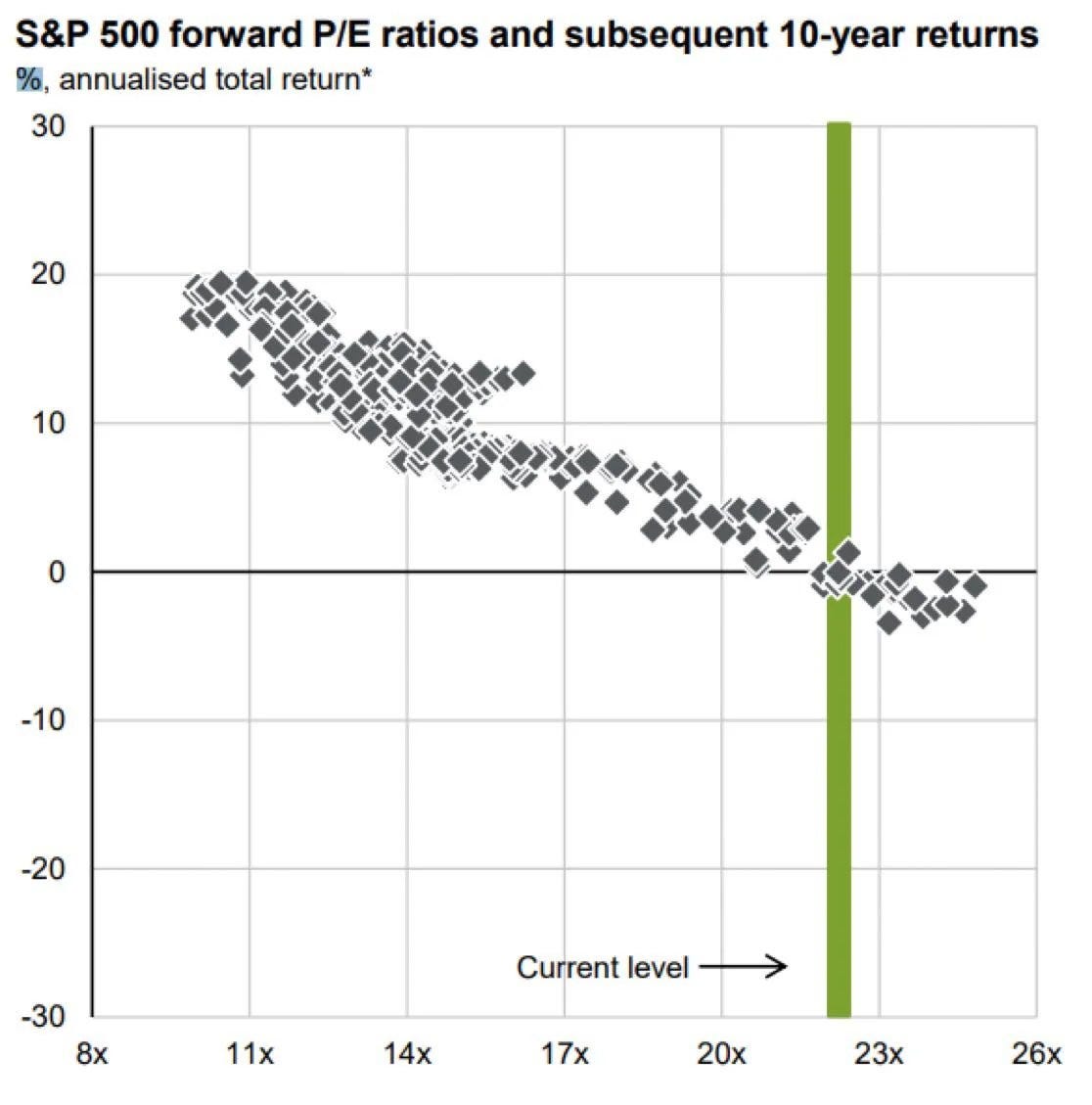

7. Dumping the S&P 500!?

Warren Buffett sold 100% of his position in $SPY and $VOO (S&P 500 ETFs).

To be fair, these were extremely small positions in his portfolio.

With that being said, the PE ratio of the S&P 500 is far higher than its historical average.

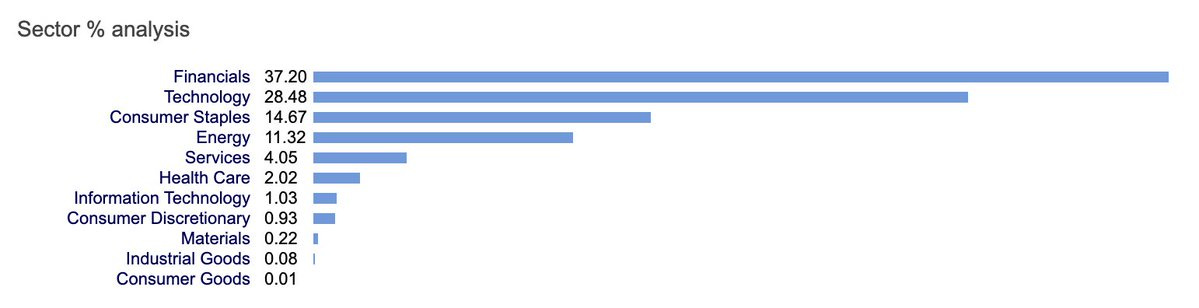

8. Financials and Tech

Financial and tech stocks continue to be the largest holdings in Buffett's portfolio.

Combined, they make up 65.68% of his portfolio.

9. Buffett is a Net Seller of Stocks

Buffett has been a net seller of stocks for multiple quarters.

Total Buys: $9.14 billion (new purchases and increased holdings).

Total Sells: $35.48 billion (reduced holdings).

10. Buffet Still Likes His Dividend Stocks

Buffett loves receiving dividends.

9 out of 10 of Buffett's top holdings pay a dividend.

Here's the dividend yield for each:

🍏 AAPL - Apple Inc. → 0.42%

💳 AXP - American Express → 0.95%%

🏦 BAC - Bank of America Corp. → 2.37%

🥤 KO - Coca Cola Co. → 2.88%

🛢️ CVX - Chevron Corp. → 4.41%

⛽ OXY - Occidental Petroleum → 1.98%

📊 MCO - Moody's Corp. → 0.75%

🧀 KHC - Kraft Heinz Co. → 5.23%

🏢 CB - Chubb Limited → 1.33%

🏥 DVA - DaVita HealthCare Partners → 0.00%

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Buffett stacking cash while trimming AAPL and dumping the S&P? Feels like he's bracing for something big. Curious, do you see this as caution or a strategic pivot?