🚨 Warren Buffett Just Bought This Stock!

Warren Buffett's Final Goodbye Message 👋

Warren Buffett’s Berkshire Hathaway recently released their latest Form 13F.

With Buffett retiring at the end of the year, this document reveals some of the last moves Buffett made before he steps down.

I spent hours reviewing it, and found 10 key takeaways for us to review. 👇

1. 📈 Buys and Sells

In the most recent quarter, Buffett added to 6 existing positions and opened 1 new one.

He reduced the size of 5 positions, and sold out of 1 entirely.

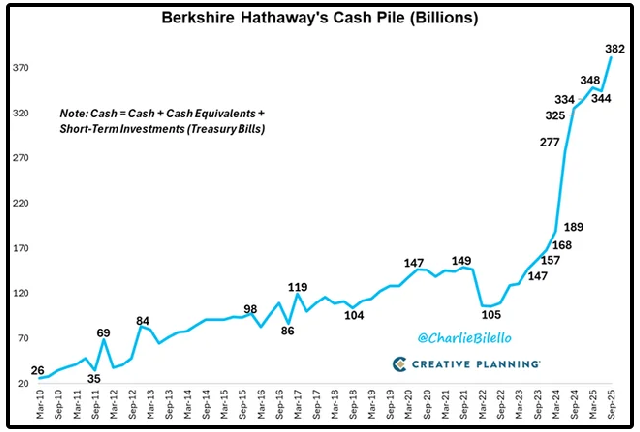

2. 💰 Buffett’s MASSIVE Cash Pile

Investors were shocked when Buffett’s cash position hit $150 billion just over two years ago.

His cash position now?

Sitting at around $382 billion.

3. 🟥 Buffett is a Net Seller of Stocks (Again)

Warren Buffett’s last 12 quarters have found him being a net seller of stocks.

While the official amount isn’t out yet, here is my rough math for Q3 2025 based on average prices for the stocks he bought and sold:

🔴 Total Sells ≈ $12.5B

🟢 Total Buys ≈ $6.4B

The Buffett indicator (Buffett’s claimed favorite measure of market valuation) is now at all-time highs.

4. 🔍 Buffett’s Google Bet

Buffett was asked about Google stock in an interview a few years ago, to which he stated-

“…The margins are incredible… I should’ve bought Google…”

In one of his final moves before retirement, Buffett added Google to his portfolio.

His buy price was in the range of $180 - $255.

Was the decision influenced by Todd Combs, Ted Weschler, or Greg Abel?

That’s completely possible.

Despite being up 67% year to date, the average analyst estimate is still giving Google 11.35% upside over the next 12 months.

But if we know anything about Berkshire Hathaway, they didn’t buy for the next 12 months-

They bought it thinking in decades.

5. 🍎 Selling Apple (Again)

Buffett had previously claimed over a year ago that he trimmed $AAPL for tax purposes...

But he continues to sell more.

Q4 2023: Reduced AAPL -1.09%

Q1 2024: Reduced AAPL -12.83%

Q2 2024: Reduced AAPL -49.33%

Q4 2024: Reduced AAPL -25%

Q1 2025: No change

Q2 2025: Reduced AAPL -6.67%

Q3 2025: Reduced AAPL -14.92%

He has now trimmed his Apple position in 6 of the last 7 quarters.

Last quarter, Apple was 22.39% of his portfolio.

It is now sitting at 22.69% of his portfolio.

His allocation increased, despite selling shares.

Why?

Because Apple is up over 16% in the last 3 months.

His Apple position has gone from 51% of his portfolio to around 22.69% in less than 2 years.

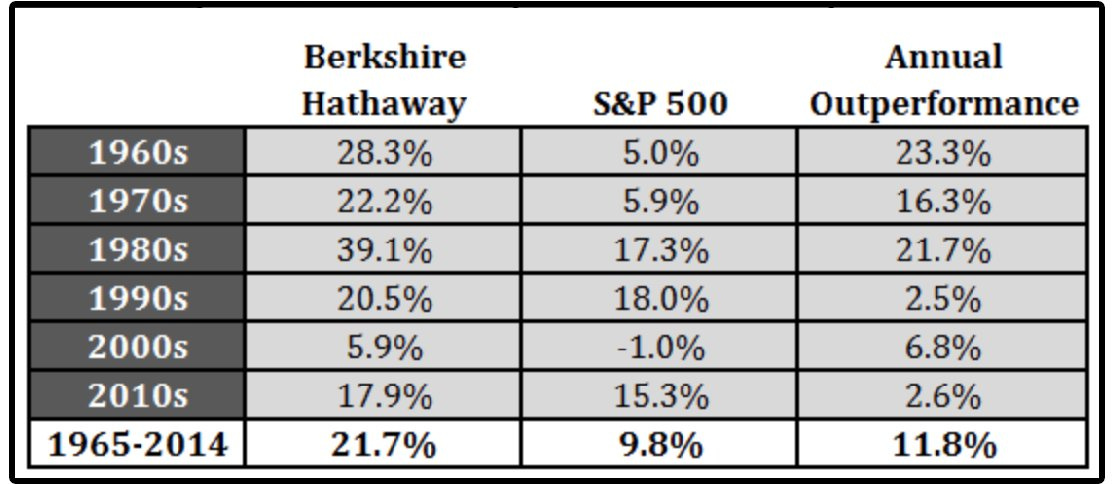

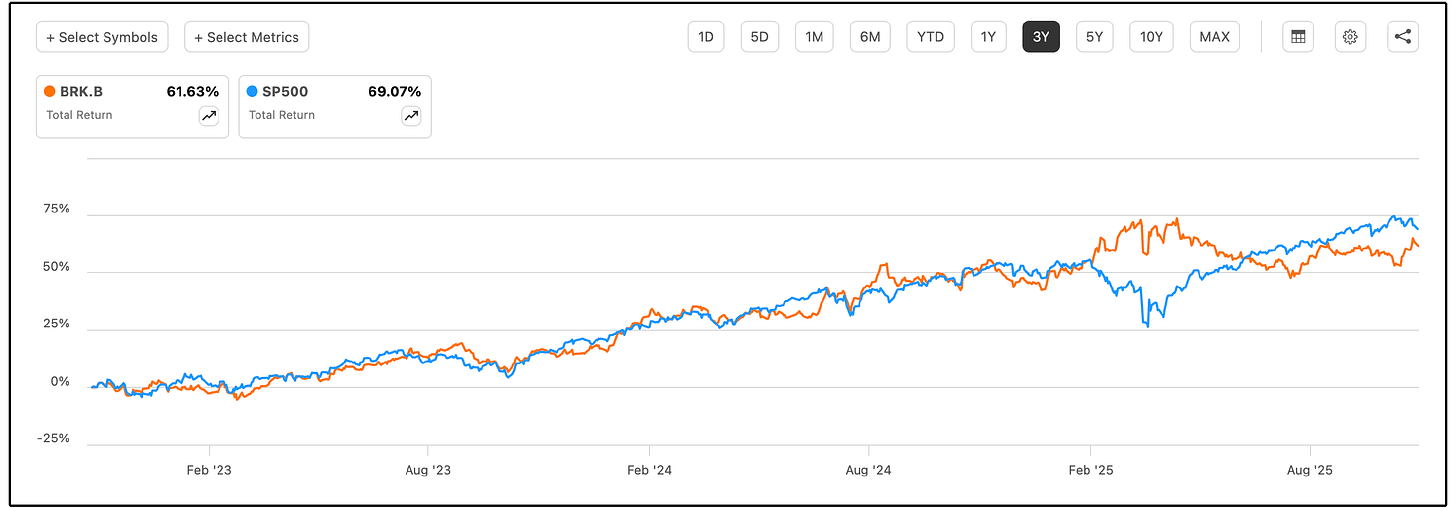

6. 📉Outperformance is Dwindling

Buffett is the greatest of all time.

He has outperformed in every decade, but that outperformance has started to grow smaller.

Berkshire Hathaway has outperformed the S&P 500 in the last 5 and 10 years-

But they’ve underperformed in the last 3 years.

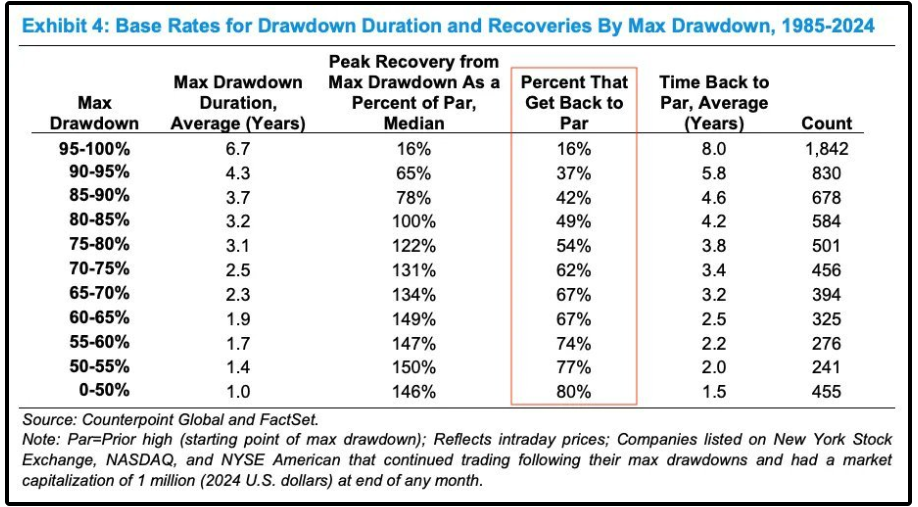

7. 📊 Buy The Dip

Buffett shocked investors when he bought UnitedHealth Group 2 quarters ago.

Many investors were equally shocked he bought Google stock this quarter.

He also recently added capital to stocks like Dominos, Chubb Limited, and Lamar Advertising.

What do the stocks all have in common?

They were in the midst of a major dip when Buffett bought.

Buying during major dips isn’t just a Buffett habit, the data actually backs it up.

The chart above shows recovery rates for thousands of stocks since 1985, and the pattern is clear:

Stocks down 55-60% recover 74% of the time.

Stocks down 65-70% recover 67% of the time.

Stocks down 75-80% recover 62% of the time

This is why buying the dip (on high quality businesses) can actually be so effective.

Buying the right dips actually puts the long-term probabilities on your side.

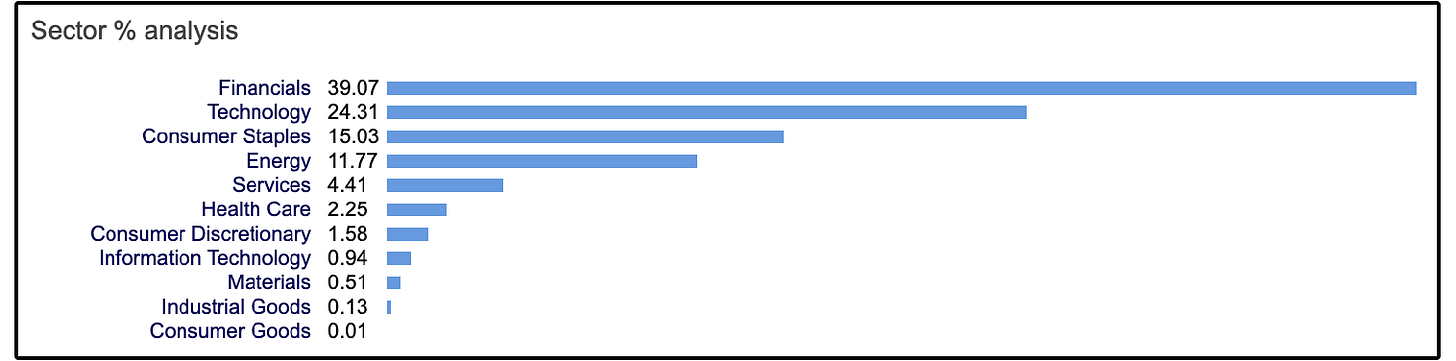

8. 🏛️ Buffett Is Still Betting on Financials and Tech

Financials and Technology together make up 63.38% of Buffett’s portfolio, which is even higher than last quarter.

So yes, he trimmed positions like Apple and Bank of America (again)-

But he still favors those sectors.

9. 💸 Buffett’s Portfolio

Here is Warren Buffett’s entire portfolio as of the most recent 13F filing.

10. 👋 Buffett’s Goodbye Letter

On November 10th, Buffett released a farewell letter to shareholders.

Here’s one of my favorite parts:

If you want to read the whole letter, you can do so here:

Did you enjoy this?

Consider becoming a Dividendology member. 👇

📊 Full Access to the Dividendology Database

Built with now over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Black Friday Sale!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

That’s all for now!

See you next week!

Dividendology 🚀

Could I ask who you are? If I’m going to trust your explanations/knowledge (which BTW your explanations are well thought out and expressed), it would be nice to know your background, experience, etc. Can you share your name? Do you alone do the research, do you have a team?

Thanks for any insights

We missed your earlier offer of a reduced subscription cost; are you planning a Black Friday reduced subscription offer?