🔥 Warren Buffett Just Bought This Stock!

The Oracle of Omaha Going Out With a Bang 💥

Warren Buffett's Berkshire Hathaway recently released their latest form 13F.

This document reveals every move he made last quarter and gives us an update on his entire portfolio.

I spent hours reviewing it, and found 10 key takeaways for us to review. 👇

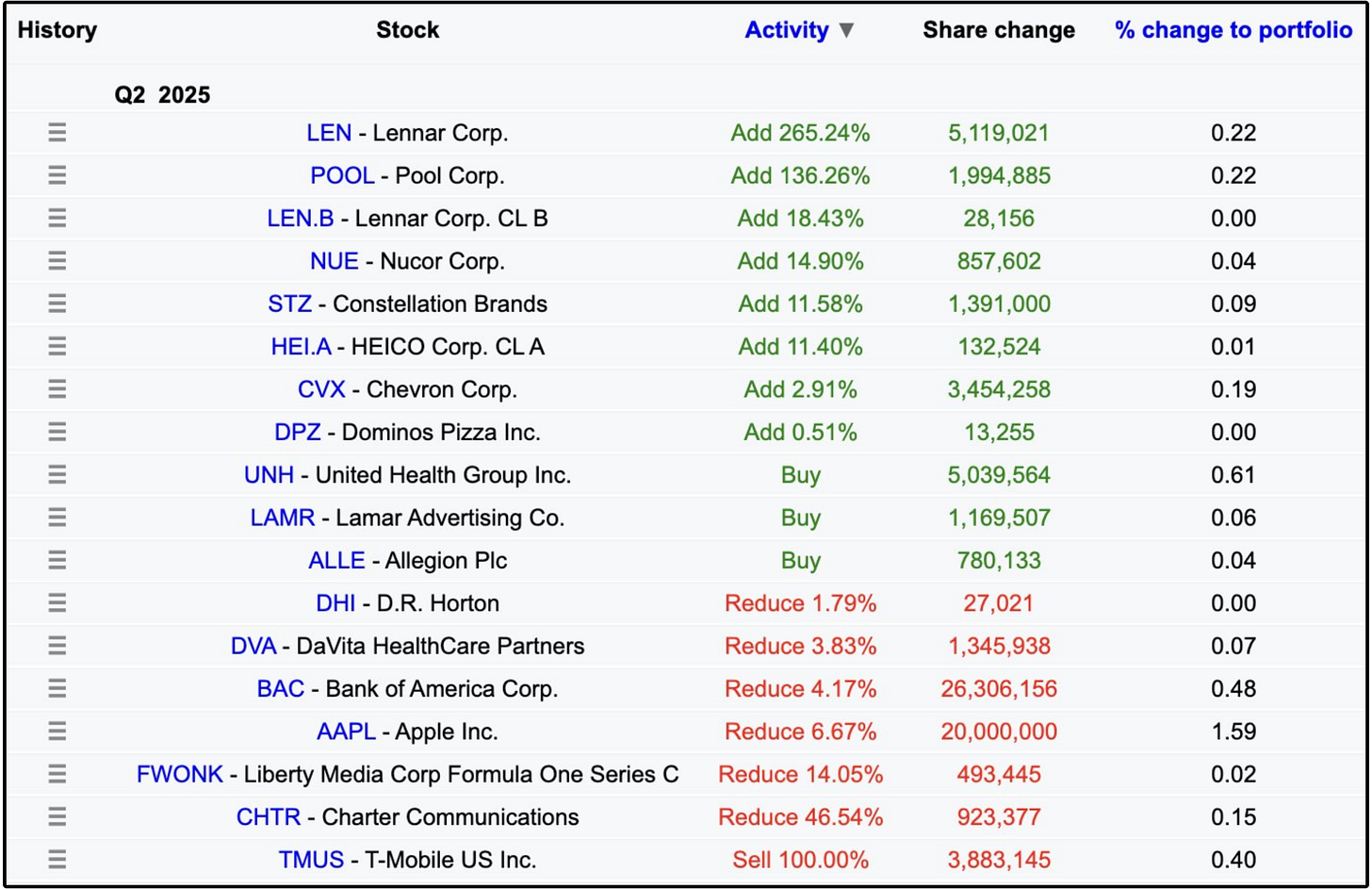

1. 📈 Buys and Sells

In the most recent quarter, Buffett added to 8 existing positions and opened 3 new ones.

He reduced the size of 6 positions, and sold out of 1 entirely.

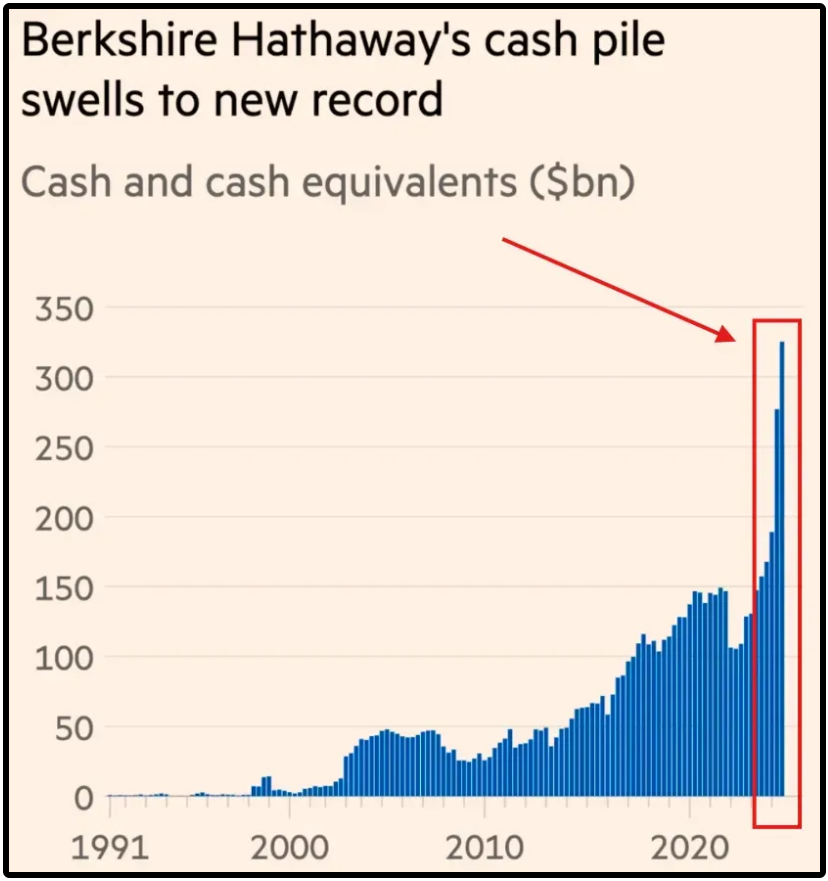

2. 💰 Buffett's MASSIVE Cash Pile

Investors were shocked when Buffett's cash position hit $150 billion just a couple of years ago.

His cash position now?

Estimated to be around $350 billion. (final number TBD)

3. 🟥 Buffett is a Net Seller of Stocks (Again)

Warren Buffett's last 12 quarters have found him being a net seller of stocks.

While the official amount isn't out yet, here is my rough math for Q2 2025:

🔴 Total Sells ≈ $6.5B

🟢 Total Buys ≈ $3.9B

The Buffett indicator (Buffett’s favorite measure of market valuation) is ringing.

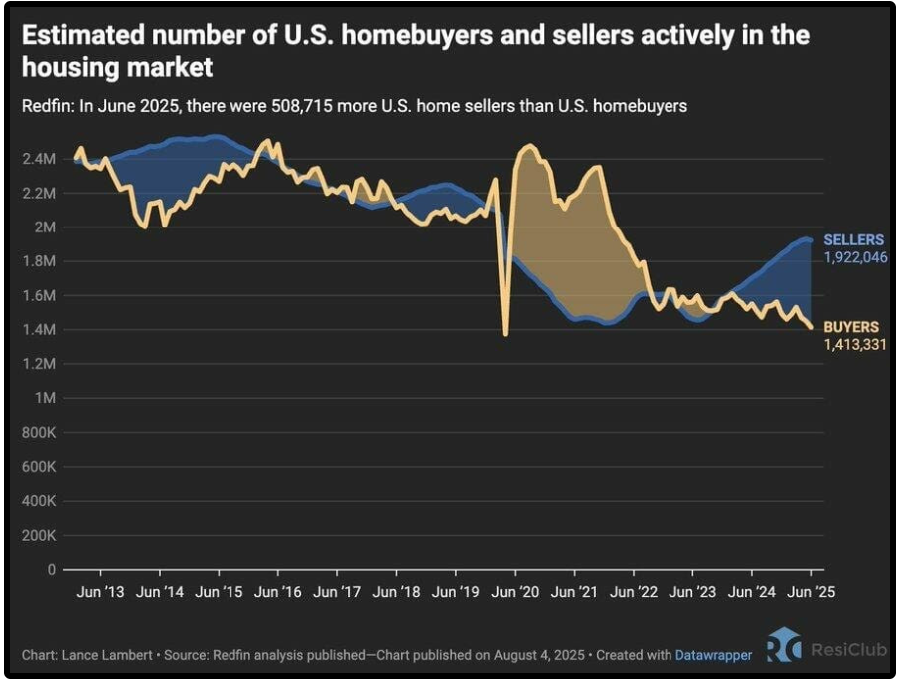

4. 🏠 Berkshire’s Housing Bet

Buffett boosted his Lennar (LEN) stake from just 152K shares to 7.23M — now worth ~$799M.

Berkshire also owns 1.49M shares of D.R. Horton.

The spread between sellers and home buyers is the largest it has been in a decade.

5. 🍎 Selling Apple (Again)

Buffett had previously claimed a year ago that he trimmed $AAPL for tax purposes... But he continues to sell more.

Q4 2023: Reduced AAPL -1.09%

Q1 2024: Reduced AAPL -12.83%

Q2 2024: Reduced AAPL -49.33%

Q4 2024: Reduced AAPL -25%

Q1 2025: No change

Q2 2025: Reduced AAPL -6.67%

His AAPL position has gone from 51% of his portfolio to around 22% in less than 2 years.

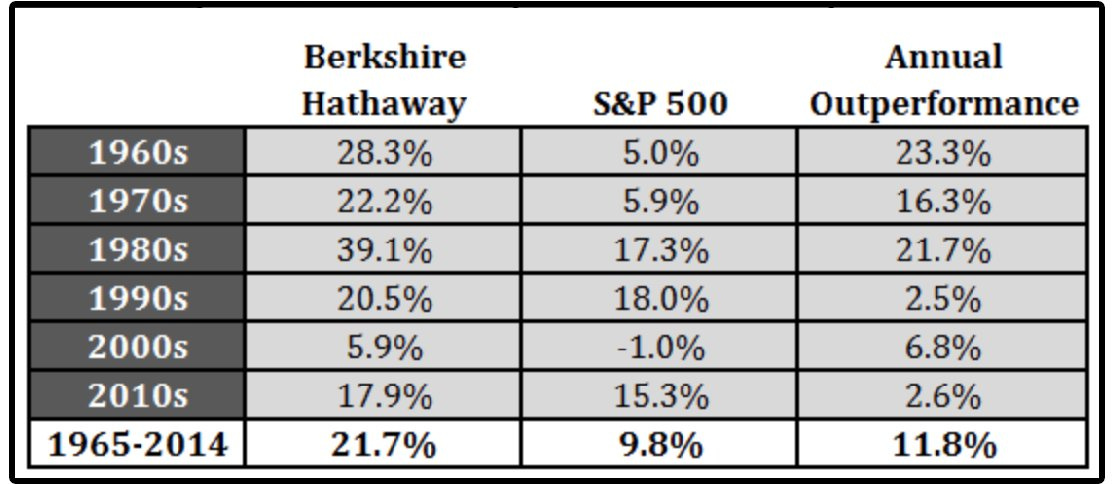

6. 📉 Outperformance is Dwindling

Buffett is the greatest of all time.

But the law of large numbers is kicking in.

He has outperformed in every decade, but that outperformance has started to grow smaller.

7. 💼 Concentration Builds Wealth, Diversification Protects It

87.29% of Buffett's portfolio is in his top 10 stocks.

Here’s the allocation:

🍏 AAPL – Apple – 22.31%

💳 AXP – American Express – 18.78%

🏦 BAC – Bank of America – 11.12%

🥤 KO – Coca-Cola – 10.99%

⛽ CVX – Chevron – 6.79%

📊 MCO – Moody’s – 4.81%

🛢 OXY – Occidental Petroleum – 4.32%

🧀 KHC – Kraft Heinz – 3.26%

🛡 CB – Chubb – 3.04%

🏥 DVA – DaVita – 1.87%

8. 🛒 Be Greedy When Others Are Fearful

Buffett shook the investing world with his biggest buy in the most recent quarter being UnitedHealth Group.

This was the mystery stock that Berkshire had been quietly building over the past few quarters, now revealed at over 5 million shares worth ~$1.37B.

“The best thing that happens to us is when a great company gets into temporary trouble... We want to buy them when they're on the operating table” - Warren Buffett

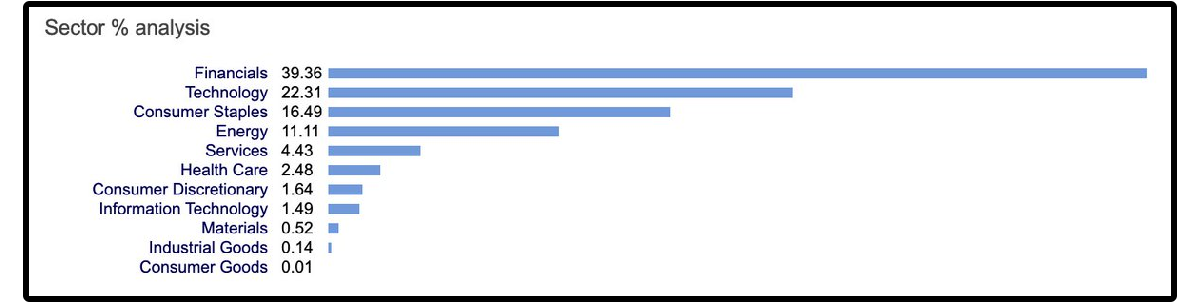

9. 🏛️ Buffett Is Still Betting on Financials and Tech

Financials and Technology together make up 61.67% of Buffett's portfolio.

So yes, he trimmed positions like Apple and Bank of America-

But he still favors those sectors.

10. 💸 Buffett's Portfolio

Here is Warren Buffett's entire portfolio as of the most recent 13F filing.

Have You Heard The News? 🛠️

Dividendology will be transforming into a full scale investment research platform in less than ONE month.

Here’s everything you get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with now over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platformsThe full launch is almost here.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($30 off! + 7day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

That’s all for now!

See you next week!

Dividendology 🚀

Thanks for this great summary! In my opinion, UNH is facing now several risks related with the business and it is a sector which is in politicians’ mind all the time. Those are some factors which make me don’t trust enough to buy this company. However, it is very interesting to know that Warren considers all these as temporary issues.

Also, we should consider that it is not the most risky decision for Warren. UNH is now the 0,61% of his portfolio so obviously this risk is well under control.