Warren Buffett's 348 Billion Bet 💰

Forget About Diversification 🤷♂️

Warren Buffett has grown his net worth from $20,000 at the age of 21 to $109,000,000,000 at the age of 92. 🤯

His holding company Berkshire Hathaway is now worth 348 billion.

The crazy part?

83.36% of it is invested in just 6 stocks.

Here's which stocks they are:

1. Apple ($AAPL) 🍎

Allocation: 51.00%

Dividend Yield: 0.54%

It’s clear Buffett is not afraid of putting all of his eggs in one basket.

Buffett first bought Apple stock in Q1 of 2023.

Since that time, Apple has grown nearly 570%, compared the S&P 500’s 116%, so it’s safe to say that bet has paid off.

*Note: My favorite investing research platform Seeking Alpha is where all data and charts were pulled. You can sign up for a 7 day free trial and get a $50 coupon here.

2. Bank of America ($BAC) 🏦

Allocation: 8.51%

Dividend Yield: 3.38%

While Buffett’s Bank of America position isn’t nearly the size of his Apple position, 8.51% is still a large holding of his.

3. American Express Company ($AXP) 💳

Allocation: 7.59%

Dividend Yield: 1.57%

American Express has been a large holding of Buffett’s for awhile now.

While the company has a low starting dividend yield, AXP has a great track record of dividend growth.

Their 3, 5, and 10 year dividend growth rates are all sitting at over 10%.

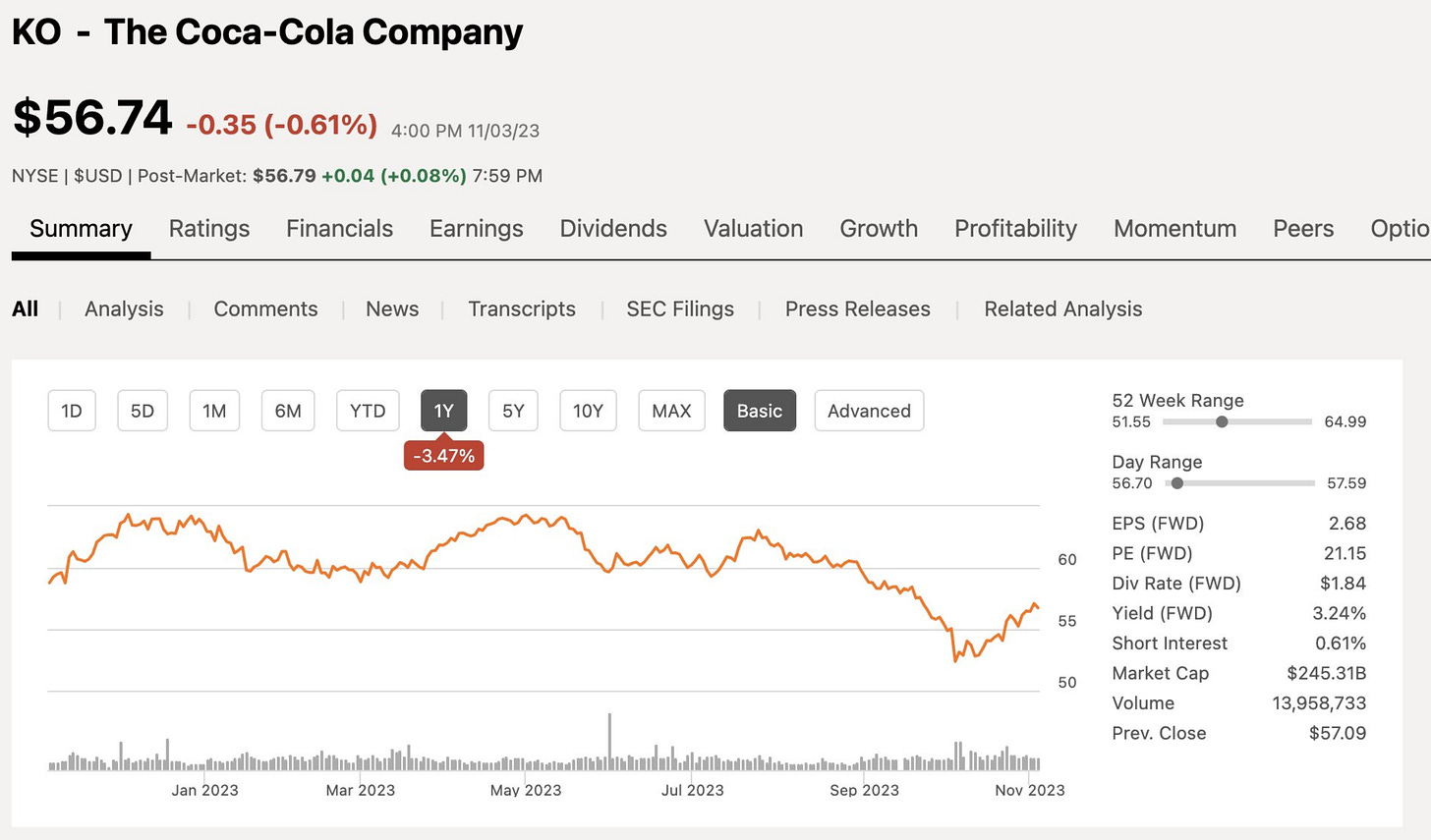

4. The Coca-Cola Company ($KO) 🥤

Allocation: 6.92%

Dividend Yield: 3.24%

The Coca-Cola Company is a great example of a long term compounder that has given Buffett phenomenal long term returns.

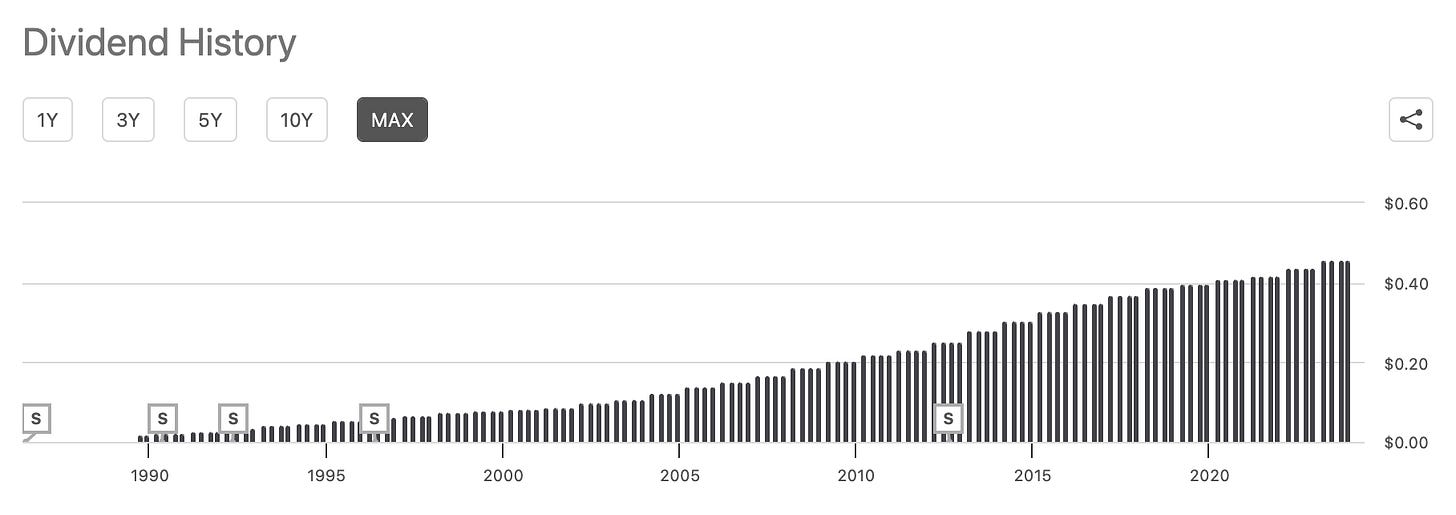

Coca-Cola has been increasing their dividend payouts for 60 consecutive years, making their dividend payment history chart a thing of beauty.

This history of dividend growth has led to Buffett having a yield on cost of over 54% on his Coca-Cola position.

Now THAT is the power of dividend growth.

5. Chevron Corporation ($CVX)⛽️

Allocation: 5.56%

Dividend Yield: 4.09%

This is one of Buffett’s higher yielding positions, but it’s also a position that Buffett reduced by about 7% last quarter.

This company is currently sitting close to its 52 week low, and is down 18.51% over the past year.

5. Occidental Petroleum Corporation ($OXY) 🛢️

Allocation: 3.78%

Dividend Yield: 1.14%

Out of his top 6 holdings, this is the only one that Buffett has added more capital during the latest quarter.

Buffett increased this position by 5.87%, bringing his total OXY position to over 13 billion.

Out of all these positions… 🤔

I believe there is one that has much more potential than the others over the next 3, 5, and 10 years.

This company presents a compelling investment opportunity with several notable strengths and potential growth drivers moving forward.