📣 Which Covered Call ETF Is Truly Winning in 2025?

How to Maximize Dividend Income! 🔥

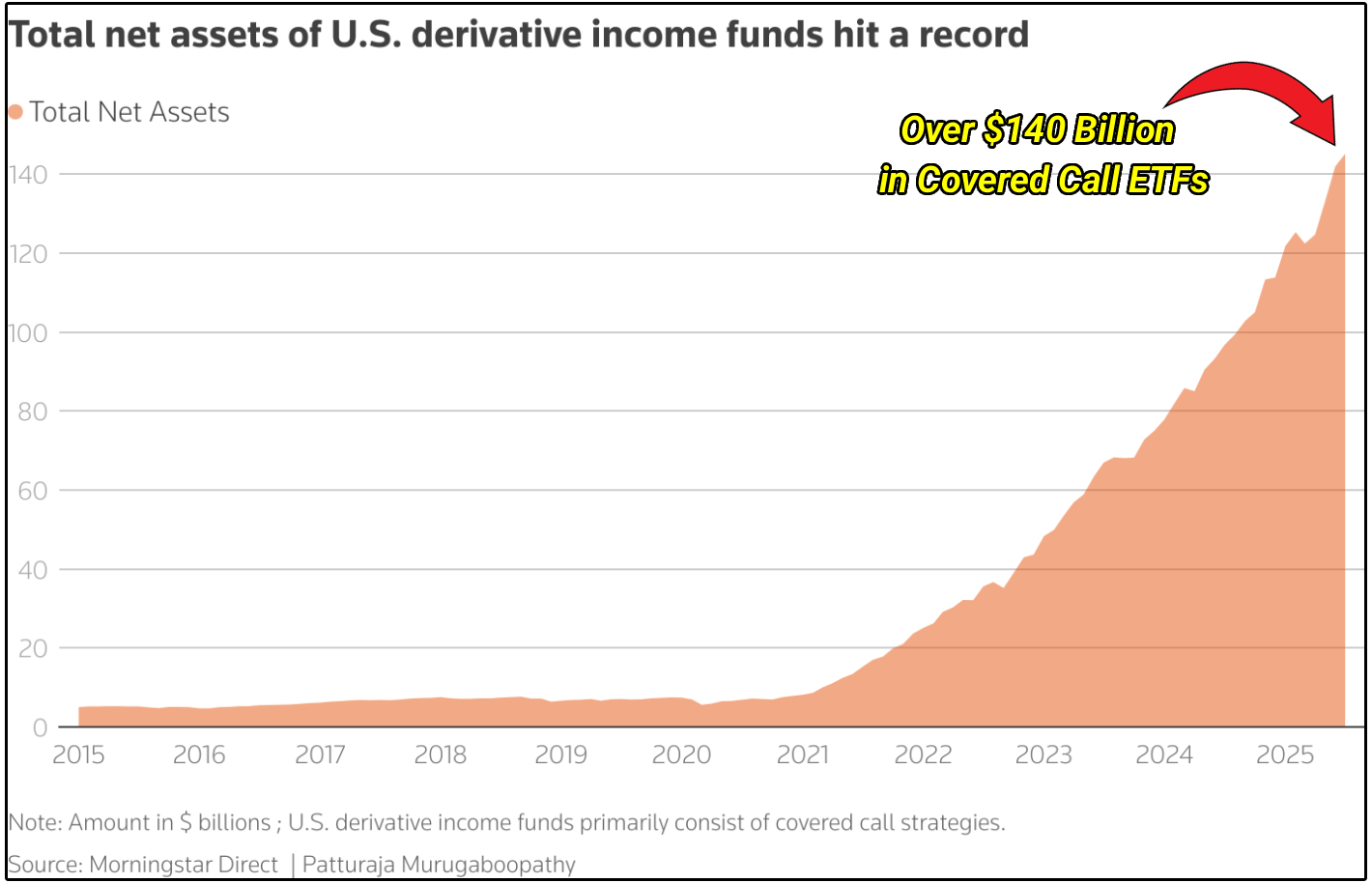

Covered Call ETFs continue to be one of the most popular asset classes for high yield investors in 2025.

Total net assets for Covered Call ETFs are now at an all-time high.

The most popular Covered call ETF?

The JPMorgan Equity Premium Income ETF (JEPI) with over $41 billion in assets under management is by far the most popular, and has existed for over 5 years.

Today, we’ll break down how a newcomer ETF (SPYI from NEOS) measures up against the titan of the covered-call universe.

📌 Understanding the Basics

SPYI and JEPI are similar in multiple ways.

According to their fact sheets, they both:

Target monthly income + reduced volatility

Aim to capture a portion of the upside of their underlying holdings

But here’s the first key difference:

While SPYI simply holds all 500 constituents of the S&P 500-

JEPI takes an active approach.

Its managers select primarily S&P 500 stocks they view as “attractive” and rotate out of them when they no longer fit that profile.

This difference is why we see such a stark gap in total returns

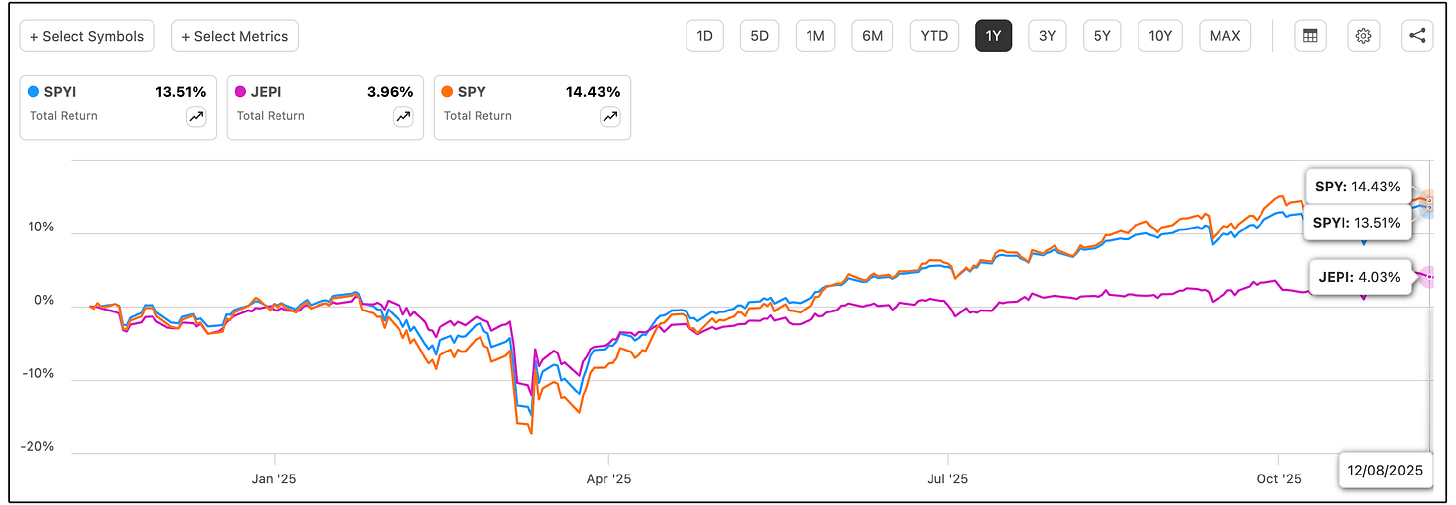

📊 Total Returns

In the last year, the S&P 500 has returned 14.43%.

But the difference in performance between JEPI and SPYI has been stark:

JEPI: 3.96%

SPYI: 13.51%

SPYI has massively outperformed JEPI.

Why is this the case?

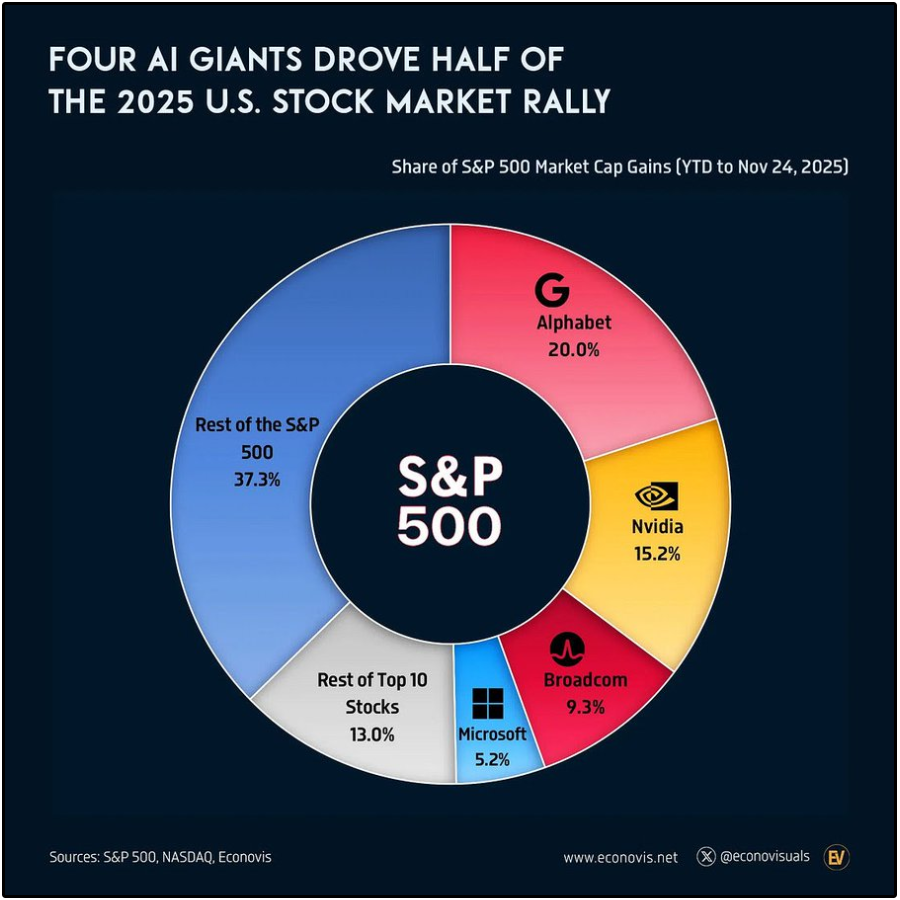

Because a small handful of stocks have driven nearly all the returns for the S&P 500 this year.

SPYI had exposure to these companies because it aims to simply track the S&P 500.

Based on the results, it appears JEPI did not have exposure to many of these outperforming companies.

Even if we zoom out and look at 3-year performance, SPYI outperforms by an even wider margin.

Keep in mind, because covered-call ETF distributions come from their net asset value (NAV), a falling NAV makes it harder to sustain high distributions.

A flat or rising NAV = easier to maintain distributions

A declining NAV = pressure on future payouts

💰Big Distributions?

If you are buying covered call ETFs, you are doing it because you are looking to maximize your immediate income.

Let’s review the trailing 12-month yield for these funds:

JEPI: 7.51%

SPYI: 11.62%

Again, that’s a massive gap.

But distribution yield isn’t the only thing we should pay attention to.

Unpredictable income can be a major problem for income-focused investors…

So we must also look at distribution stability.

🗂️ Distribution Stability

For anyone building a high-yield portfolio to live off dividends, having confidence in your future income stream is essential.

Basically, seeing a 20% drop in your income month over month would be a problem.

Using Tickerdata, I imported both funds’ distribution history into a spreadsheet and charted out the month of month percent change in distributions.

The results again were eye opening.

SPYI saw essentially no large changes in their distributions month over month.

Meanwhile, JEPI saw multiple months where distributions declined by 20% or more in the last few years.

🧾 Tax Implications

This is perhaps what is most overlooked between these two funds.

Tax treatment can dramatically change the real income you keep.

Let’s simplify this as much as possible:

🟠 JEPI Taxation

Because JEPI uses equity-linked notes (ELNs), distributions are taxed as ordinary income.

Example:

If you fall into the top 25% of U.S. taxpayers (AGI $85K–$150K), your effective tax rate is about 17% according to the Tax Foundation. So, if you’re earning $50,000 per year from JEPI, you’d owe roughly $8,500 of that to the IRS.

🔵 SPYI Taxation

SPYI’s monthly distributions are mostly classified as return of capital (ROC).

This means investors generally don’t owe taxes on that income in the year it’s received.

The exact ROC percentage changes month to month.

To stay conservative, we can assume roughly 10% of SPYI’s annual distributions are taxed as Section 1256 income.

Example:

If you’re in the top 25% taxpayer bracket (AGI $85K–$150K) and earn $50,000 per year from SPYI, you’d owe approximately:

$340 in ordinary income tax

$450 in long-term capital gains tax

That’s a potential $7,710 in tax savings compared to earning the same income from JEPI.

Again, this can vary from individual to individual based on a multitude of factors.

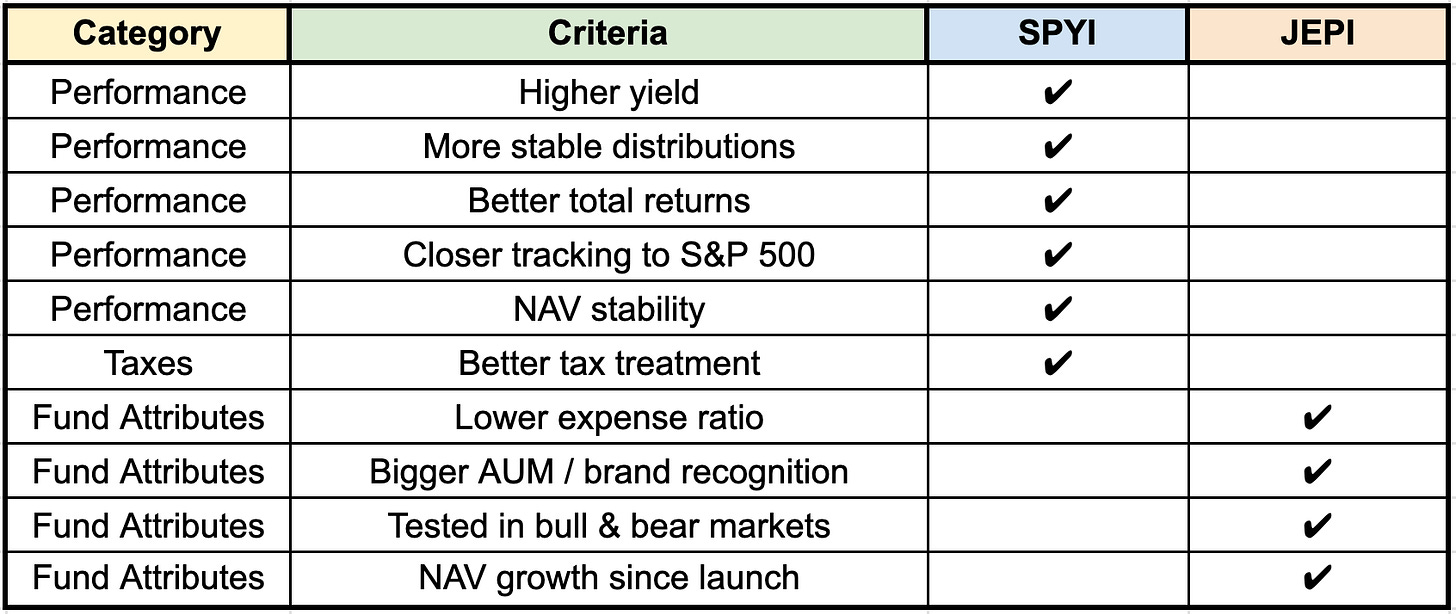

⚖️ Comparison

It’s clear the market environment we’ve been operating under over the last 3 years has been perfect for SPYI-

But don’t completely count out JEPI.

JEPI still has:

Lower expense ratio

More brand recognition and assets under management

Been tested under bull AND bear markets

Here’s how the two shape up right now:

SPYI has been a clear winner in my book, but here’s what we still don’t know:

How SPYI performs in a deep market drawdown

Whether SPYI can maintain stable payouts in a recession

How its strategy behaves when megacaps don’t lead the market

🏁 Covered Call ETFs in 2026

It’s clear the demand for Covered Call ETFs is continuing to grow as we head into 2026.

As we continue to build out our High Yield Portfolio, we will continue to consider our options for this asset class.

We will also be conducting interviews with fund managers of popular Covered Call ETFs in 2026.

Members of Dividendology get access to all of these interviews as well as updates to the Dividendology Covered Call ETF database.

As a reminder, you can get access to all of the following by becoming a member of Dividendology.

Dividendology will continue to compound the value it provides immensely in 2026.

The best is yet to come!

Dividendology

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 ($30 off! + 7 day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

JEPI and JEPQ are great ones.

Have not heard of this newcomer. Thanks for the insights!

Amazing post bro. I didn't understand lots of concepts since they are advanced and I'm not a native English speaker, but I got the main idea of the post, and I can tell this is the kind of analysis that no other blogs share.

Thank you for sharing.