Why Dividend Growth Pays BIG 💰

My Journey to Dividend Growth Investing

After years of research, I’ve found that dividend growth stocks typically allow people to live off dividends the fastest, AND are one of the most effective ways to build wealth.

But most investors don’t start out as dividend growth investors.

Many spend years placing risky bets on extremely volatile stocks.

Some spend many years chasing high yield dividend stocks that end up not growing and sometimes even cutting dividends. (I’ve been there).

And some stay away from investing altogether.

So with the start of the new year, I thought I’d share my journey to dividend growth stocks, and how I’m using them to build a portfolio that will one day allow me to live off dividends.

My Journey

I was always scared of working a job I hated for 45+ years, in hopes that I would one day maybe be able to retire.

So as a sophomore in high school, I knew I had to find ways to make my money work for me.

For a while, I thought this would come through investing in real estate. I researched and read everything I could about real estate.

While the idea of investing in real estate was exciting, the reality of it is that it had high barriers to entry, was a very high risk investment, and wasn’t truly passive income.

Discouraged, I went back daydreaming about ways to make passive income.

I was aware of what dividend investing was, but like most, I wasn’t really interested in making a measly 2% return on my investments every year.

I looked into higher yielding stocks, but unfortunately learned from experience that these investments typically don’t perform quite as well mid to long term.

Again discouraged, I felt that there was no real form of passive income that would allow me to build wealth long term.

Then I ran across the idea of dividend growth investing.

1. Why Dividend Growth?

I didn’t fully understand the concept of dividend growth at first.

I knew reinvesting your dividends played a major role in creating the compounding effect, but it wasn’t until I saw a real example of dividend growth investing that I realized how powerful it could be.

2. Broadcom ($AVGO) Example

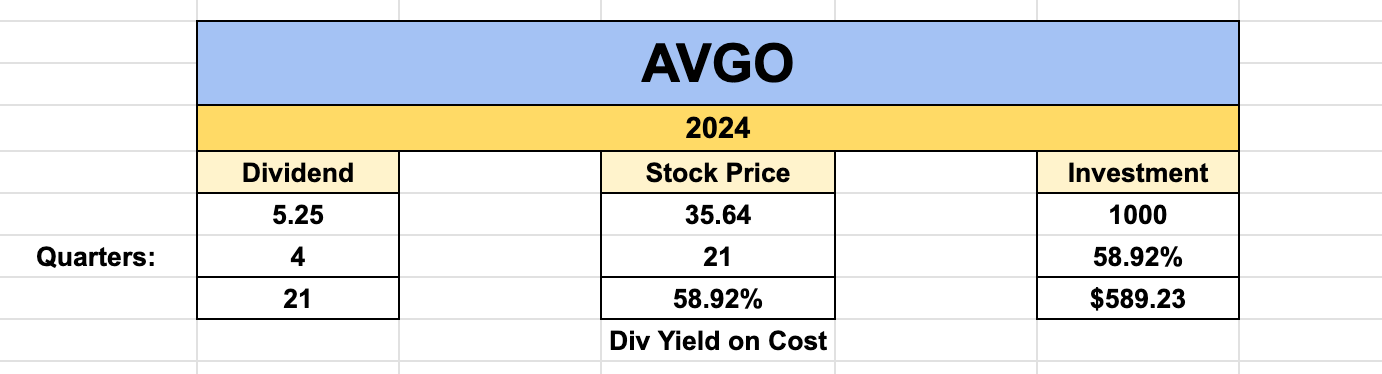

As you can see below, in 2013, this company was paying 19 cents per share quarterly, with a share price of $35.64. This gave them a low starting dividend yield of 2.13%.

This is the type of company most dividend investors would hate to buy, because the yield is "too low".

When I was a sophomore in high school, this was the exact type of stock that I would’ve loathed investing into.

But let’s fast forward to now, and see what the results would’ve been.

Broadcom now pays out $21 a share in yearly in dividends.

That means if you bought $AVGO in 2013, your yield on cost would now be 58.93%!!

Imagine getting paid $589.23 yearly from a one time $1,000 investment.

Keep in mind, this doesn't even include reinvesting dividends over that time period.

That's the power of dividend growth investing.

And that can be what happens when you buy quality companies that are able to grow free cash flow on an annual basis, and then use that free cash flow to:

1. Reinvest back into the business

2. Pay out dividends

Reinvesting back into the business is what allows the company to grow, in turn allowing them to grow their free cash flow yearly, which allows them to grow dividend payments every single year.

It’s a simple formula really.

A simple formula that most unfortunately never come to understand.

But the sooner this clicks for you…

The sooner you start building a perpetually growing, perpetually cash flowing machine.

And this machine can be your ticket to financial freedom.

Forever.

Dividendology

Some personal news… 🔥

Starting at the end of this month, paid newsletter subscribers will be getting access to a spreadsheet every month with a list of dividend stocks that I believe to be undervalued.

This will be the result of extensive research done by myself each month.

As a result, I’ll be bumping up the price of becoming a paid newsletter subscriber in 12 days.

This means this month will be the lowest price you will ever get to become a paid subscriber.

You’ll also get access to other resources (such as spreadsheets) and insights that I only make available to paid subscribers.

With a yearly subscription, you can currently get access to all of this for only 13 cents a day.

Whenever you’re ready, join to lock in the lowest price possible.

Lastly…

A few weeks ago I shared a free spreadsheet with details on some of the most bought dividend stocks by super investors over the past few months.

If you missed it, you can still get the spreadsheet by clicking here.

Ok

Is today we get a list and how we getting that?