📊 The Asset Class Nobody Wants (But I’m Buying!)

🔥 AI Will Disrupt Everything Except This.

Nobody seems to be interested in REITs right now.

The reason?

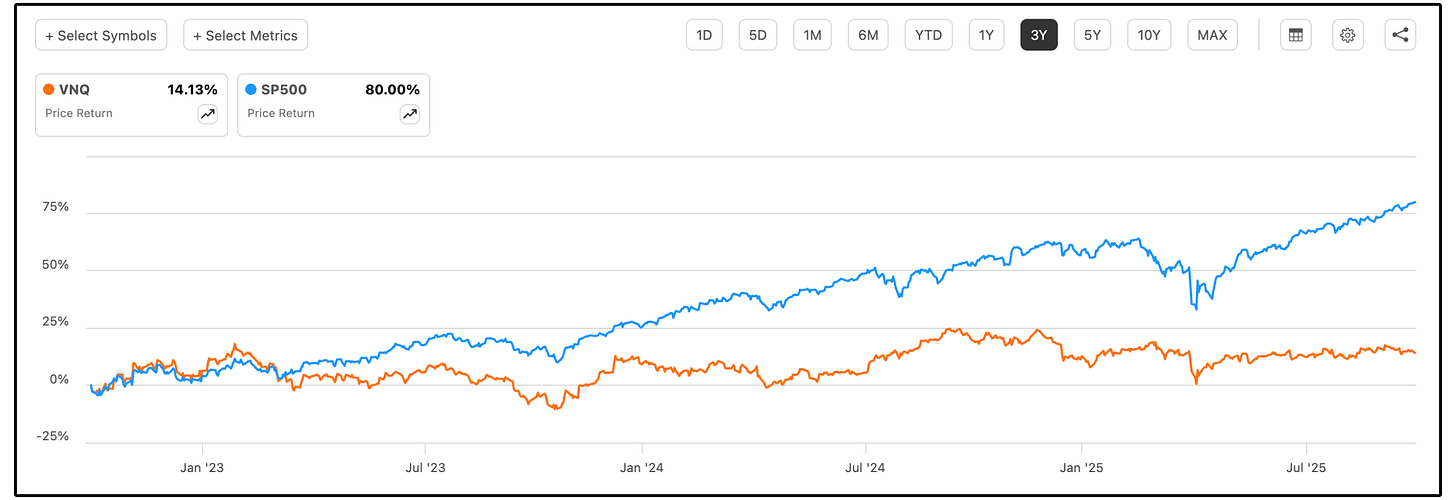

The returns over the last 3 years have been quite poor:

S&P 500 3 Year Returns: 80.0%

Vanguard Real Estate Index 3 Year Return: 14.13%

However, in a world where AI threatens to compress corporate margins and potentially disrupt passive investing-

Real estate could become one of the few asset classes that actually benefits.

🏙️ REIT Valuations

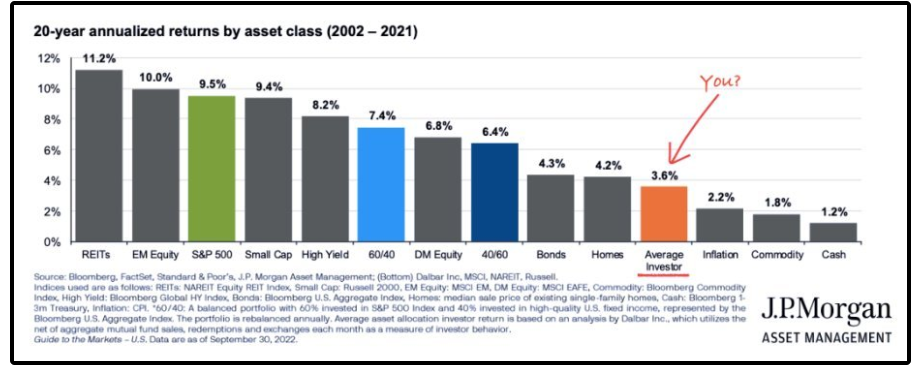

While REITs have certainly underperformed in the last 3 years, REITs have historically provided great returns.

In fact, here are some annualized returns from 2002 - 2021 we should be aware of:

The Average Investor: 3.6%

S&P 500: 9.5%

REITs: 11.2%

Amazing.

REITs outperformed all other asset classes over a 20 year time period.

Most investors are blissfully unaware of this, and the reason why is simple.

Share price drives sentiment, and most investors are extremely short-sighted.

As I’ve stated before, it is critical we understand our investments ‘sources of returns’.

Every investment’s return comes from three things:

Earnings growth (AFFO per share growth for REITs)

Dividends

Multiple expansion/contraction

Take VICI as an example:

With AFFO per share growth of ~4.4%, a dividend yield of 5.4%, and modest multiple expansion, that’s ~11%+ annualized returns.

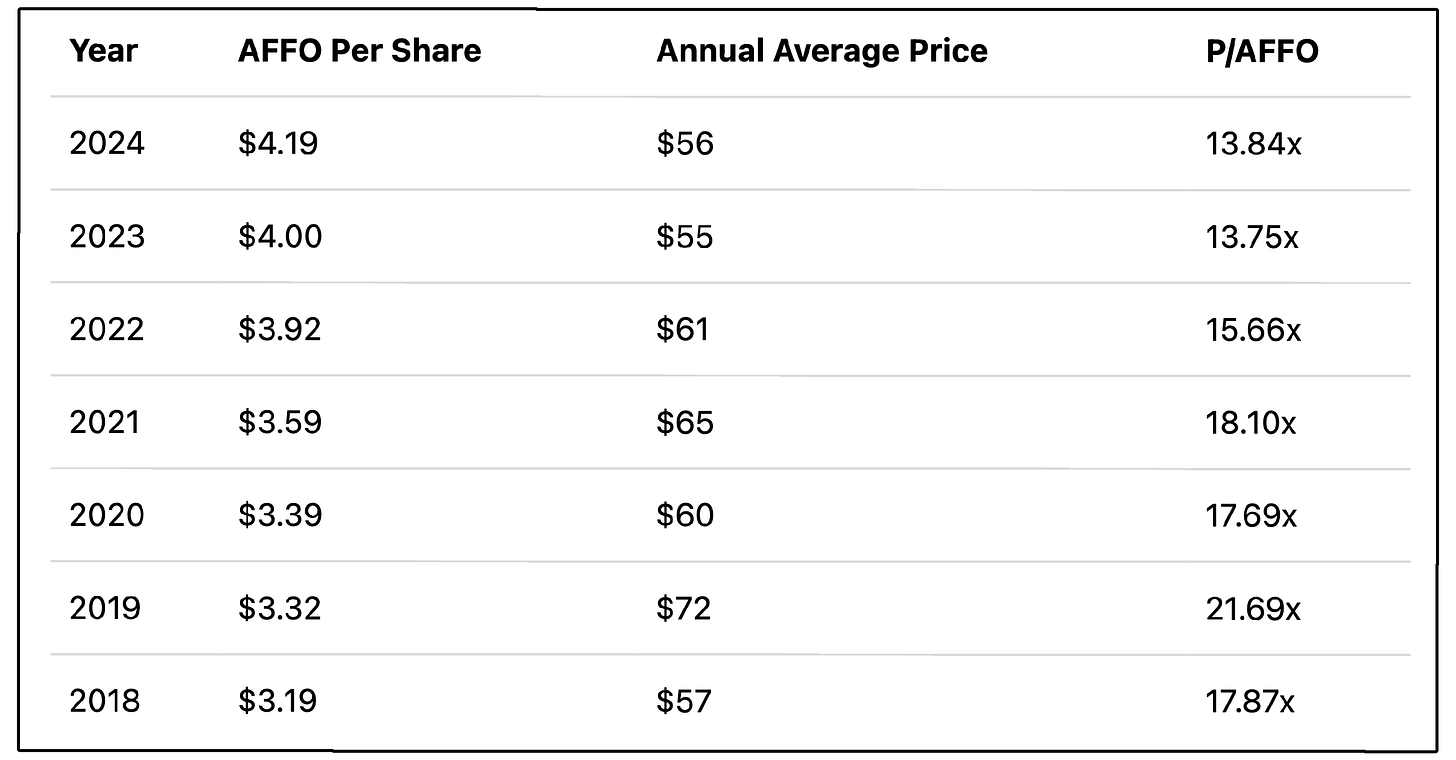

So what’s the source of the recent REIT selloff?

The recent REIT selloff wasn’t due to falling AFFO or dividends—

It’s been almost entirely multiple contraction.

Look at Realty Income.

Despite the share price decline, AFFO per share has grown every year and they have been growing dividends.

That means intrinsic value is rising.

This is exactly what has led to REITs trading at one of their most compelling valuations in decades.

⚠️ The Threat of Artificial Intelligence

AI is encompassing everything.

And projections from JP Morgan show the use of AI is going to continue to expand rapidly across industries in the coming months.

However, not every sector will be impacted by AI in the same way.

AI makes it cheaper and easier to launch and scale new companies in many sectors like tech.

The result?

More businesses created

More competition across industries

Lower prices and weaker pricing power

Margin compression across the board

As analyst Jussi Askola points out, this also majorly impacts passive investing:

This approach (passive investing) works in an environment where most businesses benefit from growth and rising margins. But it is far more dangerous in a world where structural headwinds affect most of index constituents.

Passive funds do not discriminate. They typically buy based on market cap, not on competitive durability. They cannot screen for AI exposure, moat strength, or pricing power. If AI reshapes the business landscape, passive investors may find themselves holding a large collection of declining companies. - Jussi Askola

Much of the future of the AI landscape is still somewhat unclear-

But here is what we do know:

The sectors that are rapidly adopting and integrating AI into every aspect of their business, are also the same sectors that are ripe for disruption.

This is why we are currently seeing companies that have historically been “capital-light businesses” — suddenly pouring massive amounts into capital expenditures.

Just look at the chart: 👇

Meta is spending 35% of revenue on CapEx.

Microsoft at 28%.

Google at 21%.

These tech giants are forced to compete in the expensive AI race, or face disruption in the coming years.

So this does pose the question-

How should investors mitigate the risk of disruption from AI?

🛡️ REITs in the Age of AI

REITs have unique characteristics that keep it from being threatened by AI in the same way many traditional companies are.

Irreplaceable Assets – AI can generate code, designs, and even strategy, but it cannot generate new downtown land. Those remain scarce and essential.

Reliable Income Stream – Tech giants are plowing billions into CapEx with uncertain payoffs. REITs, meanwhile, are built to return cash to shareholders through predictable, growing dividends.

Capital Rotation – As passive index funds become bloated with margin-pressured companies, institutional investors will increasingly seek out real assets with predictable cash flow.

There will undoubtedly be major tech winners from the AI race-

I own a few in my personal portfolio that have performed tremendously (ASML, AVGO, MSFT).

But there will inevitably be major companies disrupted, which could potentially make passive investing more dangerous as well.

When technology makes digital goods abundant and margins thin, investors will gravitate toward assets that can’t be replicated.

Real estate assets provide scarcity, cash flow, and inflation protection.

For example:

42% of VICI’s leases currently have inflation-linked rent escalations

90% of VICI’s leases will have inflation-linked rent escalations by 2035

The REIT sector as a whole may prove to be one of the biggest beneficiaries, as it is least threatened by AI.

⚙️ The Immediate Catalyst

Like mentioned above, although REITs have been underperforming in the last 3 years-

Many have continued to grow their intrinsic value.

This is why REITs have been in what I would consider an accumulation phase.

But the environment we’re operating in is shifting.

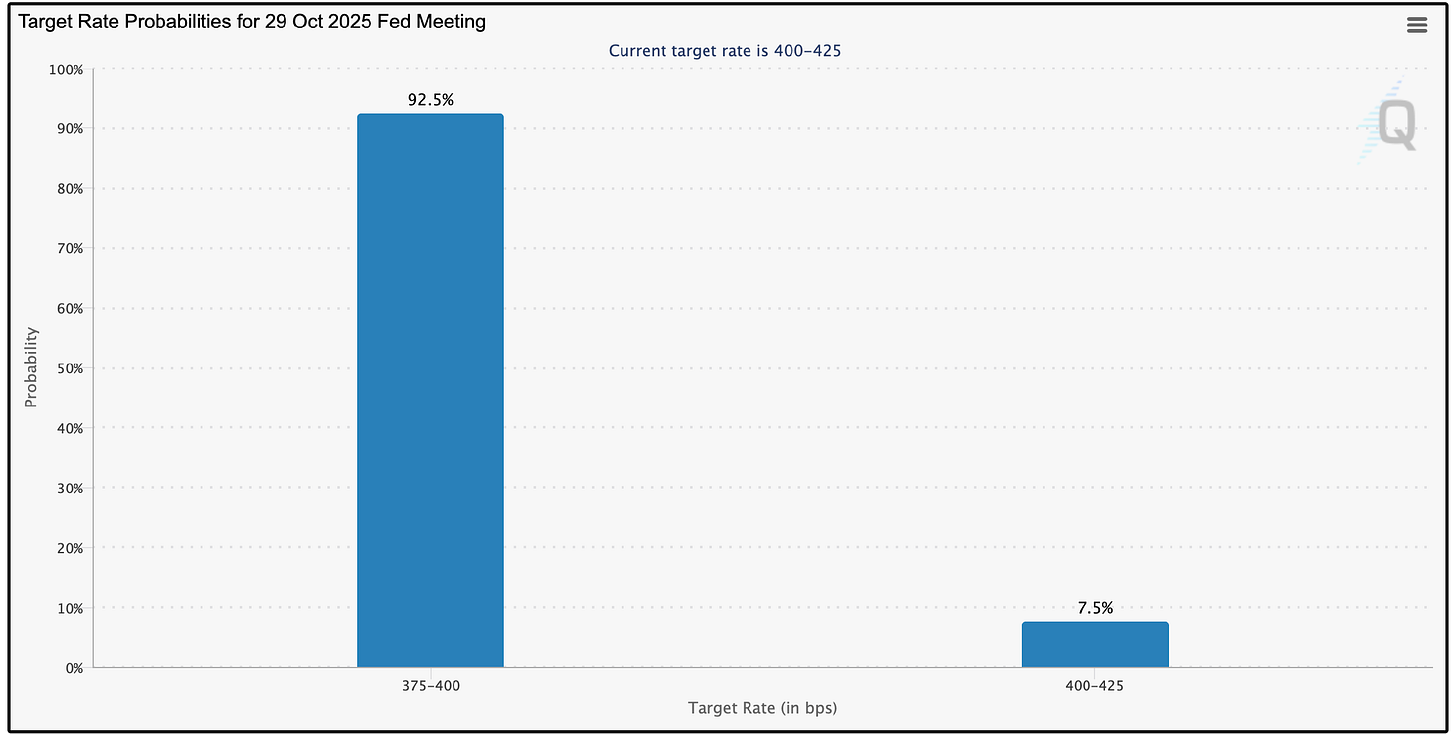

The FED cut rates last month, and the odds market is already showing a 92.5% chance we get another rate cut on October 29th.

This makes risk-free assets less compelling, and assets that provide yield (like REITs) much more compelling.

In a world that is changing and will continue to change, REITs continue to become more attractive due to:

Their compelling valuation

Resistance to the threat of AI

The declining interest rate environment

💰 Buying This REIT

One month ago, we began the process of building out our real money Dividend Growth Portfolio and High Yield Portfolio.

On Friday, we will be adding a REIT from the Dividendology Database to The High Yield Portfolio.

This REIT has a high starting yield, sufficient dividend coverage, and insider buying.

If you want to be a part of the process of building these portfolios and also get access to everything mentioned below, you can join here:

Here’s everything you’ll get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($30 off! + 7 day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

I’d guess ADC :)

I have the same question as I just joined I was wanting to review the two new dividend portfolios.

All I see on each is they are coming but I thought they were started last week.

Thanks in advance!